In this month's update of the "real" employment situation we will dig down behind the headlines and look deeper into Friday morning's release of the Employment Situation report from the Bureau of Labor Statistics. On the positive side there were 200,000 jobs created in the previous month and the unemployment rate fell from an upwardly revised 8.7% to 8.5%. Furthermore, while October was revised higher by 12,000 jobs; November was revised lower by 20,000. Now it is time to dig behind the headlines.

As we discussed earlier this week with the ADP Employment report, which showed a 325,000 job increase, this is the seasonally strong time of year for employment increases due to the retail shopping season. This also showed up into Friday's employment report as 42,000 of the 200,000 jobs "created" were "courier's and messengers" for the holiday delivery season. Therefore, due to seasonality, it is no surprise that we saw a fairly healthy jump in employment but unfortunately many of these jobs tend to be very temporary in nature.

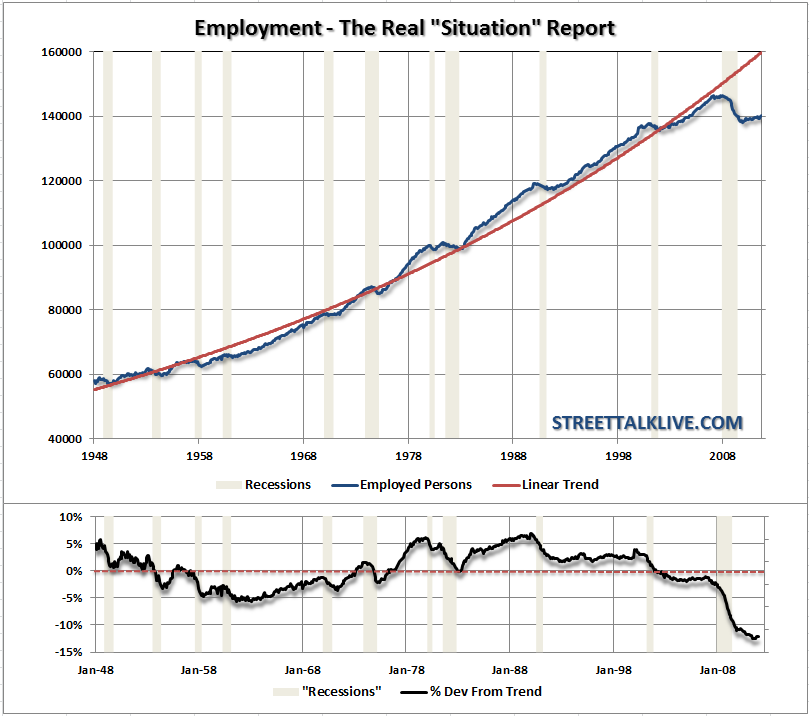

First, let's start by putting things into perspective. If you take a look at the actual number of those "counted" as employed that number has risen from the recessionary trough. However, in reality, employment is still far below the long term historical trend. Currently, the deviation from the long term trend is the widest on record and has made very little improvement.

How can this be if the unemployment rate is falling?

