There is no shortage of silly bromides and sayings in the world of trading, but one I particularly detest is “if it’s obvious, it’s obviously wrong.” I’ve mentioned this before, and I’m sure I’ll mention it again, because I think this illogical and baseless faux-truism can be misleading and financially harmful.

One example from my own trading past is the shape of energy stocks from last year. Energy stocks – – and Lord knows I spilled a lot of digital ink here on Slope yammering on about how energy stocks should be shorted – – were jumping-up-and-down short candidates. The patterns seemed too good to be true. Indeed, although I’m rarely shy with my predictions, I refrained from uttering what the measured moves were, because they seemed so ridiculous, even for someone like me.

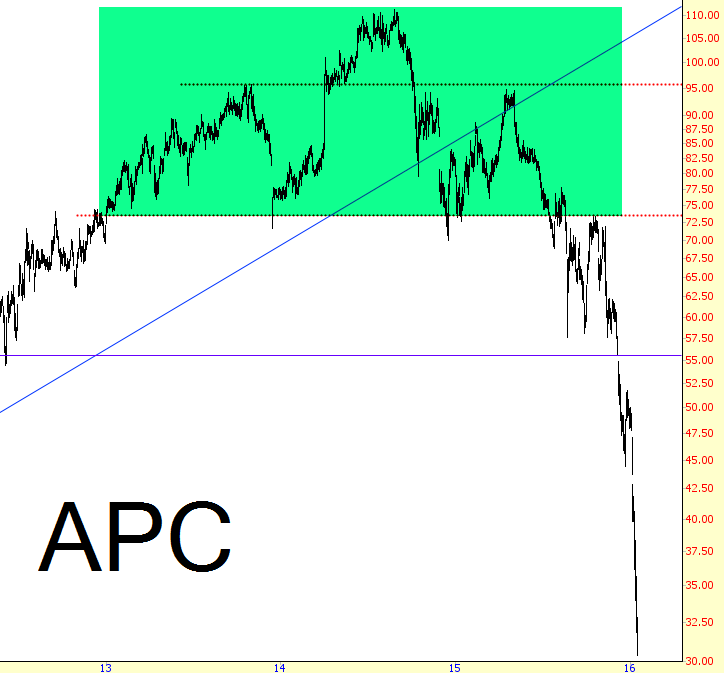

Anadarko Petroleum (N:APC) is just one of dozens of similar examples of what I’m talking about:

The head and shoulders pattern is straight-up Technical Analysis 101 type stuff. It was obvious. So it must have been obviously wrong, huh? Not at all. The stock plunged, precisely As God Intended, and to this day, it cannot seem to find any support. The only guaranteed bottom is measured at $0.00.

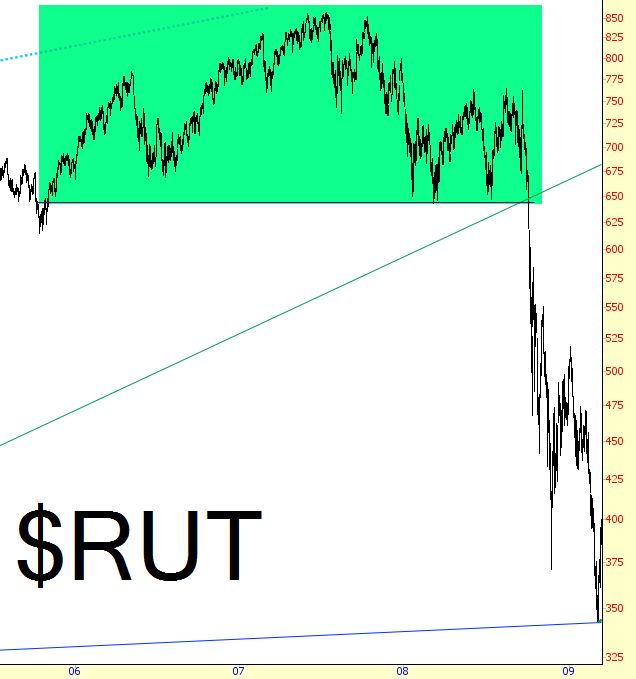

A truly awful example of this for me was how the Russell 2000 stacked up in 2007-2008. Look at the tinted pattern, and take note of what happened next (and how swiftly it transpired).

