I have been in the “money game” for a long time starting with a bank just prior to the crash of 1987. I make this point only to say that I have seen several full market cycles in my life, and my perspectives are based on experience rather than theory.

In 1999, there was a media personality who berated investors for paying fees to investment advisors/stock brokers when it was clear that ETF’s were the only way to go. His mantra was simply:

Why pay someone to underperform the indexes?

After the “Dot.com” crash in 2000, he was no longer on the air.

By the time the markets began to soar in 2007, there was a whole universe of ETF’s from which to choose. Once again, the mainstream media pounced on indexing and that “buy and hold” strategies were the only logical way for individuals to invest.

Why pay someone to underperform the indexes?

Then came the crash in 2008.

Today, we are once again becoming inundated with articles as to why it is “apparent” that individuals should only be using low-cost indexing strategies and holding for the “long term.” To wit:

When it comes to investing, it’s a losing proposition to try and be anything better than average.

If there’s no point in trying to beat the market through ‘active’ investing – using mutual funds that managers run, selecting what they hope are market-beating investments – what is the best way to invest? Through “passive” investing, which accepts average market returns (this means index funds, which track market benchmarks)

Of course, with the market seemingly impervious to any type of serious downturn, individuals are indeed listening. Via CNBC:

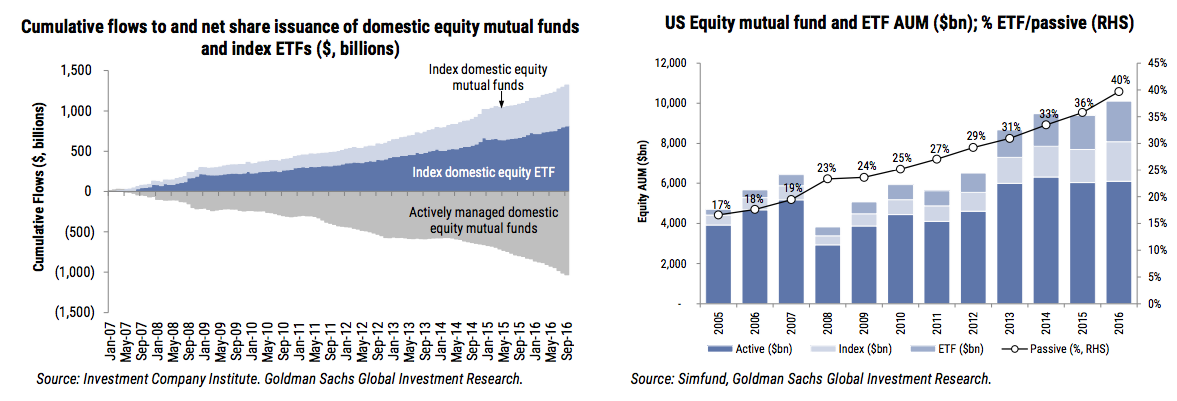

Flows out of actively managed U.S. equity mutual funds leaped to $264.5 billion in 2016, while flows into passive index funds and ETFs were $236.1 billion, according to data provided by the Vanguard Group and Morningstar. That was the greatest calendar-year asset change in the last decade, during which more than $1 trillion has shifted from active to passive U.S. equity funds.

Of course, the next crash hasn’t happened…yet.

But therein is the point.

It is effectively the final evolution of “bull market psychology” as investors capitulate to the “if you can’t beat’em, join ’em” mentality.

But it is just that. The final evolution of investor psychology that always leads the “sheep to the slaughter.”

The Inherent Costs Of “Low Costs”

