On Wall Street, cryptocurrencies are still mostly considered high-risk speculative investments. Nonetheless, their resilience since Bitcoin debuted in 2009 has shown investors that they are probably here to stay. If crypto is indeed here to stay, their performance in the last couple of years suggests that this new asset class has enough potential to outperform other kinds of traditional investments such as stocks, forex, precious metals, bonds, and commodities.

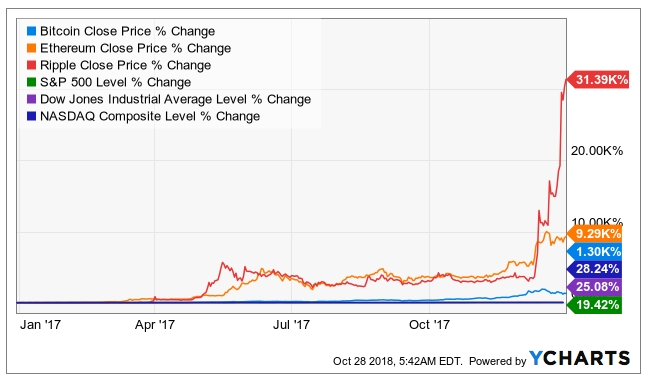

In 2017 alone, Bitcoin delivered more than 1300% price gains, Ethereum gained almost 10,000% and Ripple was up by more than 30,000%. The incredible performance of cryptocurrencies dwarfed the best-performing stocks as seen in the chart below.

Are Cryptocurrencies on the Brink of a Breakout

This year, however, the cryptocurrency market has been down almost 56% and cryptocurrencies have mostly nosedived from their 2017 hights. For instance, Bitcoin is down 48%, Ethereum is down more than 70%, and Ripple has lost over 75% in the same period. Many market watchers believe that the decline in cryptocurrencies has gone on for far too long and that the market might be on the brink of reaching new heights.

For instance, Nigel Green, founder and CEO of deVere Group, one of the world’s largest independent financial advisory organisations has become a vocal crypto bull. In his words, on Bitcoin’s 10th anniversary, he noted that cryptocurrencies will grow to a market cap of more than $20 trillion over the next decade and that investors can expect the market cap of the cryptocurrency market to jump by 5,000%.

The Potential in 3rd-Gen Crypto as Bitcoin Loses Transactional Appeal

Unfortunately, Bitcoin’s current trading price around $6,400 suggests that the cryptocurrency has lost its transactional appeal and it has become more of a store of value. In addition, its high trading price relative to other cryptocurrencies suggests that there might be a limit to its upside potential unless the predictions about Bitcoin reaching $20,000, $50,000 or $100,000 come to fruition.

In fact, it won’t be far-fetched to suggest that Bitcoin’s market dominance might decline from its current 53% in the coming years. Below are three interesting cryptocurrencies that could break out to become the next big cryptocurrency.

Ripple

Ripple (XRP) is an interesting cryptocurrency with huge promise, but its price has suffered steep losses in line with the general market this year. Ripple is fundamentally both a blockchain protocol and a cryptocurrency (XRP) with the sole aim of replacing traditional financial institutions such as SWIFT, PayPal and credit card processing firms. Ripple believes that cross-border transactions could be facilitated in near-instant speed and at negligible cost through Blockchain technology.