I profited greatly from the 2008 bear market, but I was kicking myself for not taking full advantage of it. I was too timid.

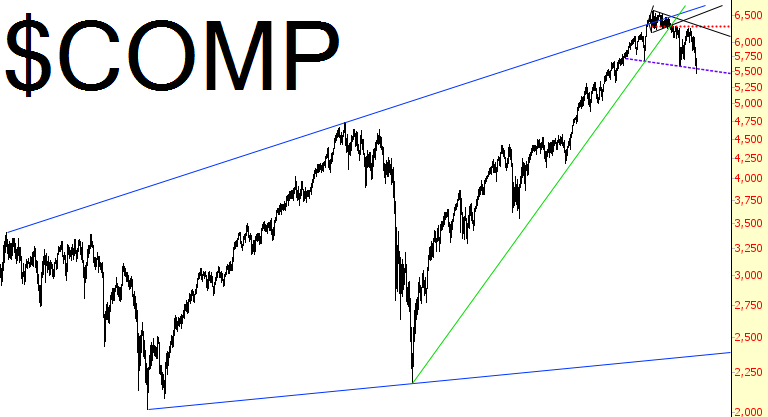

That was then, and this is now. To me, it is “obvious” that the stock market is completely, utterly, and wholly doomed. The Dow Jones Composite, shown below on a long-term chart, has already lost nearly one-fifth of its peak value. So now that our little bull friends have felt a little pain, is it over? Are the “new lifetime highs” (that, incredibly, even our friends in Gainesville are holding out as a possibility) coming up next, now that we’ve had the pause that refreshes?

I don’t think so. Sure, a bounce may come (and I’ve thrown away some thousands of dollars over the past couple of days thinking it was about to transpire right about now), but it will serve one and only one purpose: to give the bears better prices from which to sell.

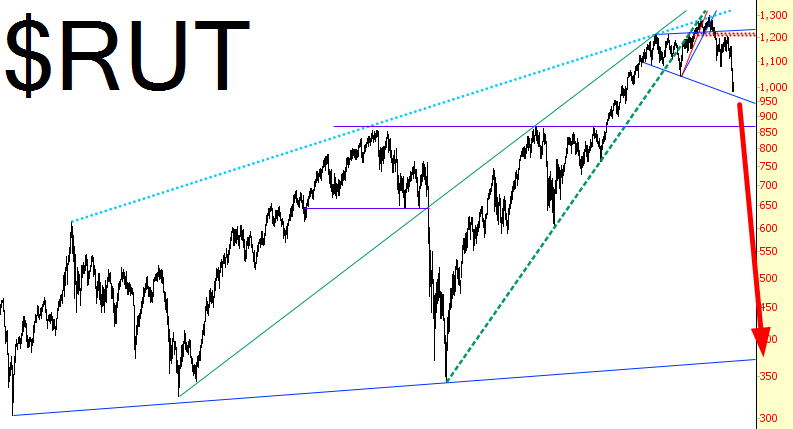

At the moment, I find the market in a very uncomfortable no-man’s-land. Glancing at the Russell 2000 below, you can see that we’ve very close to a trendline that should offer support. Should we count on this support by covering all our shorts and going long the market? I don’t plan to do so. I’ll probably revert back to my “don’t go long, just be less short” philosophy which I foolishly set aside late last week. Because, in my estimation, that red arrow you see below is going to click in sooner or later, and I sure as hell want to be strapped in for that ride. Umm – – “obviously”.