Investing.com’s stocks of the week

Thanks to broad concerns about emerging markets and worries over the taper, natural resource investing has come back into the spotlight. Many commodities are up for the year, which is something that can’t be said for the broad stock market so far in 2014.

And while many commodities have risen, their equity counterparts—such as in the precious metal mining space—have really taken off in the past few sessions. This isn’t too much of a surprise as equity commodity picks generally act as a leveraged play on their underlying commodities, at least in the precious metal world.

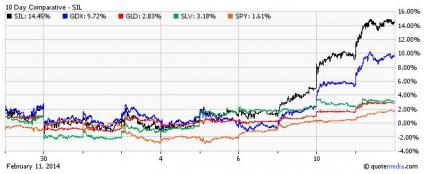

A great example of this is in the case of gold and gold miners. Gold, as represented by (GLD), has added about 2.8% in the past ten days, while the mining ETF counterpart, (GDX), has surged by nearly 9.7% in the same period. Clearly, mining ETFs have been the way to play the surge, at least in the gold world.

Silver in Focus

However, if you look at silver, the trend has been even more intense and in favor of the miners. The iShares Silver Trust (SLV), which is a play on silver bullion, has moved higher by about 3.2% in the past two week time frame. Meanwhile, the Global X Silver Miners ETF (SIL) has soared in the same time period, adding nearly 14.5%.

Once again, the equity version of the product crushed the commodity counterpart, at least in this very short time frame. It does show that the real play has been in the mining space as of late, and that while sentiment has been turning on commodities, it has seen a huge reversal in the commodity mining world.

In fact, the silver mining industry, at least in terms of its Zacks Industry Rank, has really been soaring as of late. The segment is now ranked in the top 40% overall, which is a huge move in the right direction in a very short time frame. The space has actually moved higher by 55 spots in just a week, so analysts are starting to feel better about the space, at least from an earnings estimate perspective.

Bottom Line

Gold has been stealing the show in recent sessions, as the commodity and miners have been rallying. This has been a huge shift from last year when this commodity was experiencing one of its worst years in recent memory.

Many of the same things can be said for silver ETFs as of late too, as this commodity has really rallied hard in recent sessions, and is once again looking promising. And much like the gold market, miners are really taking advantage of the trends and are leading the way higher.

In fact, silver miners are actually outperforming their gold cousins by a pretty wide margin and their Zacks Industry Rank is more favorable too. So if you are looking for a way to ride the commodity producer wave higher, consider a silver mining ETF like SIL, as it could offer more bang for your buck if the current trends in the space continue.