The (at least short-term) top on September 18 wasn’t too hard to predict. That’s not hindsight quarterbacking — on the same day we tweeted:

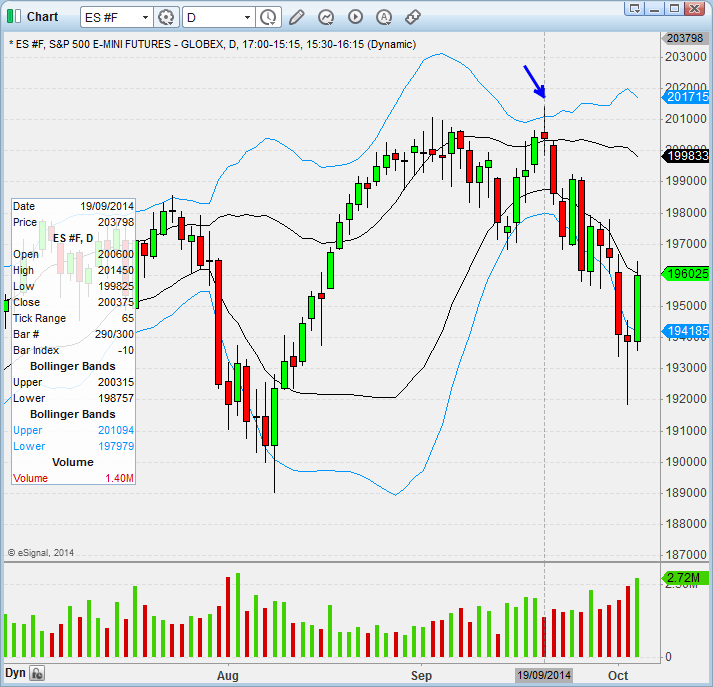

And if you were watching later that night we even gave out a short future trade we made (and this was the first future trade we had posted going back months — we only do this when we have a very strong feeling about the trade) which marked the very top on Thursday night (but alas which we covered too early on Friday wanting to go flat into the weekend):

Got the top by 1 point, and didn’t get stopped by .5 point. One of our better ones:

So believe us when we say that the top part wasn’t too hard to predict — but the bottom part, well that’s a different story. For a while now we have talked about PowerShares QQQ (NASDAQ:QQQ) 92 as the level we want to be tested before we can talk about real bottom.

You can see why — it’s the first weekly trend-line and a decent pullback from the highs. It’s not even the big kahuna trend-line from 2009 — more just a friendly, conventional 8% pullback from the highs.

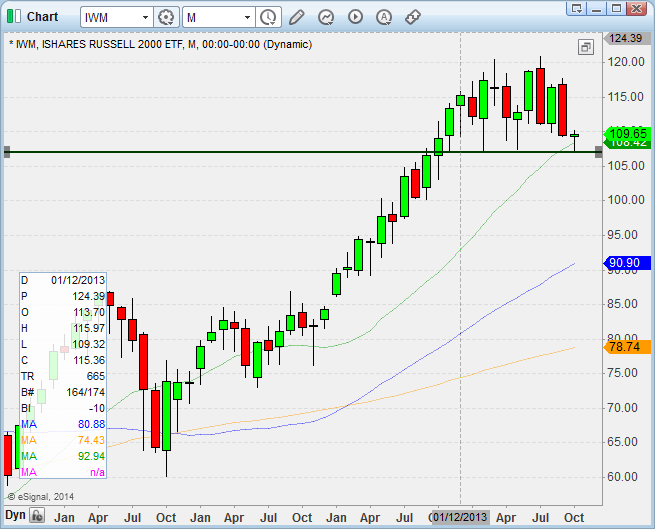

On Thursday/Friday we had a bounce — that again wasn’t too surprising considering iShares Russell 2000 Index (ARCA:IWM) bounced at major monthly levels (horizontal support and held the 20sma). As expected, Russell stalled the bleeding on Thursday and led the bounce on Friday.

Now the hard part and the question we feel a lot less confident on — was that it? We find ourselves questioning our original thesis about QQQ falling to 92. On one hand we look through our own stock universe and really are not impressed. It seems that a lot of stocks managed to run up to resistance in the rally and stall.

Tesla (NASDAQ:TSLA) is a great example here — nothing particularly bullish about this chart. Looks like a dead cat bounce to the underside of the 50sma. Won’t look bullish until it closes above 260.

Lots of charts look like TSLA and make us think that we had a dead cat bounce and are still going lower. But what gives us the greatest pause are the financials. The Financial Select Sector SPDR Fund (ARCA:XLF) acts great–nothing wrong with this picture as the ETF stays within the channel. One day this channel will break but we will deal with that when it comes – it hasn’t paid to anticipate major trend break-downs in this tape.

And what better proxy for looking at financial action than Goldman Sachs Group (NYSE:GS) – multi-year highs printed on Friday.

Biotech for us is also a canary in the coal mine — one of our favorite tells for hot money, and in scared markets, hot money gets cold very fast. So what did biotech do this past week (via iShares NASDAQ Biotech (NASDAQ:IBB))? Pullback to first minor support and then rally the hell up back to near highs. Again, for us to feel more bearish we would want money to start leaving this sector — something which is not happening right now. But if it does you can bet we will get more cautious.

So where does that leave us? Looking at individual stocks and indices we think 'meh'. Looking at financial and biotech stocks, not to mention what has happened on every dip since 2013, we think, well, maybe yes, this indeed was the bottom. Our gut says no, we will see lower prices, but we don’t trade on our gut. We trade on price action. The good thing about last week is that it gave us a major line in sand — the IWM lows at 107 which was horizontal support and monthly 20sma. If that goes, then we think 100 could come pretty fast.

Last week we were pretty cautious for our subs but going into next week we are going to give priority to individual stock set-ups versus feeling strong market bias. If we lose the Thursday lows on IWM we will go back to our QQQ 92 thesis but if bulls can keep the recent gains then we could just as easily be in for new highs.

Going into this coming week open minded to either direction — if bullish then trade against the Thursday IWM lows. We think IWM is the most important tell of the three right now. If bearish then watch stocks like TSLA — if they can get above those resistance lines and follow through then re-check and re-asses your bias.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.