Key Points:

- A bearish channel should make itself felt this week.

- Stochastics could finally come back into play.

- Bollinger Bands suggest that an upside breakout is currently unlikely.

The GBP/CHF could be about to finally cool off significantly as we move into the second half of the week, especially if UK results come in short of the current forecasts. However, setting economic news aside, technicals will largely be driving prices for the pair moving forward as there are a number of forces working against any further bullishness for the recently resurgent pair.

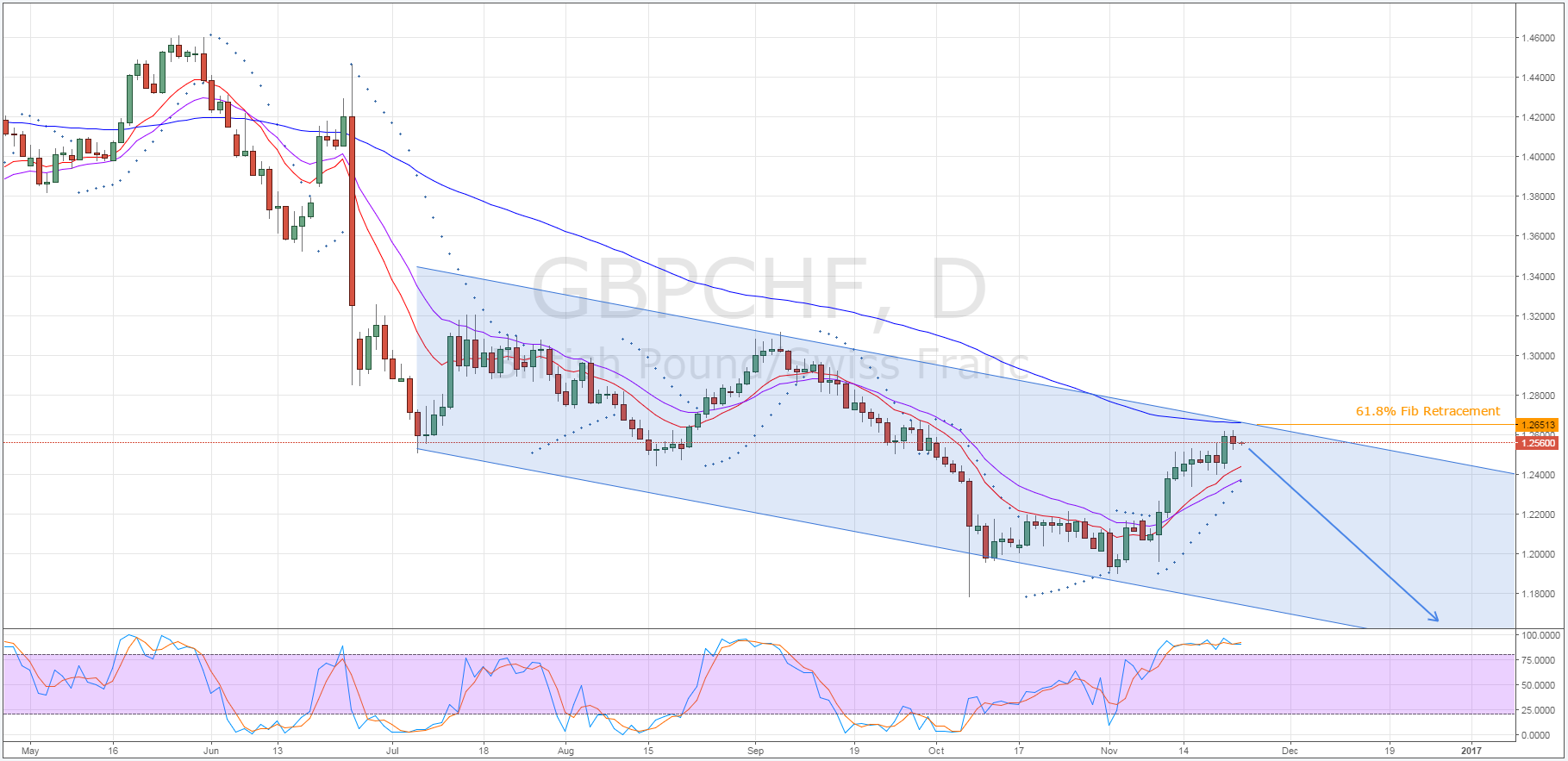

First and foremost, there is currently a rather patent bearish channel in place, the upside constraint of which is being challenged by the pair. As a result of this, buying pressure is already beginning to abate which is evidenced by last session’s slight pull back. However, given the rather strong surge in sentiment post-election, one could ask if we are finally going to see a breakout from the four-month downtrend instead.

Fortunately for the bears out there, the opposite is currently looking like the more likely outcome due to a handful of key technical factors. The first of these is the recent EMA activity which while, yes, the 12 and 20 day averages are rather bullish, the 100 day moving average is poised to provide some strong dynamic resistance. In addition to this however, the 61.8% Fibonacci retracement is also exerting some downward price pressure which should cap upsides drastically.

Furthermore, whilst not shown above, the Bollinger bands have diverged substantially which implies we are unlikely to see a breakout above the upside of the channel. This would be in line with the latest stochastic readings which are deep in overbought territory, a strong signal that a reversal could be on the cards in the next few sessions.

From a fundamental perspective, the major news which could upset the technical bias would be the UK Preliminary GDP data. Currently forecasted at 0.5% q/q, an outcome significantly above this could result in an extension of last week’s gains. All things considered however, there is a relatively slim chance of the GDP figure diverging materially from forecasts given that the recent NIESR estimates came in at around 0.4% q/q.

Ultimately, whether the pound’s recent string of gains can be extended past the 1.2651 mark or if a reversal will occur this week remains to be seen. However, the odds seem somewhat stacked against the pair as it looks as though a sizable portion of the Trump effect may have run its course, in the near-term a least. Consequently, monitor the news and the GDP results as they are likely the only things capable of adding momentum back in to the GBP/CHF moving ahead.