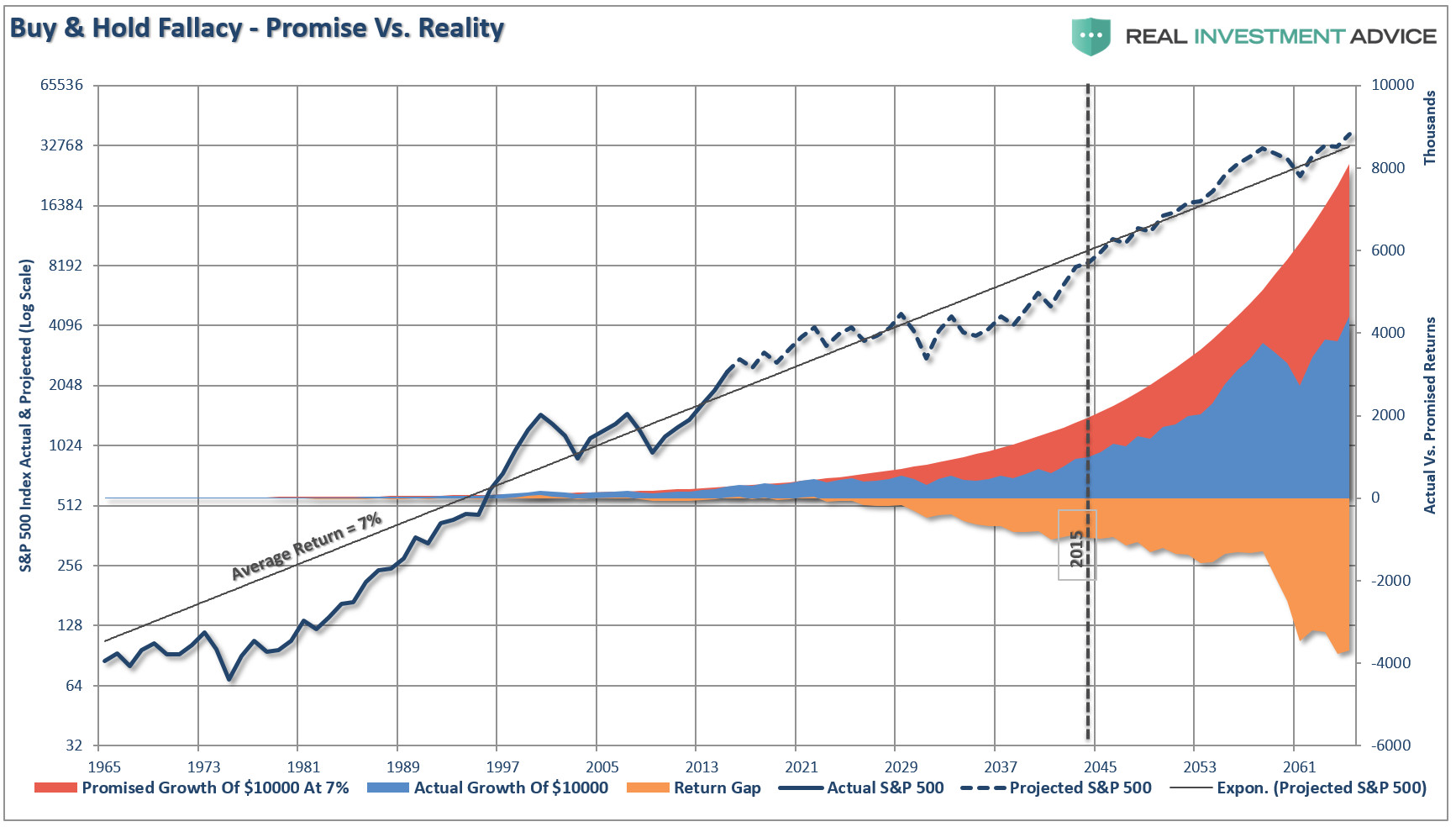

There is a “cost” to chasing “low costs” and “being average.” I do NOT disagree that costs are an important component of long-term returns; however there are two missing ingredients of “buy and hold” index investing are ignoring: 1) time; and, 2) psychology.

As I have discussed previously, the most important commodity to all investors is “time.” It is the one thing we can not manufacture more of. There is a massive difference between AVERAGE and ACTUAL returns on invested capital. The impact of losses, in any given year, destroys the annualized “compounding” effect of money.

Individuals who experienced either one, or both, of the last two bear markets, now understand the importance of “time” relating to their investment goals. Individuals that were close to retirement in either 2000, or 2007, and failed to navigate the subsequent market drawdowns have had to postpone their retirement plans, potentially indefinitely.

While the media cheers the rise of the markets to new all-time highs, the reality is that most investors have still not financially recovered due to the second point of “psychology.”

Despite the logic of mainstream arguments that “buy and hold” investing will work, given a long enough time frame, the reality is that investors generally don’t invest “logically.” All investors are driven by “psychology” in their decision-making which results in the age-old pattern of “buying high” and “selling low.”

The biggest problem for individuals, and the culprit of the great “ETF buying panic,” is the “herding effect” as investors rush to chase market returns. The coming problem will be “loss aversion,” as the herding effect runs in reverse in the rush to get out.

The Passive Indexing Trap

Let me just clarify the record – “There is no such thing as passive investing.”

While you may be invested in an “index,” when the next bear market correction begins, and the pain of loss becomes large enough, “passive indexing” will turn into “active panic.”

Not surprisingly, as markets have risen, individuals begin to rationalize the current price trend will continue indefinitely. The longer the rising trend lasts, the more ingrained the belief becomes until the last of “holdouts” finally “buy in.”

We can see this in the surge of ETF flows. As the “bull market” continues to run, the more rampant the increase in flows have become. (Note – they same thing was occurring in 2005-2007.)

