In 1976, three of the pioneers of the leveraged buyout world left Bear Stearns to start their new firm Kohlberg Kravis Roberts. They completed their first buyout of a public company in 1984 and were doing quite well. But in 1988, they made a real name for themselves, with the largest leveraged buyout in history at the time, $25 billion for RJR Nabisco. The deal became the topic of the bestseller Barbarians at the Gate, and was later made into a movie. It was a masterful play of the partners against outside factors and the board. A game of chess. A waiting game.

Fast forward nearly 40 years into their history, and Kohlberg Kravis Roberts has become NYSE:KKR and has their hooks into all facets of finance. Their stock is now playing a game of chess with the market.

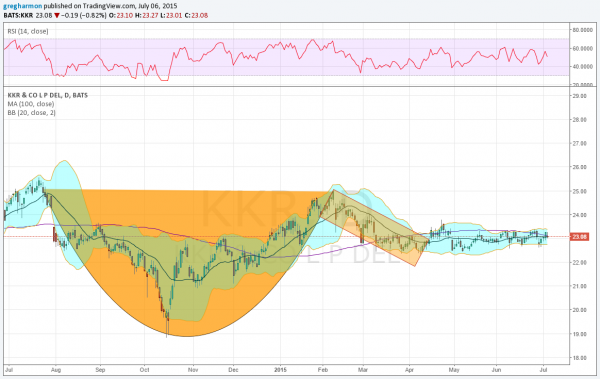

The stock pulled back from a high in July over the back half of 2014. It made a low at the October market low and started back higher. But unlike some other financial names, it stalled in February and pulled back again. The combined action appears like a Cup and Handle pattern and would target a move to 31. But the break higher of the handle failed, and the stock has been moving sideways since April. Not violating the pattern, but also not confirming it. Waiting for the right moment.

One thing is happening though. The Bollinger Bands® are starting to tighten. This is often a precursor to a move. Which way? We will have to wait and see. A break higher has resistance at 25 and then the target. A break lower 21 and then the prior low at 19. Will the partners win this battle?

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.