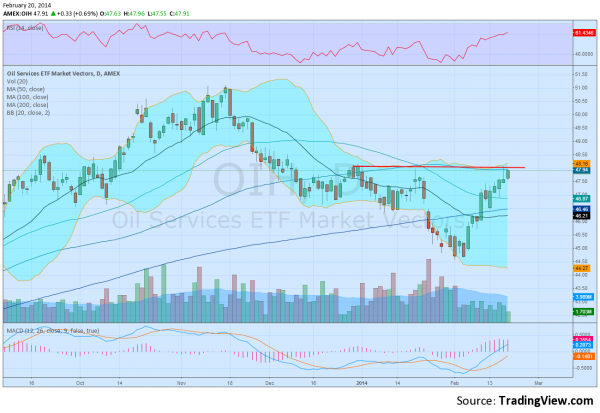

Crude Oil (USO) has had a great run since early January, moving from over 10% on the West Texas Intermediate. The Oil Servicers (OIH) have also done quite well rising about 8%. In fact the Servicers look that they could continue for quite some time if they can just go a little higher. The chart below shows the OIH is at resistance at 48. A level that has stopped it since Christmas. The RSI and MACD both are rising, supporting a break out.

And a break out higher does not see resistance again until 49.50 and then 51. Not a bad place to be. But Crude Oil looks good too, so why shift? It is the relative strength chart that gives an answer. The weekly chart below of the Servicers measured against Crude Oil shows the under performance with a falling ratio on the chart. But there are 3 reasons in that chart that suggest a shift from Oil to Servicers is warranted, at least for a trade. First the pullback is finding support, and for a prolonged period of time. Nearly a month. The other two reasons are about where that support is. It happens to be at both a 61.8% retracement of the move higher from the August 2013 low and at the 50 week Simple Moving Average (SMA). Using a stop under the the support ratio at 1.28 gives a good place from a risk reward perspective to try the reversal higher, if not just an OIH position outright.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.