With market volatility at the highest levels we've seen in some time, investors are rightly nervous about how the next few months will unfold. But, that may be all the more reason to take a step back and focus on our overall asset allocations and longer-term return goals.

I must concede that right around the time we begin talking about asset allocation and portfolio construction, we get to the bounds of what a brief article can cover responsibly. We have to just acknowledge that, and then move forward, because regardless of whether your target retirement date is 2016 or 2050, chances are a blend of:

- equities – stocks

- fixed income (bonds)

- cash

- real estate

is what your ideal asset allocation should look like. And most of us – whether in retirement accounts like 401ks and IRAs, or in taxable accounts – hold a base of investments in broad stock funds like S&P 500 index funds. And, most of these funds will be focused on largecap and megacap stocks.

Rounding it Out

On the fixed income side, most of us will have general holdings of bond funds with medium duration, representing bond maturities between 5 and 7 years out. Again, that's pretty standard, and a good base position to navigate from.

But, is your portfolio really capturing all the distinct variety available in today's market? And not just variety for the sake of it, but useful variety that improves our risk-adjusted returns as investors.

The current market is one that has provided pretty strong returns the past few years. Stocks have performed well, and so have bonds, while real estate is making a strong comeback from the abyss. So even if you've had a sub-optimal asset allocation (given your risk tolerance and time horizon), chances are you've been doing OK so long as you haven't been sitting all in cash.

Today I'm going to bring you a handful of ETFs that can be great additions to a balanced portfolio; little slices that offer the wonderful combo of diversification and low correlations to the base investments I just mentioned. The three categories that follow have all earned their place in millions of portfolios designed by professional money managers for typical investors.

ETFs for Small Cap Stocks

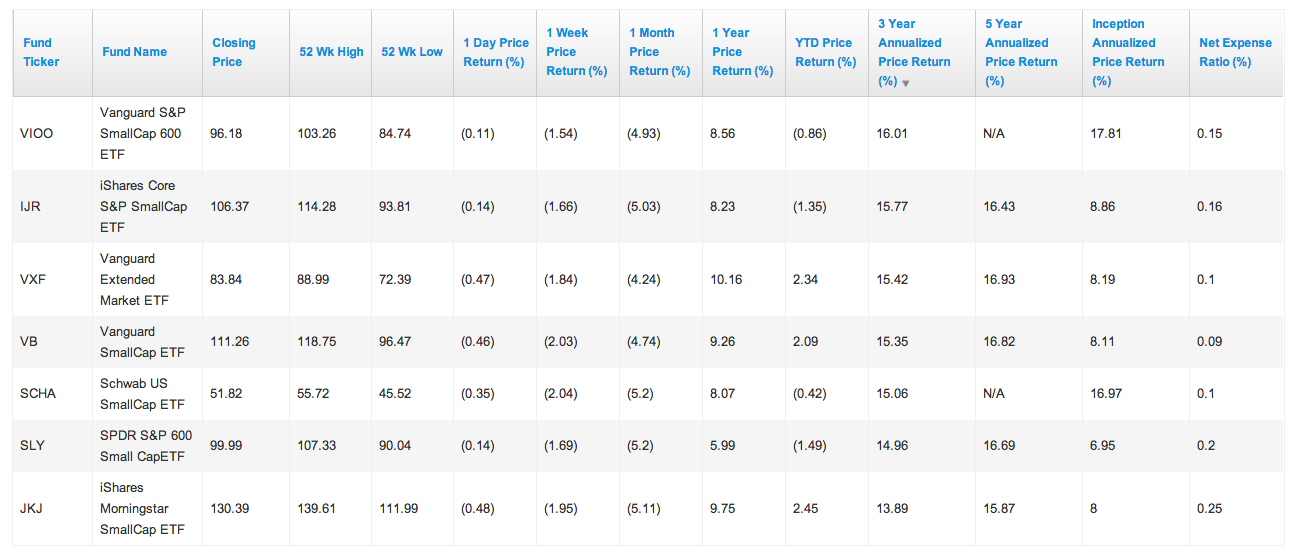

The S&P 500 does a very good job reflecting the performance of the very largest companies. But small caps deserve a small allocation in a balanced portfolio. Small caps have outperformed large cap stocks by nearly two full percentage points annually since 2009. Some of the largest funds in the space are the iShares S&P SmallCap 600 Index (NYSE:IJR) and the Vanguard SmallCap (NYSE:VB). The IJR has outperformed the Vanguard offering by 0.42% percent per year since 2011:

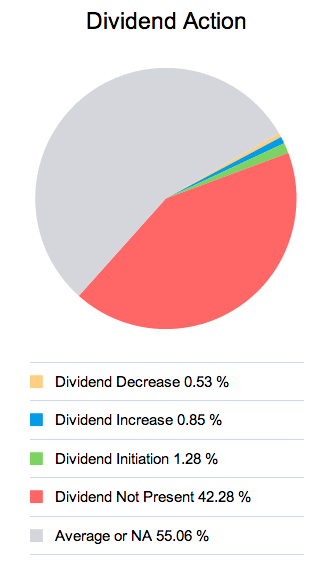

But I would give the slight nod to VB because it has a broader range of holdings (more than twice as many as IJR), and a lower expense ratio (0.09% to 0.16%). Remember, small caps tend to be in growth-generating mode, meaning little to no dividends. As you can see here from this CapitalCube constituent analysis on VB, nearly half the holdings pay no dividend at all.

