When swing trading with the trend of the major indices, we firmly believe it is absolutely necessary to focus on reacting to market action, rather than attempting to predict it. As such, if we change our minds about a position, such as where to place the protective stop, it is because we are constantly trying to manage risk to keep in line with the market. The goal is always to process market information and data by simply “going with the flow,” which prevents us from sticking to unsubstantiated opinions. In an uptrending market, for example, the only good stocks or ETFs are the ones that go up.

With recent stalling action around the 1,500 level in the S&P 500 Index, combined with yesterday’s (January 31) higher volume selling in the broad market, the rally in the S&P has lost some momentum. Although we are not yet calling the rally dead, the objective rules of our market timing model will force us to close existing positions and move to cash if the distribution days begin to cluster over a short period of time. Therefore, now is an ideal time to take an updated look at the technical chart patterns of a few of our open ETF positions.

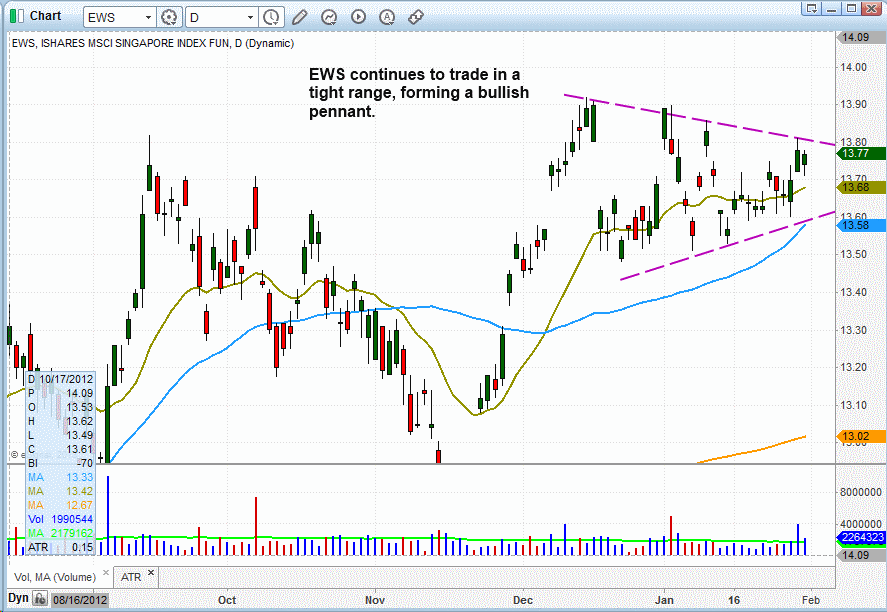

The bullish pennant formation in iShares Singapore ETF (EWS), which we bought in The Wagner Daily on January 30, is still intact and could break out any day now:

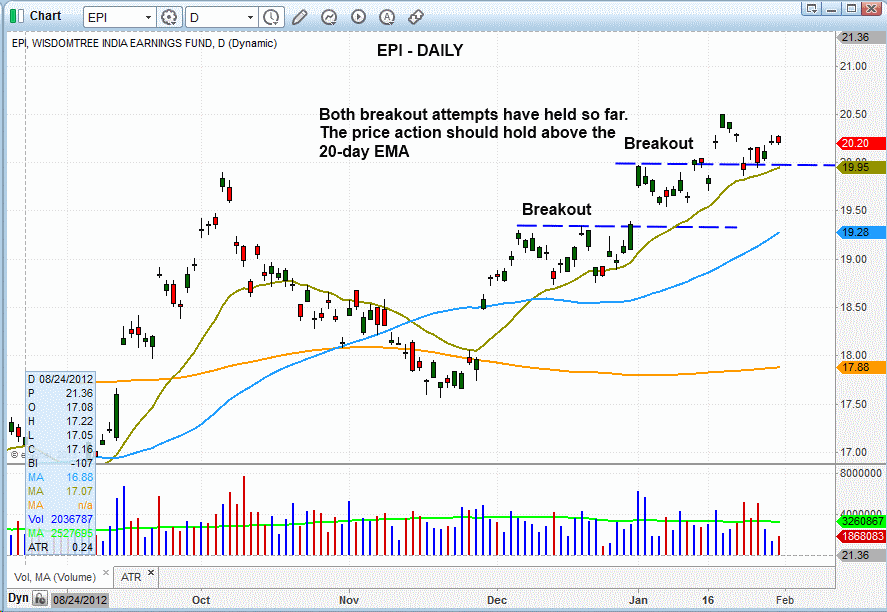

The WisdomTree India Earnings Fund (EPI) has pulled back to new support of the prior breakout level at the $20 level, and is holding up so far. We plan to continue holding EPI as long as the price action remains above the 20-day exponential moving average (beige line on the chart below):

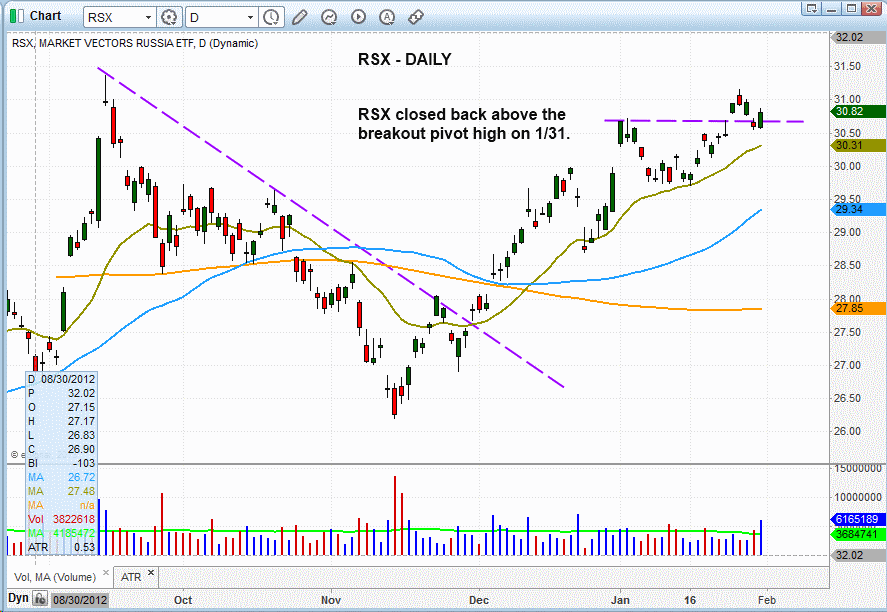

Like EPI above, Market Vectors Russia ETF (RSX), which we entered as a swing trade on January 22, recently pulled back to support of its prior breakout level and is holding. As with EPI, we are willing to stick with RSX as long as it manages to hold above its 20-day EMA (plus a bit of “wiggle room” below the exact level of support):

Going into today, there are no new ETF or individual stock trade setups we are stalking for potential buy entry. Rather, we are now focusing on managing our existing open positions for maximum profitability with the least amount of risk.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Only Good Stocks And ETFs To Buy Are Ones That Go Up

Published 02/01/2013, 11:46 AM

Updated 07/09/2023, 06:31 AM

The Only Good Stocks And ETFs To Buy Are Ones That Go Up

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.