I’ve spent much of last week highlighting the bubble-like qualities of investment-grade scotch, farmland, Bitcoins, real estate in the United Kingdom – and, most recently, 3-D printing stocks.

If you’re like me, the exercise proved frustrating, even if there were no easy ways to invest in most of the assets. Why? Because outside 3D Systems (DDD), it underscored the fact that those huge run-ups are over.

Sure, if you could just turn back time, a la Cher in the late 1980s, you’d be sitting on a ton of profits. Unfortunately, that’s just not possible.

So instead of whining and complaining about the past, let’s look to where the next explosive profits reside.

Fair warning, though…

This opportunity is a bit counterintuitive.

In fact, it’s hiding inside of an asset bubble.

Confused? Don’t be. Because I’m about to explain everything and reveal the one stock that I’m convinced will be a top performer in 2014. So let’s get to it…

The Best 3-D Opportunity

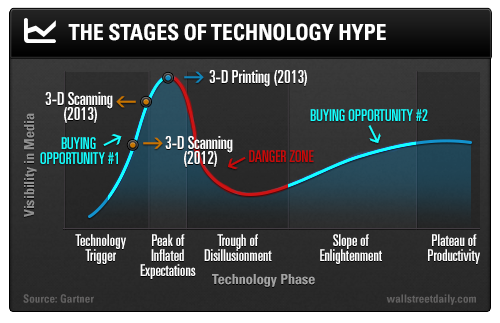

Yesterday, I pointed out that 3-D printing is perched right atop the “Peak of Inflated Expectations” in Gartner’s latest Hype Cycle Report for Emerging Technologies.

From an investment standpoint, that puts it squarely in the “Danger Zone” I identified in January.

But that’s not the case with another emerging technology in the space – 3-D scanning.

Last year, Gartner identified it as a “tipping point technology” and placed it in the “Technology Trigger” phase. Fast forward to this year, and 3-D scanning is officially ready for primetime.

I say that because it’s just entering the “Peak of Inflated Expectations” phase, which is precisely the point at which 3-D printing stock prices really took off.

Here’s why I’m convinced that 3-D scanning stocks are about to do the same thing…

The Perfect Marriage

The easiest way to think of the 3-D scanning process is 3-D printing in reverse.

Whereas 3-D printing takes a digital file and “prints” a tangible model in the real world, 3-D scanning captures detailed images of the geometry of a tangible object and converts it into a digital file.

Yet this lucrative niche space is like a modern-day Bermuda Triangle for Wall Street analysts. It’s not even a blip on their radar.

It should be…

Because without 3-D scanning, not a single airplane could be built today. Same goes for many automobiles.

3-D scanning is also used by the entertainment industry to create 3-D models of various real world places. For instance, Electronic Arts (EA) scans every Division I football stadium and every PGA course to use in its games.

All told, we’re talking about a $3-billion to $5-billion industry that’s about to kick into hypergrowth mode.

You see, the next legitimate catalyst for the 3-D printing boom promises to be 3-D scanners. After all, before you can print an object, you need to create an accurate three-dimensional model.

The analysts at Gartner concur: “Whether in an enterprise or an educational institution, 3-D scanners should be used in conjunction with design and creative programs that employ 3-D printers to produce physical output from CAD software and other similar software.”

Of course, everyday investors haven’t connected the dots yet. And that’s the good news.

Once they do, they’re bound to bid up leading 3-D scanning company, FARO Technologies (FARO), to stratospheric levels. Especially when they realize that the company is growing profits even faster than 3D Systems.

Now, if we assume the same amount of hype overtakes 3-D scanning stocks – and we use 3D Systems’ forward price-to-earnings (P/E) ratio as a proxy – FARO could rally to almost $92 per share. That works out to an upside of more than 70% to current prices.

Need I say more? Probably not. But I will.

It’s All About the Patents

As I’ve said before, patents are the only tangible proof of a company’s technological leadership. And when it comes to 3-D scanning, no company comes close to matching FARO’s portfolio of U.S. patents.

FARO has amassed 129 patents, with an average age of 8.04 years, according to MDB Capital Group’s PatentVest database.

The company’s sheer quantity of patents isn’t what interests me most, however. It’s the recent surge in patent applications.

Over the last three years, the company has increased its filings at a compound annual growth rate of 45%. All told, FARO is waiting for approval on 78 patent applications.

What’s the big deal? It’s simple, really.

You can’t sell a product without a patent, can you? Not if you plan to maintain any semblance of a competitive advantage. So, in terms of timing disruptive technology investments, the best time to buy is right after a spike in patent filings, as it signals that a new wave of products is about to launch.

Apple (AAPL) serves as the poster boy for this reality.

The naysayers are bound to point out that not every patent is valuable, and that many companies file junk patents that never get approved. But that’s not the case here.

How can I be so sure? Because FARO’s patent application conversion rate – the percentage of patent applications that result in actual patent grants – stands at 86%.

In comparison, conversion rates for the standard-bearers of innovation – Apple, Google (GOOG) and IBM (IBM) – check in at about 65%.

Long story short, almost every patent filed by FARO represents a novel invention with the potential to dramatically increase sales, profits and – in turn – share prices.

Full disclosure: I originally recommended FARO to WSD Insiders back in February. Since then, the stock has rallied 50%. (It obviously pays to upgrade to insider status. To learn more about WSD Insider, just click here.)

But there’s still plenty more room for shares to run. So much so, that I’m convinced the stock will be one of the top performers in the technology sector in 2014.

So don’t miss out. Otherwise you won’t ever get Cher’s “If I Could Turn Back Time” out of your head.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Next Big Technology Breakout

Published 11/27/2013, 05:48 AM

Updated 05/14/2017, 06:45 AM

The Next Big Technology Breakout

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.