Of course, while it is believed that ETF investors have become “passive,” the reality is they have simply become “active” investors in a different form. As the markets decline, there will be a slow realization “this decline” is something more than a “buy the dip” opportunity. As losses mount, the anxiety of those “losses” mounts until individuals seek to “avert further loss” by selling.

There are two problems forming.

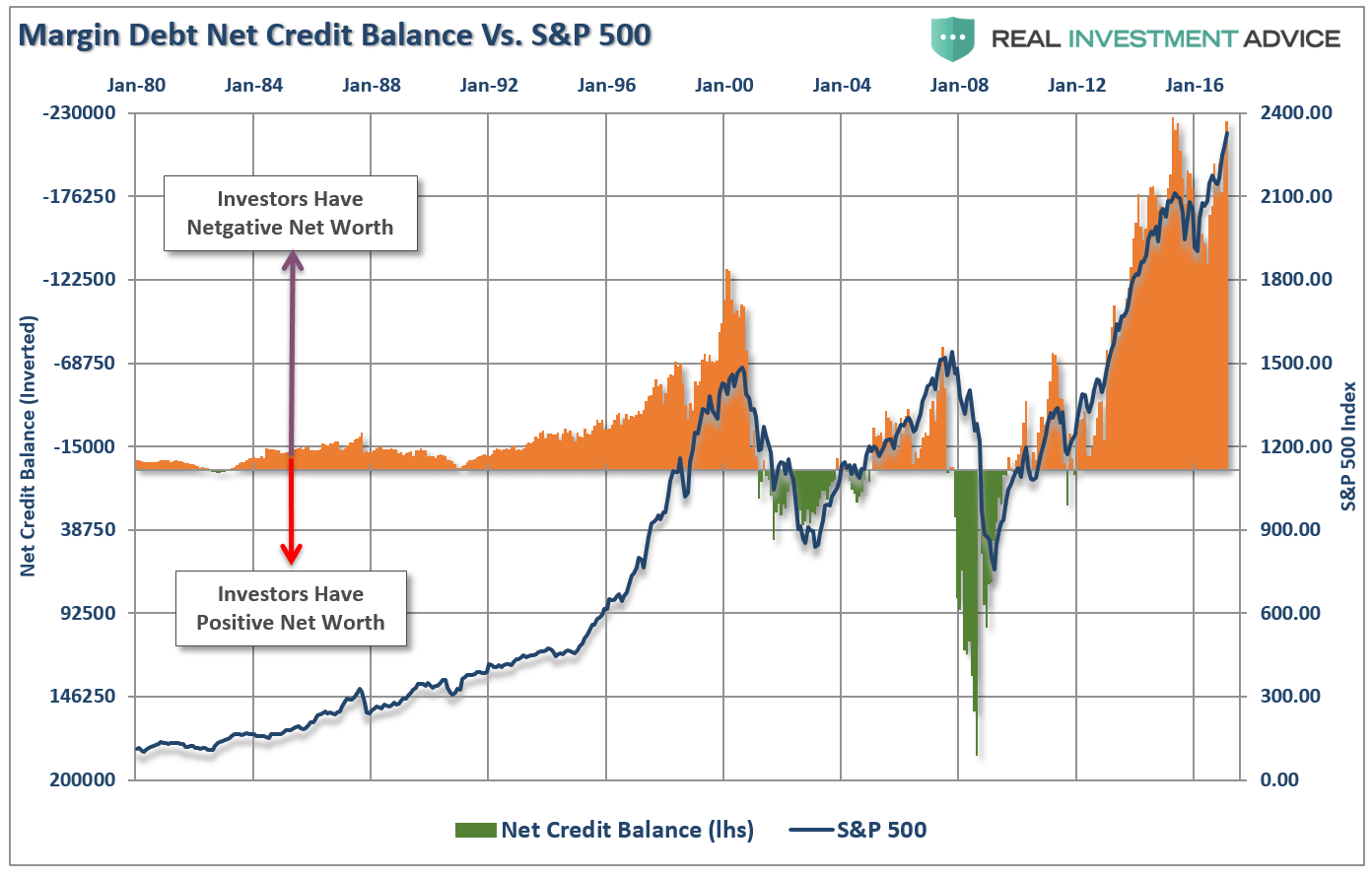

The first is leverage. While investors have been chasing returns in the “can’t-lose” market, they have also been piling on leverage in order to increase their return.

However, it isn’t just margin debt which has hit record highs as of late, but “shadow margin” as well. Via Wolf Richter:

So how much margin debt is out there? We know only the $528 billion reported by NYSE. Then there are companies like Wealthfront. But it’s just small fry. Big players have been doing this for a long time. These securities-based loans (SBLs) are called ‘shadow margin,’ and no one knows how much of it is out there. But it’s a lot.

