If the supply market is so tight, as we explored in Part One, why aren’t prices already at $25,000 or 30,000 per ton?

Well, tin has certainly been characterized by boom and bust.

When the metal price last hit an all-time high of $33,600 per ton in April 2011, China stopped importing and actually became a net exporter as volumes of tin products rose. The price then crashed in the following six months to nearly half.

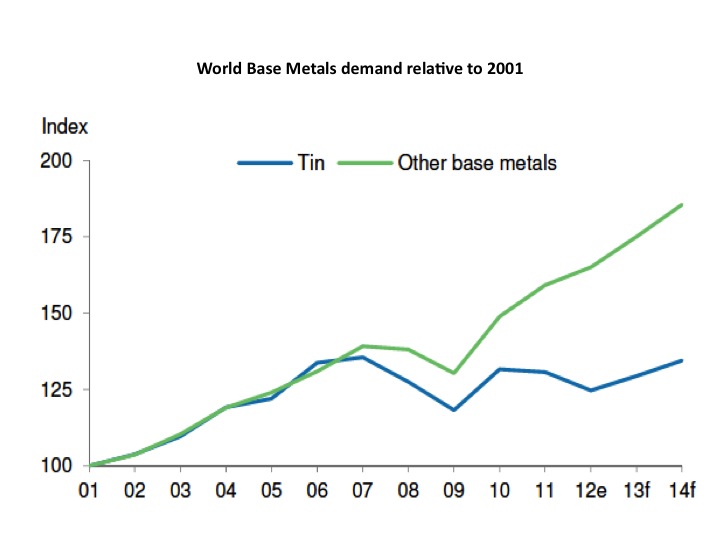

The BNP Paribas report observes that what makes tin’s price performance – both in 2012 and since 2001 – all the more remarkable is that it has been achieved despite demand being relatively weak.

Tin demand fared reasonably well up until 2006-07 compared with other base metals, boosted by the migration to lead-free, high-tin-content solder for the European market.

But since then it has fallen behind, due to a drop-off in demand for consumer electronics and de-stocking, as this chart from the bank illustrates.

The report states that tin’s poor demand record since 2007 has both structural and cyclical causes.

Usage in chemicals (said to be 15 percent of overall demand) and several small applications has shown some growth, but tinplate and float glass (together around 20 percent) have been broadly flat. More importantly, solder use has fallen since 2007 (when it accounted for 55 percent of demand), first largely through miniaturization and thrifting, and then in 2012 due to a downturn in the consumer electronics and home appliance markets, hitting Chinese solder manufacturers hard.

Tin’s shorter-term demand prospects depend more on the health of solder’s end-use markets, and there BNP sees growth of 3.5-4.0 percent in 2013, applying further pressure on the constrained supply market. Much of this will come from the Asian electronics market, particularly China.

So if Indonesia controls the bottom of the market, then China can be said to control the top. Even so, many observers are expecting further strength in the tin price this year.

Edward Meir, senior commodities analyst with INTL FCStone, is quoted in Resource Investing News as saying he could see the price up to $28,000 per ton this year, but with the average around $23,300 per ton.

Wayne Bramwell is more bullish, saying the price could be above $30,000 by the time his project comes on-stream in 2015. With the supply market as tight as it is, it would not take much of a global recovery to prove him right.

By Stuart Burns

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Price of Tin: It’s All About Boom And Bust

Published 01/23/2013, 03:52 AM

Updated 07/09/2023, 06:31 AM

The Price of Tin: It’s All About Boom And Bust

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.