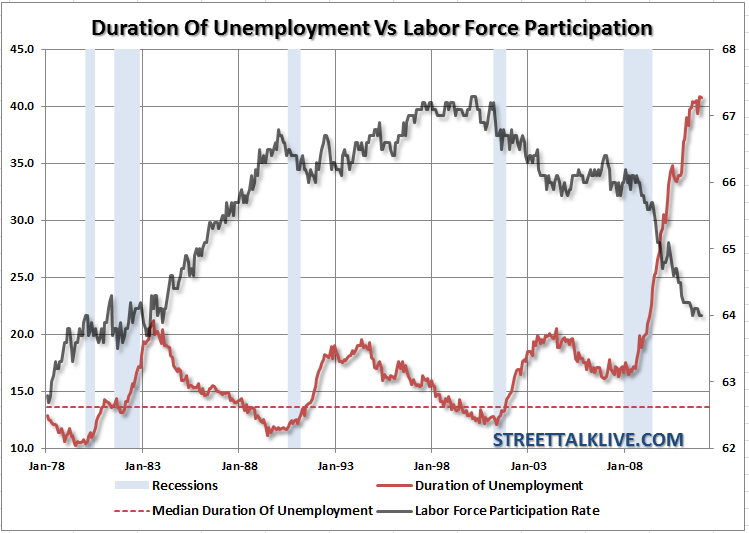

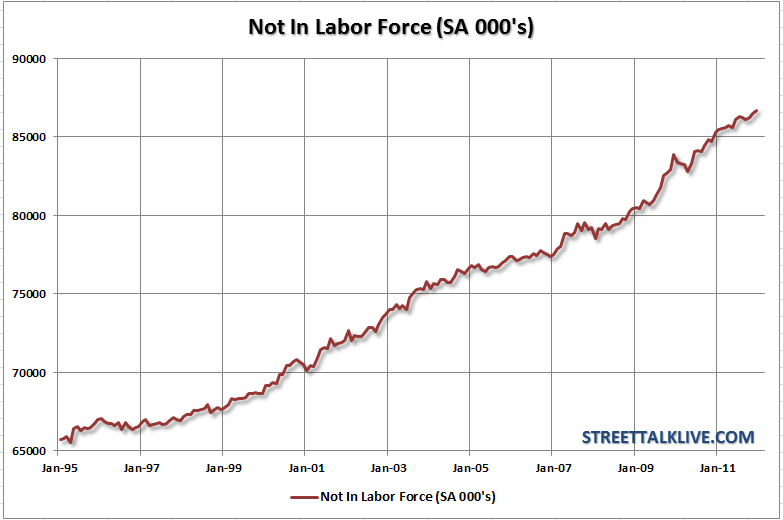

To answer that question we only need to look at the number of individuals that have "fallen off" the rolls entirely due to long term unemployment. Those individuals not counted as part of the labor force swelled by 194,000 to a record 86.7 million. This is why the labor force participation rate declined to 64% which is the lowest level of labor force participation that we have seen since the early 1980's. The important difference is that in the 80’s the participation rate was rising – not falling. This weakness is further confirmed by the duration of those out of work which remains near last month’s record at 40.8 weeks.

If, and that is a big "IF", employment was truly improving we would be seeing these numbers begin to reverse course. They aren't and the reason is due to population growth. During the last month it is estimated that the number of individuals of working age, 16 years and over, rose by 143,000 with the working age population now residing at 240.6 million. The offset is that while job gains are modest, and primarily located in lower paying temporary employment for the end of year seasonality, the population continues to grow at an unfettered clip. In simple terms the economy is not creating jobs fast enough to keep up with population growth.

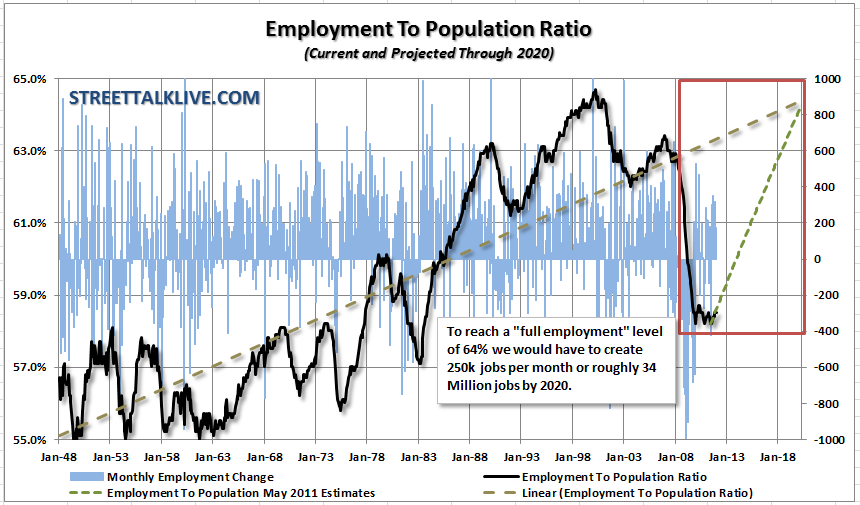

This is why I prefer to look at the employment to population ratio as a better means of understanding the real employment situation in the country. In order for the country to return to the long term trend of employment by 2020 we will need to be creating nearly 250,000 jobs each month. This, of course, is a far cry from 200,000 that we saw this month. With the employment to population ratio remaining at levels not seen since 1984 the real pressure on the economy remains focused on the consumer.

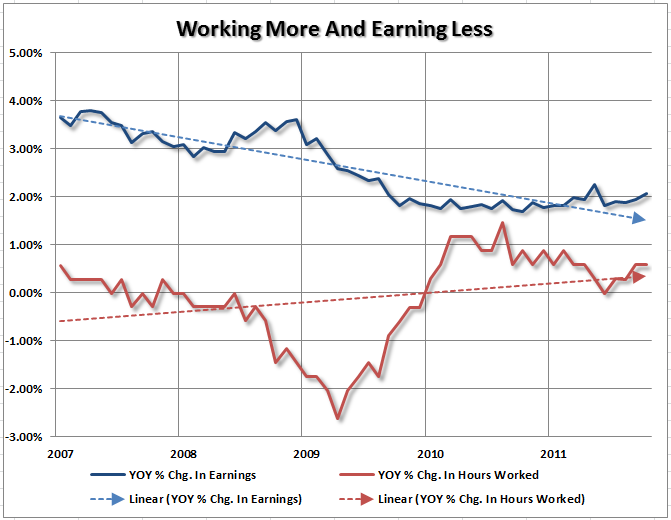

There are two very negative ramifications of this large and "available" labor pool. The first is that the longer an individual remains unemployed the degradation in job skills weighs on future employment potential and income. The second, and most importantly, is that with a high level of competition for existing jobs; wages remain under significant downward pressure.

Business owners are highly aware of the employment and business climate, and regardless of the ranting and raving about the "cash on the sidelines", businesses are not in the business of charity. Business owners are milking the current employment climate for all it is worth in order to maintain profitability. With high competition levels for existing jobs, and the impeding threat of job loss for those working, employers can work employees longer hours at less pay. This is great for profit margins and workers won't complain because there are plenty of individuals that will be happy to take their job and do it for less pay.

