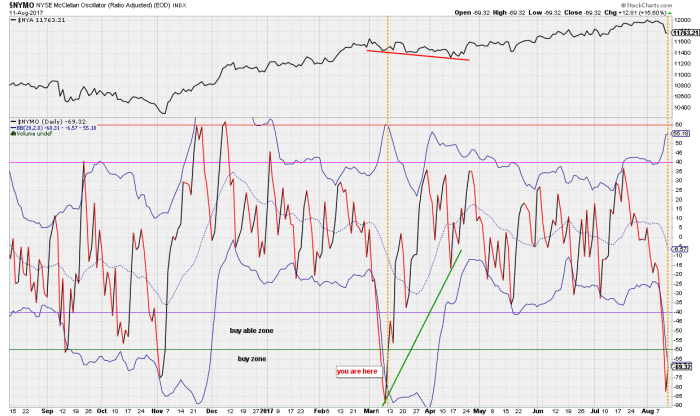

On Friday, the NYMO (McClellan Oscillator for the NYSE; a market breadth indicator) closed below its lower Bollinger Band (BB) for the 4th consecutive day (see my tweet and prior tweet here). The last time it did this was in early-March of this year (see orange vertical lines) and this brings the total of “4x” over the past 20 years (for which I have data) to 4. A rare occasion which all led to a multi-day bounce followed by lower prices. The chart below only shows the current and prior occasion (orange vertical lines).

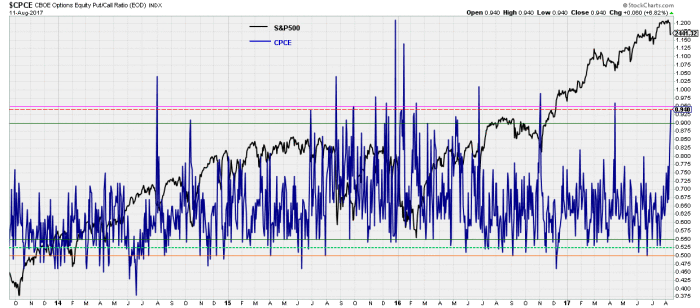

The 2nd chart I wanted to show is that of the equities only put/call ratio (CPCE), which I’ve not shown and/or mentioned for a while as there was not much to mention. But, it closed on Friday at 0.94, which is a rather extreme reading and well-inside the “top imminent” zone: too many traders are now expecting continued downside and opened put-options positions. Hence the high put/call ratio (almost 1-to-1). Since the market often punishes the majority, max-pain is now inflicted by price going back up.

Together with several other indicators I showed in the weekly digest available to my premium members, the weight of the evidence thus points to a bounce over the next few days. My ideal target zone for this bounce is SPX2457-2474. Once it completes I can then assess price targets for the next leg down more accurately.