Stocks are seeing great strength now after the Fed meeting and decision to keep rates on hold, as expected.

There is just no reason to hike rates until after the elections, meaning December is the earliest possible rate hike in my view.

I was looking for the typical fall weak/consolidating market, but it seems we are going to rally into the elections, so I’m trying to take full advantage of it.

Metals moved well off support areas and are now moving back up to resistance.

Gold gained 2.40% for the week after testing and holding the 100 day moving average at the $1,310 support area.

We’ve now got resistance at $1,350, then above at $1,375, which is the major breakout area that will take us up to the next base building area at $1,430 on the top end, and $1,370 on the lower end of the next consolidation phase.

All in all, gold remains in the very early stages of this new bull.

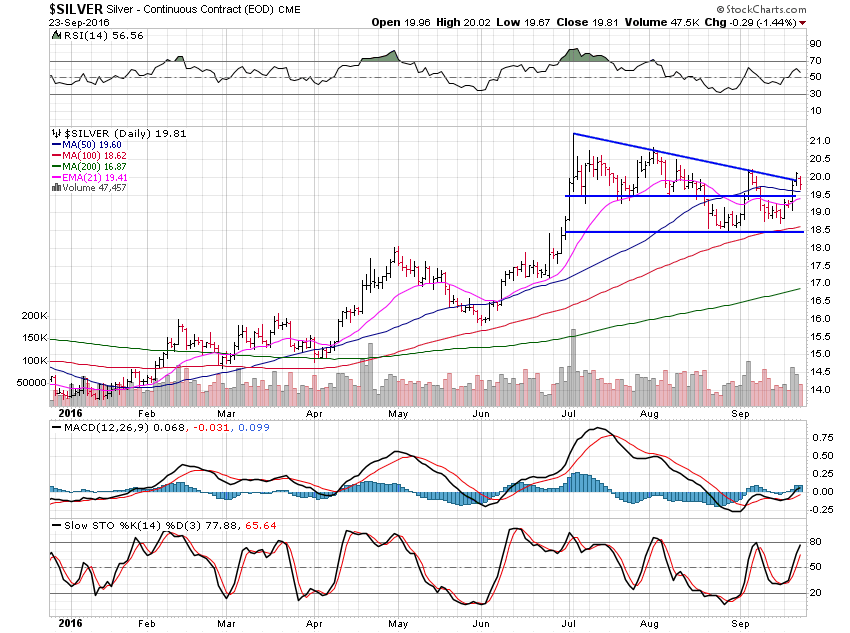

Silver rallied 5.03% this past week and is ready to breakout anytime now.

If silver can get going past the $20 area, then we will quickly see the $20.50 resistance level tested.

Metals are usually strong into years end and with elections looming, most sectors, including the metals, should do pretty well.

I am focused on finding the best and fastest moving sectors, and the best stocks within, to focus in on and make the most out of this move.

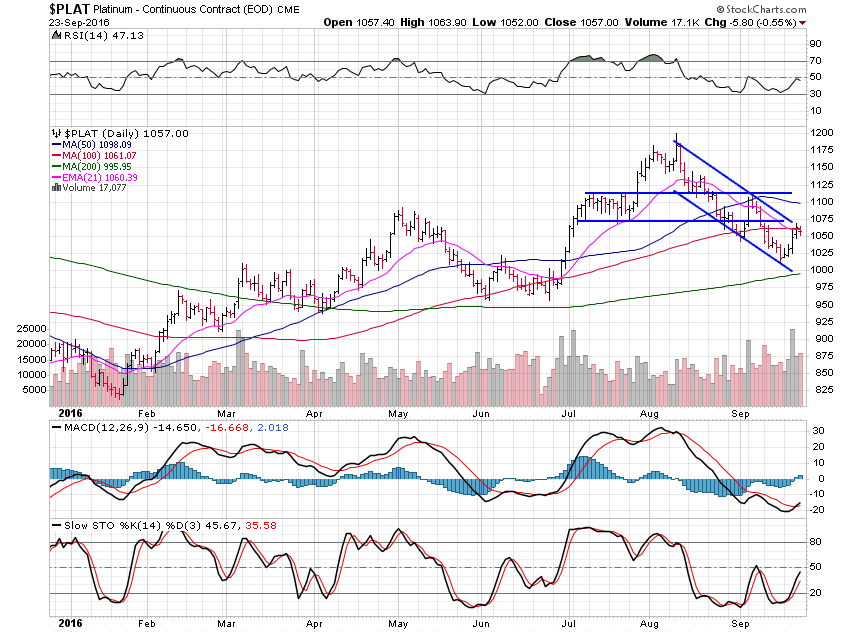

Platinum gained 3.87% this past week and looks set for more upside.

We’re setup to move past $1,075 and move up to the next resistance level at $1,125 anytime now.

Nice to see all the metals moving up well after some well deserved rest.

Palladium put in a solid effort rising 5.06% on the week and now set up for more gains.

Palladium is trying to break above the $700 area now and $725 is the next resistance level to watch.

$800 remains the major resistance area, where a longer rest is surely to be seen.

I hope you enjoy your first weekend of fall and are being quick to take advantage of the move which has just begun.