This impact on wages, as other inflationary pressures rise, hits the consumer where it hurts the most. We have discussed the recent declines in wages and salaries combined with the rising costs of food and energy are consuming more of the household income. This bleed on incomes has led to significant slides in the personal savings rate and the ability for the consumer to continue to spend outside of the main necessities to meet their basic standard of living. This pattern is very unsustainable long term and sharp decreases in personal savings rates have historically been precursors to the onset of recessions.

Employment and Recessions

One of the key questions to be answered is whether or not the recent increases in employment are sustainable into 2012. While the recent increases have certainly been encouraging there are several influences that cause the recent increases to reverse. As we discussed in our report yesterday the “increases that we have seen in recent economic reports are the result of the restart from the near ‘economic freeze’ due to the combination of the Japan earthquake, Eurozone and Debt Ceiling crisis' this past summer. That ‘pent up demand’ has likely run its course and while Q4 may look good there is likely going to be weakness in the first half of 2012.” Furthermore, any impact from weakness in consumption, with corporate profit margins already under pressure, could lead to further hiring pressures as corporations adjust to protect their bottom line.

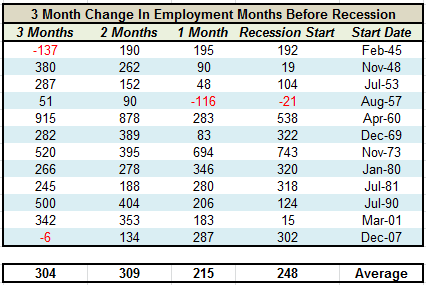

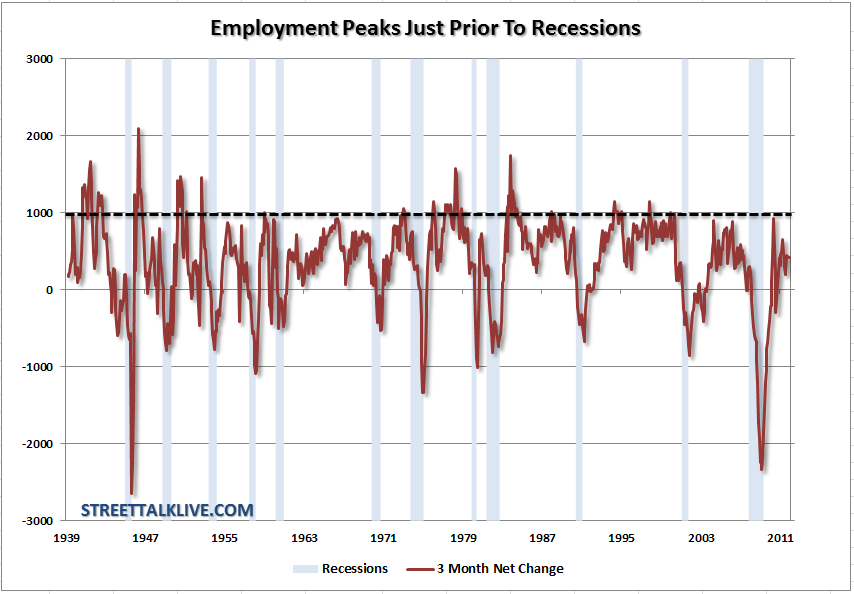

We have been fairly vocal that 2012 could likely see the start of the next recession. However, does the recent uptick in employment dissuade us about our call? Not really. The table details every recession going back to 1948 as identified by the "Start Date" which is the first month of the recession as identified by the National Bureau of Economic Research. The table shows the month-over-month increases in payrolls beginning 3, 2 and 1 month before the actual first month of economic recession.

The first thing to notice is that there are only 4 months in the entire table that actually show job losses. Employers are generally very slow to hire, and fire, employees which is why employment is a lagging indicator. However, if we look at the net change of employment over a 3 month period what we notice is that job gains were actually quite strong just prior to the onset of an economic recession.

The chart of the 3 month net change in jobs shows this a little more clearly. As you can see the 3 month net change in jobs tends to peak just prior to the onset of a recession. What is important to note here is that the 3 month net change in jobs has already peaked at normal historical levels and has begun to trend lower.

With the end of the holiday shopping season now behind us it is likely that we will see renewed weakness in the employment reports in the coming months ahead. While Friday's data was certainly better than a "sharp stick in the eye" the reality is that the economy is currently struggling along at a very anemic pace. Without employment growing fast enough to offset labor pool overhang we are unlikely to reduce the real unemployment problem that persists in the U.S. This bodes poorly for the consumer, the economy and ultimately the markets as this weakness leaves all three very susceptible to unexpected system shocks. While we certainly hope for the best - "hope" is not an investment strategy that we can use.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Real Employment Situation Report For December 2011

Published 01/07/2012, 02:42 AM

Updated 02/15/2024, 03:10 AM

The Real Employment Situation Report For December 2011

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.