Wall Street realised last night that the European debt crisis would have wider consequences than merely problems for the continent’s banks and the sovereigns to which they belong. As it seems is de rigeur now, a collapse in risky assets came as a result of a statement from a ratings agency. Fitch stated that further contagion from stressed Euro area markets poses a “serious risk” to US banks – the “outlook for the industry is stable…However risks of a negative shock are rising and could alter this outlook”. The S&P lost heavily in the last hour of trade although Asian markets have been able to hold up somewhat overnight and European indices should open the day roughly flat.

Here in the UK it was no surprise that the general tone of Governor King’s statement was relatively downcast and we agree with the Bank’s assertions that inflation should fall through 2012 as certain extraordinary factors, such as the VAT increase, will fall out of the numbers as long as political situations in the Middle East don’t cause oil prices to blow higher. The quarterly inflation report seemed to focus more on the Eurozone than the UK and the uncertainty in financial markets has led to 17 inflation reports that have seen growth expectations cut. As a result we see the Bank of England doing a very simple calculation: poor growth in the short term + falling inflation = more quantitative easing and we would expect the MPC to vote for an additional £75-100bn of asset purchases in the February meeting.

This didn’t have quite the negative effect on the pound that we expected but sterling has remained depressed in the aftermath of his speech and yesterday’s unemployment numbers. The UK ILO unemployment rate rose to 8.3% in the 3 months through September from 8.1% in August. This marked a new cycle high and matched a level last seen Jun 1996. Women seem to be losing their jobs at 10 times the speed that men are as well which would seem to fit that it is

temporary and seasonal workers who have borne the brunt of the cost cutting measures by businesses. I also think that it is wrong that ministers seem to be

blaming the European situation for this increase in unemployment; while it will be a factor in businesses decision making and has brought about an obvious

wobble in confidence, issues at home are far more pressing (housing market uncertainty, inflation and poor consumer demand alongside poor business credit conditions for a start).

Sterling finished the day in the mid-1.57s versus the USD and in the mid-1.16s versus the euro.

Focus will shift back to the Eurozone today after quite a strange day for the continent. Mario Monti was sworn in as Prime Minister and unveiled his cabinet. In a rather novel effort to reduce disagreement between the position of Prime Minister and Finance Minister he has decided to take on both jobs. There’s a lot to be said for dictatorship obviously. Today he will present his reform plans to the Senate, after which a confidence vote is expected in both houses of parliament. Lucas Papademos, the new Greek technocratic PM, passed a confidence vote against him in the Greek parliament yesterday while the Irish Prime Minister stated that a credible backstop was needed in the Eurozone and “ultimately that’s the ECB”. Not what his German hosts really wanted to hear.

With everyone asking which European country is next we get a look at how Spain holds up in the firing line today as it auctions around EUR4bn of 10yr debt while France will try and get rid of EUR7bn of debt from 2 year to 10 year maturities. Spanish yields have opened at Euro-area records this morning and therefore it is likely to trigger quite a poor auction. In the UK we have our October retail sales numbers that are expected to show a slip to -0.3% as consumers once again tighten their belts, this follows the lowest consumer confidence figure surveyed by the Nationwide in the UK ever; lower than the Lehman Brothers dip. This will solidify the Bank of England’s view that growth in the 4th quarter of this year will prove to relatively non-existent.

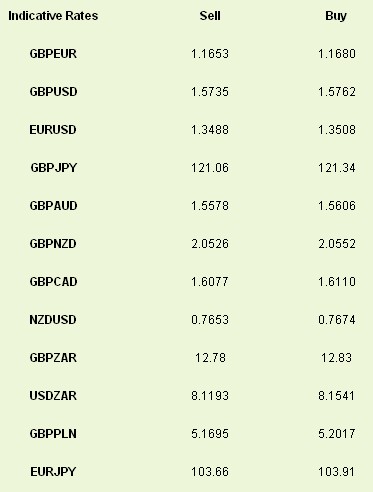

Latest

exchange rates at time of writing

Here in the UK it was no surprise that the general tone of Governor King’s statement was relatively downcast and we agree with the Bank’s assertions that inflation should fall through 2012 as certain extraordinary factors, such as the VAT increase, will fall out of the numbers as long as political situations in the Middle East don’t cause oil prices to blow higher. The quarterly inflation report seemed to focus more on the Eurozone than the UK and the uncertainty in financial markets has led to 17 inflation reports that have seen growth expectations cut. As a result we see the Bank of England doing a very simple calculation: poor growth in the short term + falling inflation = more quantitative easing and we would expect the MPC to vote for an additional £75-100bn of asset purchases in the February meeting.

This didn’t have quite the negative effect on the pound that we expected but sterling has remained depressed in the aftermath of his speech and yesterday’s unemployment numbers. The UK ILO unemployment rate rose to 8.3% in the 3 months through September from 8.1% in August. This marked a new cycle high and matched a level last seen Jun 1996. Women seem to be losing their jobs at 10 times the speed that men are as well which would seem to fit that it is

temporary and seasonal workers who have borne the brunt of the cost cutting measures by businesses. I also think that it is wrong that ministers seem to be

blaming the European situation for this increase in unemployment; while it will be a factor in businesses decision making and has brought about an obvious

wobble in confidence, issues at home are far more pressing (housing market uncertainty, inflation and poor consumer demand alongside poor business credit conditions for a start).

Sterling finished the day in the mid-1.57s versus the USD and in the mid-1.16s versus the euro.

Focus will shift back to the Eurozone today after quite a strange day for the continent. Mario Monti was sworn in as Prime Minister and unveiled his cabinet. In a rather novel effort to reduce disagreement between the position of Prime Minister and Finance Minister he has decided to take on both jobs. There’s a lot to be said for dictatorship obviously. Today he will present his reform plans to the Senate, after which a confidence vote is expected in both houses of parliament. Lucas Papademos, the new Greek technocratic PM, passed a confidence vote against him in the Greek parliament yesterday while the Irish Prime Minister stated that a credible backstop was needed in the Eurozone and “ultimately that’s the ECB”. Not what his German hosts really wanted to hear.

With everyone asking which European country is next we get a look at how Spain holds up in the firing line today as it auctions around EUR4bn of 10yr debt while France will try and get rid of EUR7bn of debt from 2 year to 10 year maturities. Spanish yields have opened at Euro-area records this morning and therefore it is likely to trigger quite a poor auction. In the UK we have our October retail sales numbers that are expected to show a slip to -0.3% as consumers once again tighten their belts, this follows the lowest consumer confidence figure surveyed by the Nationwide in the UK ever; lower than the Lehman Brothers dip. This will solidify the Bank of England’s view that growth in the 4th quarter of this year will prove to relatively non-existent.

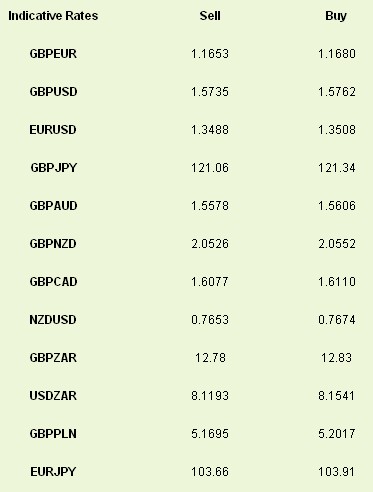

Latest

exchange rates at time of writing