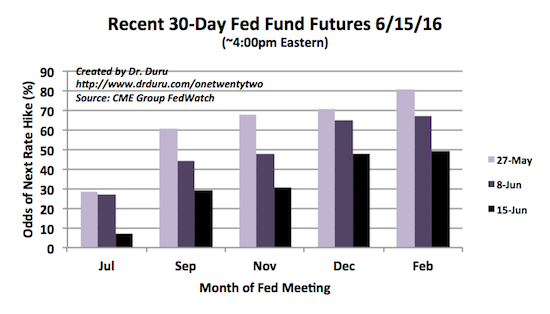

The U.S. Federal Reserve failed to hike rates in its June policy meeting just as expected. More importantly, the Fed left alone its projection of the appropriate policy path for 2016 at 0.9%. The Fed trimmed its expectation for 2017 from 1.9% to 1.6% and slashed 2018 from 3.0% to 2.4%. The “long run” dropped from 3.3% to 3.0%. These changes, along with a Q&A session that provided zero clues to the timing of future rate hikes, motivated the market to push out the next rate hike to what I consider “never” for trading purposes.

The market responds to the Fed’s June decision on monetary policy by dropping the odds for a February rate hike to 49.4%.

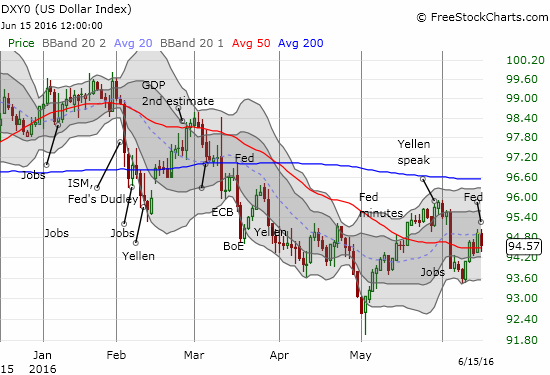

The impact on the dollar (DXY0) was immediate but not as steep as it could have been. The dollar index held support at its 50-day moving average (DMA).

The U.S. dollar index (DXY0) drops 0.4% in response to the Fed’s June decision but manages to hold support at its 50DMA. Lots of chop ahead?

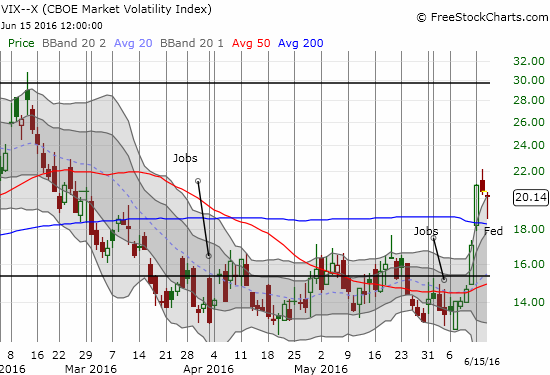

The Fed was once again good for fading volatility but the window of opportunity closed very fast.

The volatility index, the VIX, started cooling off the day before the Fed. The VIX dropped as low as 18.6 before rebounding into the close.

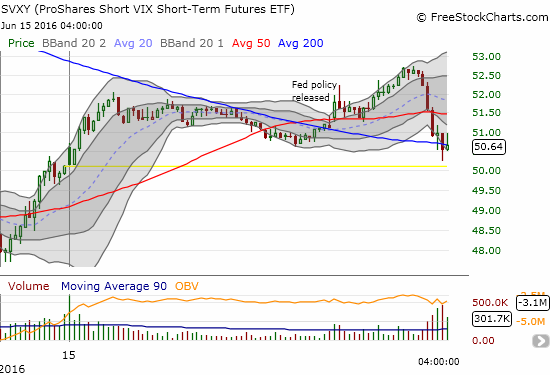

This 5-minute view of ProShares Short VIX Short-Term Futures (NYSE:SVXY) shows how the market got ahead of the post-Fed volatility fade. After the Fed release, volatility faded again only to have the whole setup crumble into the close of the trading day.

Soon after the Fed release, I closed out my put options on ProShares Ultra VIX Short-Term Futures (NYSE:UVXY). The puts expired on Friday, and I figured they would start losing value quickly post-Fed. I held onto my SVXY shares in the hopes of closing them out into a gap up on Thursday.

The rebound in volatility ruined THAT plan, and I strongly suspect I will get stopped out on Thursday with minimal to zero profit. I was a bit surprised by the poor close because the market has typically celebrated when the Fed backs down from rate hike talk. With the Fed fund futures pushing out the next rate hike to never, I expected a MAJOR celebration. Perhaps this time a sober economic assessment is enough to dampen the elation…

I now assume the market is back to its regularly scheduled programming of bearish indicators and signals and Brexit anxieties. The challenge for the rest of the week is dealing with a Japanese yen that is surging thanks to a Bank of Japan which again decided against adding more policy accommodation.

USD/JPY now looks headed for the psychologically important 100 level.

Be careful out there!

Full disclosure: net long the U.S. dollar, long SVXY shares