Oil has decidedly moved yesterday, and the closing price didn't make the bulls happy. They haven't had much success repairing the damage earlier today, though. Does it mean that the bears can set their sights even lower now? Can geopolitical events, or any other factors come to the rescue of the bulls?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

Yesterday, we wrote that:

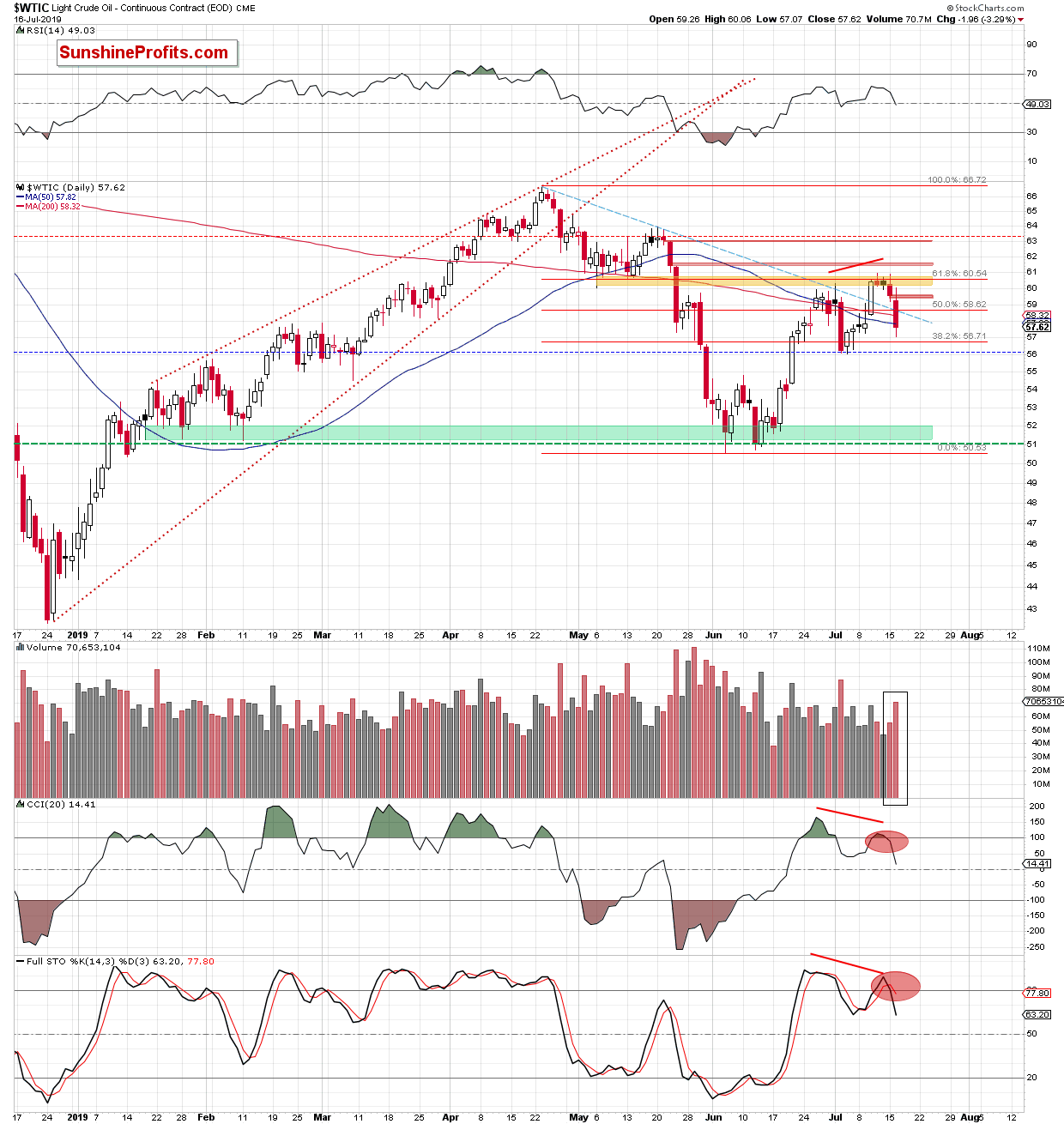

(...) the bulls didn't have much success breaking above the yellow resistance zone. The commodity reversed and invalidated two earlier tiny intraday breakouts: above the yellow resistance and above the 61.8% Fibonacci retracement.

The CCI and the Stochastic Oscillator generated their sell signals, encouraging the sellers. The volume picked up, suggesting that another downswing may be just around the corner.

Crude oil has finished yesterday's session sharply lower, slipping below $58 and making our short position even more profitable. That also marks a close below the 50-day moving average, which is another bearish factor to boot.

The volume comparison also speaks loudly - increasing volume of the downswing attests to the bears' strength and involvement. Both the CCI and the Stochastic Oscillator have generated their sell signals, lending further support to the bears.

Let's see today's pre-market action now.

Yesterday's decline took crude oil futures below the lower border of the green gap created on July 10. The price also dropped back below the previously broken declining red resistance line. Instead of being a support, this line is acting as a resistance now, because the breakout above it has been invalidated. Further, the green bullish gap has been closed yesterday, which is a negative omen for the bulls.

As the lower green gap created on July 8 still remains open, the bulls may get their act together there and attempt to reach the declining red resistance line before we see another move south towards our initial downside target.

Summing up, after a couple of days of sideways trading, oil plunged yesterday. It happened on strong volume and after black gold had been unable to overcome a strong combination of resistances (the red resistance zone and the 61.8% Fibonacci retracement) earlier this week. The bearish divergences remain in force: both between the CCI and oil prices, and between the Stochastic Oscillator and oil prices. All the above support the bears, and the short position remains justified.