You might be able to bounce in this gold colored sneaker, but what did you think when you heard about a Gold bounce? My first thought went to a Dennis Gartman quote, “I only like to invest in things that hurt if they fell on my foot” or something like that. Well I may be the opposite. If Gold is falling on my foot I am gonna move my foot out of the way. So when I hear about a Gold bounce I think about how a high density rock could possibly bounce at all. And this may be what is happening in the price of Gold right now.

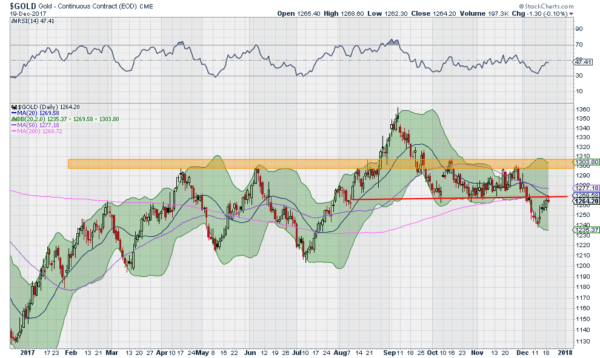

The chart below shows the price of Gold this year. After a good start it met resistance around 1300, a big round number (a topic for another blog) and paused. It pulled back and retested that 1300 level twice before briefly pushing through it in August. By mid September that glory had faded and it was back below 1300. It held a tight range between 1270 and 1300 until the beginning of December, when it broke down to a lower low.

The bottom in mid-December with a Morning Star reversal looked promising. But now it is back at that prior support zone at 1270 which is acting as resistance. If that were not enough to stall and reverse Gold, the 50 day SMA is about to cross down through the 200 day SMA, a Death Cross. Momentum as measured by the RSI is stalling as it closes in on the mid line and the Bollinger Bands® are turning down. All of these signs point to a possible end in the Gold bounce.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.