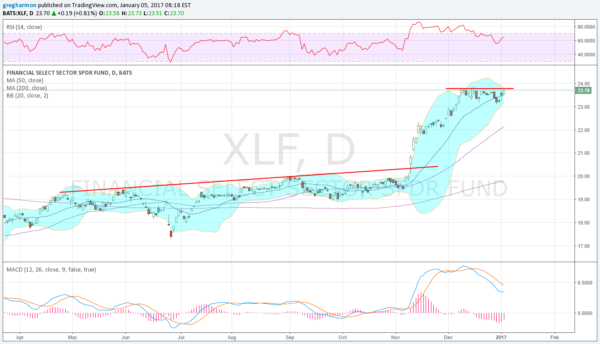

Financial stocks have been big winners following the U.S. election. The Financial Sector ETF (NYSE:XLF) is up over 18% during that period -- great news if you owned it. But what if you didn’t? Is it too late to buy? And if you do own it, is it time to sell and protect your profits? The chart below suggests a second move may be about to happen.

The chart shows the XLF from April until Wednesday. Most prominent is the long, slow plod to the upside, capped by trending resistance from April until the election. Then came a fast move higher and continuation to the current level at the beginning of December. Since then, there has been consolidation under resistance in a tight range. But there's more there.

The indicators suggest a second move may be about to happen. First, the Bollinger Bands® are squeezing. Tight Bollinger Bands are an indication that a move may be coming very soon, though they do not indicate direction. The momentum indicators suggest that the move, if it comes soon, will be to the upside. The RSI has worked off an overbought condition as it pulled back. The pullback held in the bullish zone and has reversed back higher. The MACD has also pulled back from extremes and is now level, in positive territory.

The price has reconnected with its 20-day SMA, so it has waited out that extended move. A measured move out of this consolidation would give a target to 27 on a second leg higher. With a natural stop level at the bottom of the current consolidation range, just over 23, this gives a great reward-to-risk ratio for a new trade.