But that's OK; we only seek to put a small percentage of a balanced portfolio here, and we'll look to other parts of our portfolio to provide income streams. A good target allocation for smallcap holdings is up to 10% for investors nearing retirement; younger investors can go higher, towards 20%.

ETFs for International Stocks

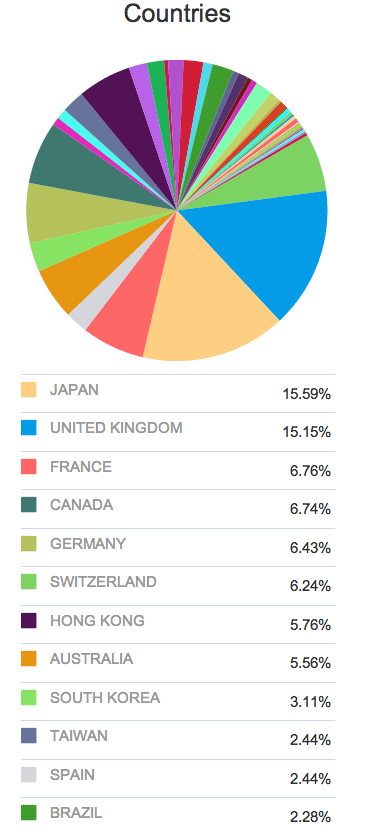

The world's a pretty big place; it's far too complex economically to try and time the success of different nations. My plate is generally kept full just trying to keep up with U.S. activity. So the best bet here is to not overthink things, and invest in a broad index like the MSCI or the FTSE, the standard international equity benchmarks. And while the “rest of world” indexes have lagged behind the U.S. for the past five years, they beat in the five years prior, and the ROW is generally considered to have more growth in its future than we are in the United States; investors should position themselves to participate in some of that growth.

Two of the best funds in the space are the iShares MSCI ACWI X US (NASDAQ:ACWX) and the Vanguard FTSE All World X US (NYSE:VEU). Both of them have the key feature of no U.S. exposure; most “global” funds have about half their assets parked in U.S. stocks, which kind of defeats the purpose of seeking an investment that diversifies your portfolio.

I give the nod to the Vanguard offering, VEU, because it has the superior 5 year return and a lower expense ratio (0.15% to the iShare's 0.34%).

A good target allocation for international stocks is between 10% and 20% of your total equity allocation. So for an investor that wishes to hold stocks and bonds in an 80/20 overall mix, international stocks could make up 8 to 16% of the portfolio. And if there's a particular country or region that you feel knowledgeable and confident about, feel free to invest in an ETF focusing there. You'll find multiple options for any developed nation; just be sure that any investment comes out of your existing allocation for international stocks, and isn't being added on top of it.

Commodity ETFs

There certainly hasn't been any shortage of media attention paid to this asset class over the past decade. The glamour, of course, is always about gold, but there are many other commodities that are more vital to the health of the economy. Commodity ETFs are valuable portfolio additions for both investors who want inflation protection and those bullish on the long-term demand for scarce resources.

There are two distinct types of exchange-traded products related to commodities. Both invest in futures contracts, because that's the only way to get direct exposure to price changes. “Standard” exchange-traded funds here will bring you extra paperwork come tax time. To get around this issue, exchange-traded notes (ETNs) were created. While technically a debt instrument from the issuing financial firm, an ETN only incurs taxes when it is sold, like regular capital gains.

My favorite name amongst the ETNs is the iPath DJ-UBS Commodity Index TR (NYSE:DJP), which invests in futures contracts for 19 commodities across energy, agriculture, metals, and livestock. I like the higher weighting for agricultural commodities, which in this current market is where I think we will see inflation rear its head first. The DJP – like all the choices in this space – has a high expense ratio, typically above 1% to account for the higher brokerage costs to manage the fund's assets.

On the ETF side of things, I really like the GreenHaven Continuous Commodity (NYSE:GCC), which takes an equal-weighted approach to its commodity basket. They have done a great job of limiting volatility by strategically choosing futures contracts across a 6 month spectrum, sometimes defraying the rollover issues that plague other commodity funds.

A good target allocation for commodity-based funds is up to 5% for a balanced portfolio, and up to 10% for younger investors. And if you have a tax-advantaged account like an IRA, that's a great place to stick a commodity ETF like the GCC; you won't have to worry about year-end tax headaches.

DisclaimerThe views and opinions expressed above are those of the author and do not necessarily reflect the views of CapitalCube.com, AnalytixInsight, Inc., its affiliates, or its employees.