I was digging through some of the economic data from this week, and most looked pretty solid. It is unlikely that a recession will come in the second quarter. It makes me wonder where all of the recession discourse comes from.

Economic Data Appears Solid

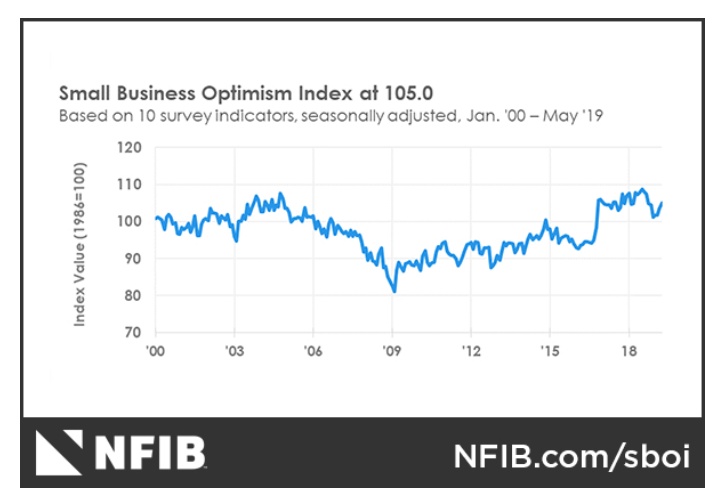

The NFIB Small business optimism index came in at 105, ahead of an estimate for 102. Even more impressive is that it is the highest reading since late 2018. The reading is also near a 20-year high.

With all the talk about tariffs and the rising cost to the consumer, it certainly didn’t reflect in the reading for May import/export prices. Both readings were down versus last year, by -1.5% for import prices and -0.7% for export prices.

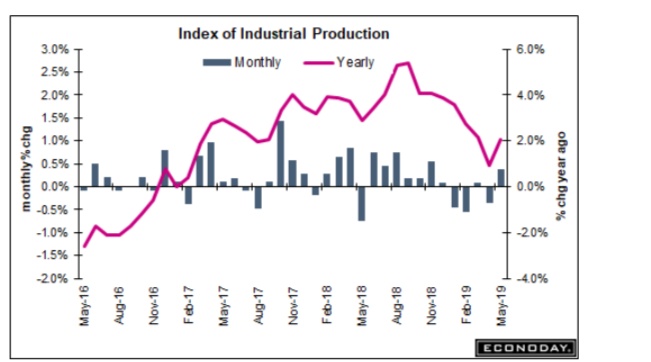

US Industrial production came in ahead of expectation too, rising by 0.4% m/m versus expectation of 0.2%. It was its highest reading in some time.

Meanwhile, retail sales for May came in 0.5% less than estimates for 0.7%. However, April’s results were revised higher to 0.5% from 0.3%.

As a result, the Atlanta Fed GDPNow reading for second-quarter growth was lifted to 2.1% from 1.4%.

Again tough to say a recession is on the way.

Earnings

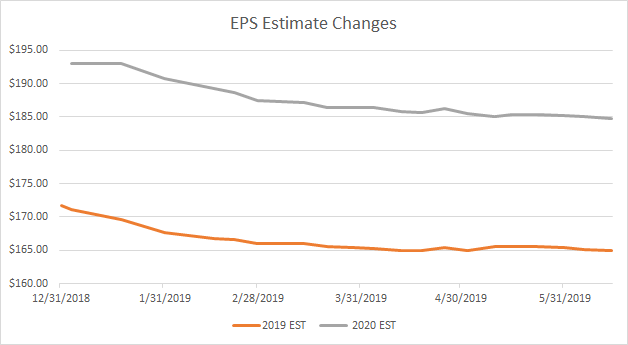

Earnings for 2019 are still moving lower, but at a snail’s pace, again suggesting substantial growth for 2019 at 8.8% to $164.92, and 12.1% to $184.82 in 2020. That is down from estimates on May 31 for growth of 9.1% and $165.38 per share in 2019. While earnings for 2020 were expected to grow by 12% of $185.27 per share.

(Data from S&P Dow Jones)

Meanwhile, my model estimates earnings of $164.96 in 2019 and $183.05 per share in 2020. Again, it slow drip lower and these number could change materially as companies report results in July. But at the moment it is tough to paint a scenario of a recession.

Yields

The move lower in the 10-Year yield seems to me to be more a result of a negative interest rate environment in some of the most significant economies. Germany’s 10-Year now has a rate of around -0.25%, while Japan’s is at -0.125%.

Spreads for these bonds and US bonds are still very wide and suggests there will be a further contraction in the future. The US and German bond spread are near a historic high.

Meanwhile, the spread between the US and Japanese bonds are narrowing; the technical chart suggests that further contraction is on the way.

I wrote on December 10 that the 10-Year US Treasury rate would fall to 2.3% and followed that up on March 27 saying they would fall to 2%.

I just looked at the spreads.

U.S. bonds are attractive to any globe investors and longer-dated bond rates are going to continue to fall, especially given the latest PPI and CPI reading that both showed a y/y rise of just 1.8%.

From many fronts, we may be in a perfect scenario from an economic standpoint. If GDP grows at 2%, and inflation rates stay low, with low-interest rates, we may not need 3% GDP growth to have a vibrant economy.

Growth may be slower this quarter, sure, but a recession? If there is one looming, I don’t see it.