The recent imagery from the horrific bombings in Paris has spurred a public outpouring of grief as France considers the human cost of the attacks. However, as the media focuses upon the location and identification of the perpetrators, little has been said about the impact to financial markets.

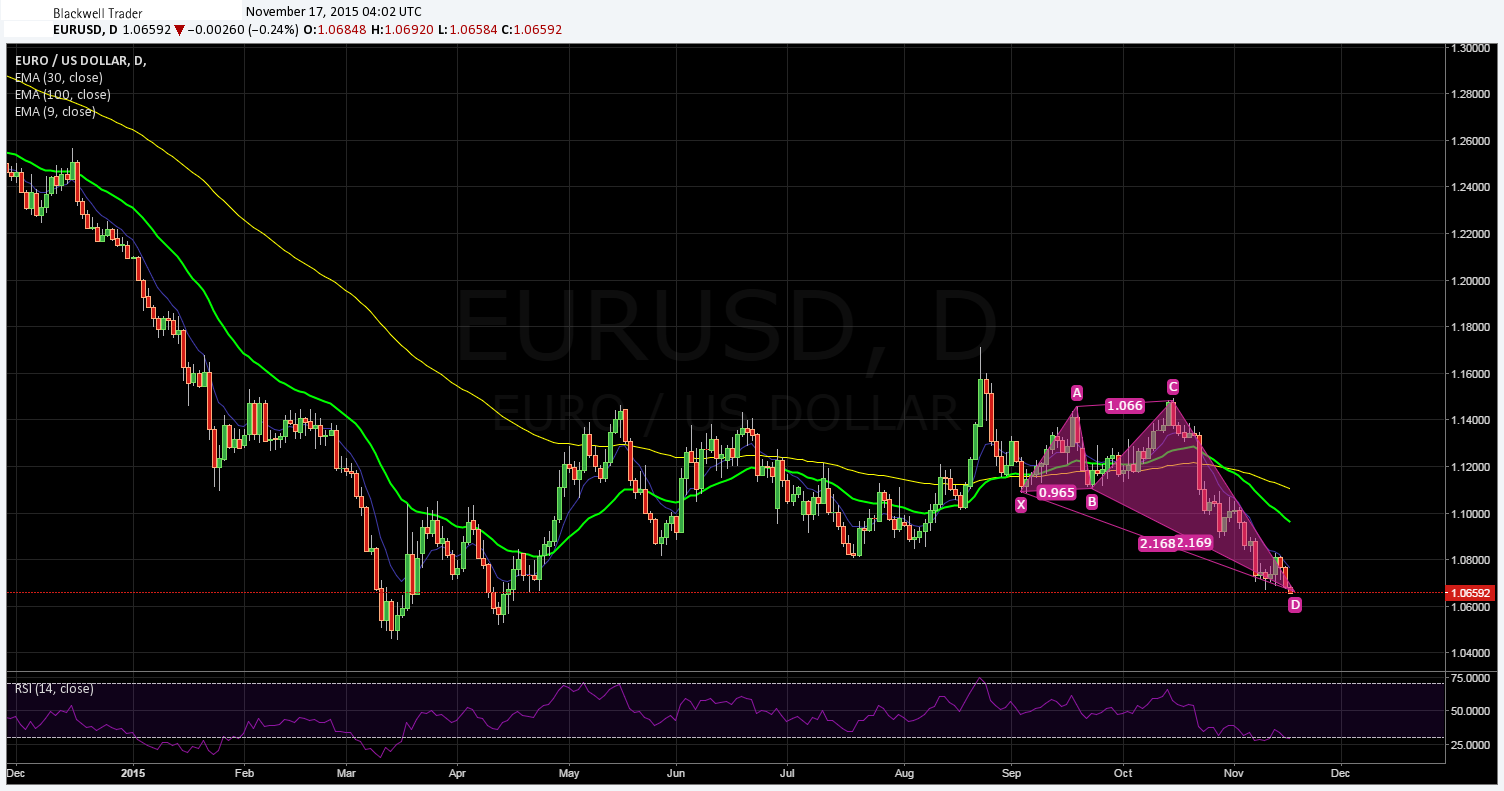

Despite the carnage from the Paris terrorist attacks, world financial markets have been relatively resilient in the face of political change. World equity markets have been relatively stable and euro selling although significant, has been limited. In fact, as a positive for the rule of law, the market reaction to the event has been orderly and predictable with the euro only shedding around 80 pips.

However, some pundits are now questioning what the long-run effects of a concerted string of attacks within the Eurozone would have on financial markets. The good news is that the majority of economic research seems to suggest that the impact of terrorism on financial markets is fairly limited. In fact, research undertaken by Choudhry (2003), and Chen and Siems (2004), found that the effects of terrorist attacks are relatively limited to the short term and also potentially diminish over time. Subsequently, despite the human toll, the long-run financial impact of the Paris attack is likely to be relatively muted.

In fact, studying the after effects of the 2004 Madrid bombing shows the lingering financial effects of the attack on the markets lasted two days. This reaction time was also mirrored by the recent Charlie Hebdo incidents which also impacted the capital markets for the same period of time. Although the sample size is limited, it tends to imply that the markets are likely to recover relatively quickly in the short term.

Government spending, in light of the changing security environment, is also a consideration due to the risk of it impacting investment and growth. However, the long term effect of increased homeland security expenditure within the United States of America was studied by Hobijn (2002) who concluded that that the large increase in security spending accounted for just 0.35% of GDP in 2003. Subsequently any future increased counter-terrorism expenditure, in response to the attacks by the French government, is likely to have little short term impact upon output.

Subsequently, expect the European markets to slowly return to normality and stable equilibrium in the coming days as the financial impact of the attacks is digested. In particular, the euro could prove to be resurgent, regaining much of the losses following the terrorist atrocity.However, the psyche of the French people is likely to take significantly longer to heal as many grapple with a great sense of loss.

References

Chen, A.H. and T.F. Siems. 2004. “The Effects of Terrorism on Global Capital Markets.” European Journal of Political Economy, Vol. 20, No. 2, pp.. 349-366

Choudhry, T. 2003. “September 11 and Time-Varying Beta of United States Companies.” Mimeo. Bradford University School of Management

Hobjin, B. 2002. “What Will Homeland Security Cost?” Federal Reserve Bank of New York Economic Policy Review (November)