Yesterday’s session in stocks was a true bloodbath that extended well into today’s overnight sessions. It offered two glimmers of hope: one very temporary that came shortly after we exited our tremendously profitable short position, and the other that is unfolding at the moment of writing these words. As the current prices are within spitting distance of our yesterday’s exit, it’s high time for the short-term outlook reexamination.

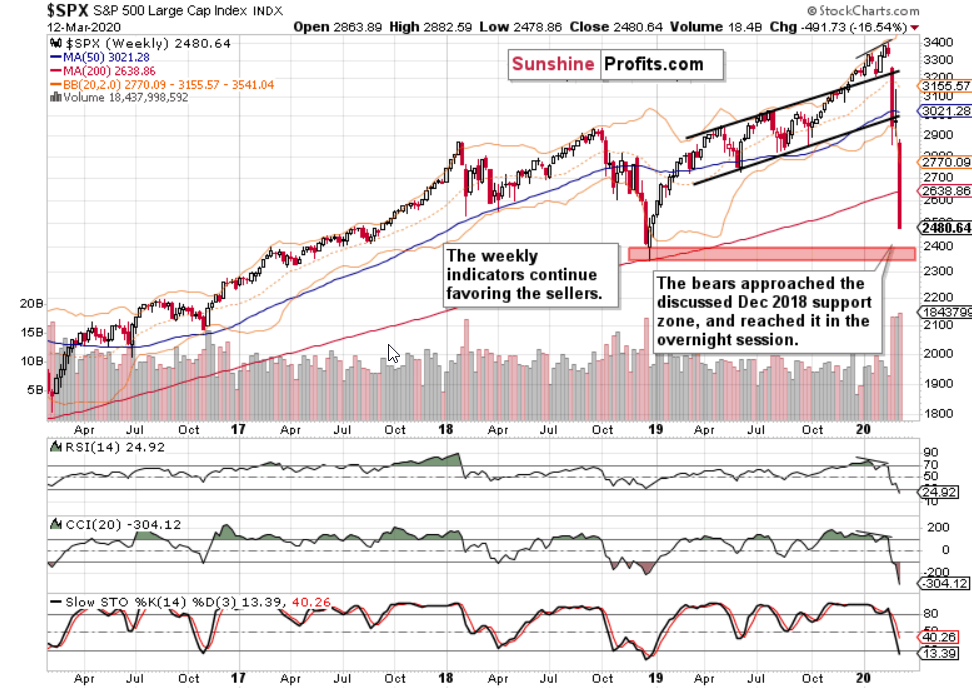

Let’s jump right into the weekly chart to see the shape of the week-in-progress.

(charts courtesy of stockcharts.com).

These were our yesterday’s observations:

(…) The sizable bearish gap remains unchallenged, and the bears keep the reins.

(…) This week’s volume is on track to beat that of the either two preceding weeks, lending more support to the bears. And so do the weekly indicators. The bottom clearly appears not to be in yet.

(…) New 2020 lows are very likely ahead of us – that’s a pretty safe bet to make as the nearest strong S&P 500 support is at the December 2018 lows at around 2400.

And indeed, the S&P 500 Futures turned at the 2400 after the short-lived bounce that took them over 2650. We didn’t have to ride that one as we have taken our 276-point gain off the table comfortably ahead of it.

The S&P 500 upswing didn’t stick however, and stocks rolled over later in the day and in today’s overnight session all the way to the December 2018 support‘s upper border. There, they turned around and trade at 2555 as we speak.

Let’s take a look at the daily chart.

While the daily indicators are very extended on the downside, a temporary rebound would not surprise us in the coming days as the bulls are likely to build upon today’s gains so far.

Would it make sense to chase it? The answer is reserved for our subscribers. And it’s not a yes-or-no one at that.

Good news! When you’re reading this article only later, we have the honor to tell you we’ve just made a 61-point profit on this trade along with our subscribers!

Summing up, the bears are firmly in control, and have reached a key support in today’s overnight session. Prices rebounded though, and a short-term price recovery wouldn’t surprise us in the least. The weekly chart though remains solidly in bearish territory, regardless of the daily chart’s potential for a rebound. Within the trading position details, you’ll find our game plan of the setup at hand. Through diligent preparation, things turned out really well.