However, several advisers surveyed by The Post estimated there is between $100 billion and $250 billion in outstanding SBLs among all brokerages.

Morgan Stanley (NYSE:MS) is one of the few firms that says how much in SBLs it’s sold – $36 billion, as of Dec. 31, a 26-percent increase from the year before.

Other major sellers of the loans are United Bankshares (NASDAQ:UBSI), Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), Raymond James, and Stifel Nicolaus, sources said.

If this “shadow margin” is $250 billion, it would bring total margin debt to $778 billion. That would make for a lot of forced selling.”

The second, which will be greatly impacted by the leverage issue, is liquidity of these instruments.

The head of the BOE Mark Carney himself has warned about the risk of “disorderly unwinding of portfolios” due to the lack of market liquidity.”

Market adjustments to date have occurred without significant stress. However, the risk of a sharp and disorderly reversal remains given the compressed credit and liquidity risk premia. As a result, market participants need to be mindful of the risks of diminished market liquidity, asset price discontinuities and contagion across asset markets.

And then there was, of course, Howard Marks, who mused in his “Liquidity” note:

ETF’s have become popular because they’re generally believed to be ‘better than mutual funds,’ in that they’re traded all day. Thus an ETF investor can get in or out anytime during trading hours. But do the investors in ETFs wonder about the source of their liquidity?

What Howard is referring to is the “Greater Fool Theory,” which surmises there is always a “greater fool” than you in the market to sell to. While the answer is “yes,” as there is always a buyer for every seller, the question is always “at what price?”

The eventual reversion is part of the market cycle. This is why managing portfolio risk is so critically important and why if you don’t sell high, you cannot buy low.

Being bullish on the market in the short term is fine – you should be. The expansion of Central Banks balance sheets and the hopes of a fiscal policy tsunami should continue to support stocks as long as no other crisis presents itself. However, the problem is that a crisis, which is ALWAYS unexpected, inevitably will trigger a reversion back to the fundamentals.

At some point, that reversion process will take hold. It is then investor “psychology” will collide with “margin debt” and ETF liquidity. It will be the equivalent of striking a match, lighting a stick of dynamite and throwing it into a tanker full of gasoline.

When the “herding” into ETF’s begins to reverse, it will not be a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures.

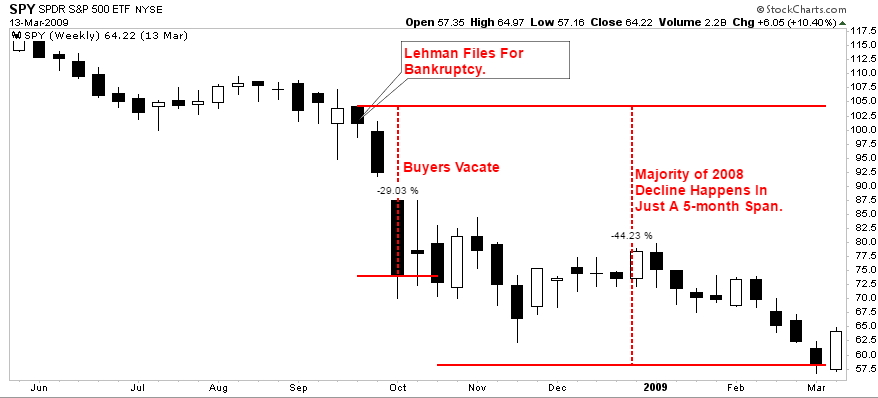

Importantly, as prices decline it will trigger margin calls which will induce more indiscriminate selling. The forced redemption cycle will cause catastrophic spreads between the current bid and ask pricing for ETF’s. As investors are forced to dump positions to meet margin calls, the lack of buyers will form a vacuum causing rapid price declines which leave investors helpless on the sidelines watching years of capital appreciation vanish in moments. Don’t believe me? It happened in 2008 as the “Lehman Moment” left investors helpless watching the crash.

Over a 3-week span, investors lost 29% of their capital and 44% over the entire 3-month period. This is what happens during a margin liquidation event. It is fast, furious and without remorse.

Currently, with complacency and optimism near record levels, no one sees a severe market retracement as a possibility. But maybe that should be warning enough.

If you are paying an investment advisor to index your portfolio with a “buy and hold” strategy, then “yes” you should absolutely opt for buying a portfolio of low-cost ETF’s and improve your performance by the delta of the fees. But you are paying for what you will get, both now and in the future.

However, the real goal of any investment advisor is not to “beat the index” on the way up, but rather to protect capital on the “way down.” It is capital destruction that leads to poor investment decision making, emotionally based financial mistakes and destruction of financial goals. It is also what advisors should be hired for, evaluated on, and ultimately paid for, as their real job should be keeping you out of “the trap.”