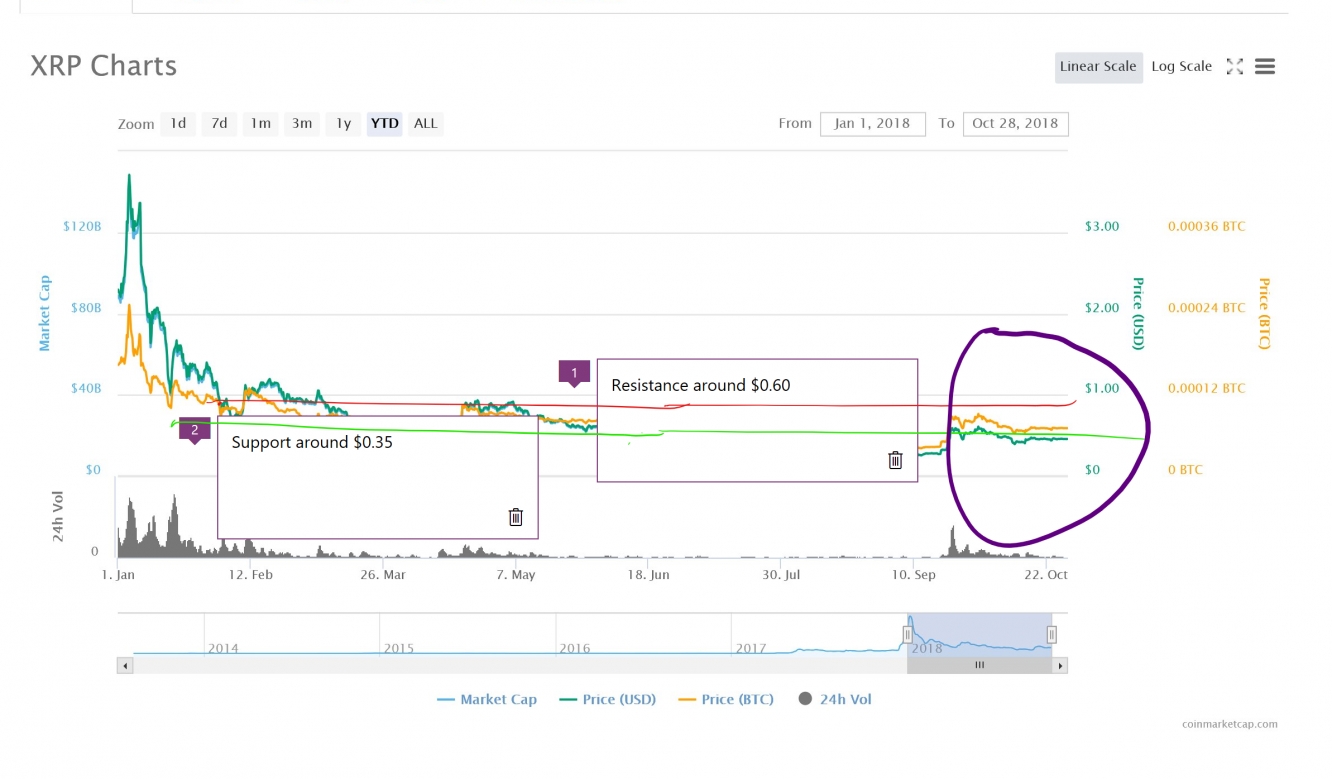

On Ripple, transaction fees cost about an1000th of a cent compared to the 2.9% + $0.30 that PayPal charges. In the year-to-date period, the price of Ripple has declined by 37% from about $2.30 to $0.45.

Ripple seems to be building up momentum for a breakout buoyed by recent positive developments around the adoption and use of the cryptocurrency. In the chart above, Ripple has established resistance and support trendlines at $0.60 and $0.35 respectively and the coin is currently trading in a range around $0.45.

TRON

TRON (TRX) deserves a position among the cryptocurrencies with the most potential because of its practical application for the Internet and in the entertainment industry. TRON, which is simply a blockchain-powered operating system has differentiated itself with a focus on increasing its transaction speeds and ensuring scalability and currently boasts of more than 20,000 transactions per second.

TRON is also forging ahead in its bid to build the infrastructure to become a truly decentralized Internet, having recently acquired the famous Torrenting client, BitTorrent and currently incorporating TRX payments within the network to incentivize users. This effort to connect Torrenting and Blockchain is a promising step towards web decentralization and mass adoption.

Currently, TRON is the 11th largest cryptocurrency by market cap and its TRONbet DApp has recently caused it daily transaction volume to surpass Ethereum’s volume of more than 500,000 individual transactions between October 19 and October 22.

The Tron Foundation has also revealed that it is planning to release a whole suite of DApps over the next several weeks. The launch of the Tron Virtual Machine (TVM) has allayed fears about Tron’s scalability and the growth of smart contracts on its network suggests that it is on the fast-track to mass-market adoption.

At its current trading price of $0.023, TRON is down about 37% in the year-to-date period. TRON has established support at $0.035 (green) and has faced resistance at $0.055 for much of the first three quarters of 2017. However, in Q4, Tron has broken down below critical support and it is currently in a fight to stay afloat within range.

The recent level of good news around the cryptocurrency suggests that TRON has decent odds of making it back to its support trend and, if all goes well with Tron returning to its January high at $0.25, you can expect to record an incredible 986% price gain.

Cardano

Cardano (ADA), a third-generation smart contract platform developed by a former Ethereum executive as a fully open-source project for the sending and receiving of cryptocurrency. Cardano differentiates itself from other protocols because i is based on scientific philosophy and peer-reviewed academic research. Cardano has recently been in the news because of the strength of its interoperability and its scalability. Its Daedalus wallet for instance, is on track to become compliant with Bitcoin and Ethereum tokens. Apart from this, Cardano also has strong fundamentals; which include a strong governance system that has displayed a willingness to manage constantly changing regulations with their soft fork capabilities.

In the year-to-date period, the price of Cardano has declined by almost 87% however, for some bulls, the weakness is an opportunity to buy ADA at a discount. Over the last three months, the price of the cryptocurrency has stabilized in a range and this might be the lull before the breakout into previous highs or a breakdown into new lows.