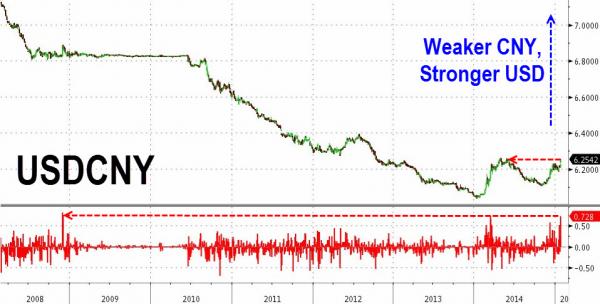

The drop in the Yuan over the past 2 days is the largest against the US Dollar since Nov 2008 as USD/CNY nears its highest (CNY weakest) since mid-2012. What is more critical is that for the first time since the new 2% CNY peg bands, USD/CNY is trading at the extremes - 11.5 handles cheap to the fix. At the opposite end of the spectrum, the EUR/CNY just dropped below 7.00 for the first time since June 2001 with the biggest 2-day strengthening of the Chinese currency against the Euro in almost 4 years. It appears the consequences of ECB QE, SNB volatility, and now Greek concerns continue to ripple through the rest of the world.. and at a time when China faces its ubiquitous new year liquidity squeeze, that is not a good sign.

Biggest 2-day drop in the Yuan against the US Dollar since 2008.

With USD/CNY pushing against its 2% peg band for the first time.

As the Yuan shifts to its strongest against the Euro since 2001 (almost 2000) - back below 7.000.

Charts: bloomberg