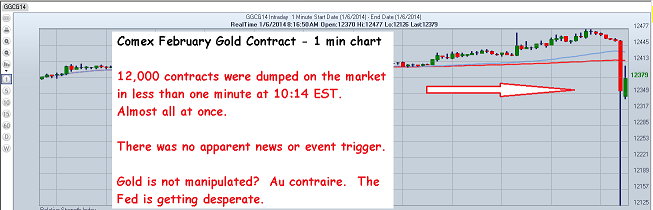

The price of gold had remarkably smashed $35 in the space of 60 seconds at 10:14 a.m. NY time this morning. 12,000 contracts hit the market almost all at once. To put this size in context, on Friday a little over 107,000 Feb contracts traded during the entire 23 hour Globex system session. In other words, today at 10:14 a.m., a little over 11% of Friday's total volume traded in the space of 1/1380th of the entire Globex session for a given period.

The hit came from nowhere and halted a strong rally in the price of gold that began last night in Asia. Concurrently, the dollar was selling off hard, as was the S&P 500. There was no apparent news or event that would have triggered the price smash:

The price of gold at the time of writing has since recovered about 90% of the price hit. Silver, which was giving all indications of behaving like a runaway freight train before the hit, has recovered about 2/3 of its price-ambush.

Mere manipulation by desperate criminals?

This is the unmistakable sign of desperation. Desperation to keep a lid on the price of gold in an attempt to make the public believe that everything is ok in this country and with the U.S. dollar. But we all know otherwise...

I have no doubt that the hit was used by JP Morgan to get more long Comex gold futures and to induce a flood of GLD share selling. The GLD shares will be turned into the GLD Trust either today or tomorrow and used to remove more gold. I bet within the next couple of days, today inclusive, we'll see a large withdrawal of gold from the GLD Trust. For the record, the selling of GLD shares does not trigger the removal of gold. Actually, gold can only be removed by the banks who exchange shares for gold.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Price Of Gold: The Fed's 60 Seconds Of Desperation

Published 01/07/2014, 01:30 AM

Updated 08/21/2024, 03:35 AM

The Price Of Gold: The Fed's 60 Seconds Of Desperation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.