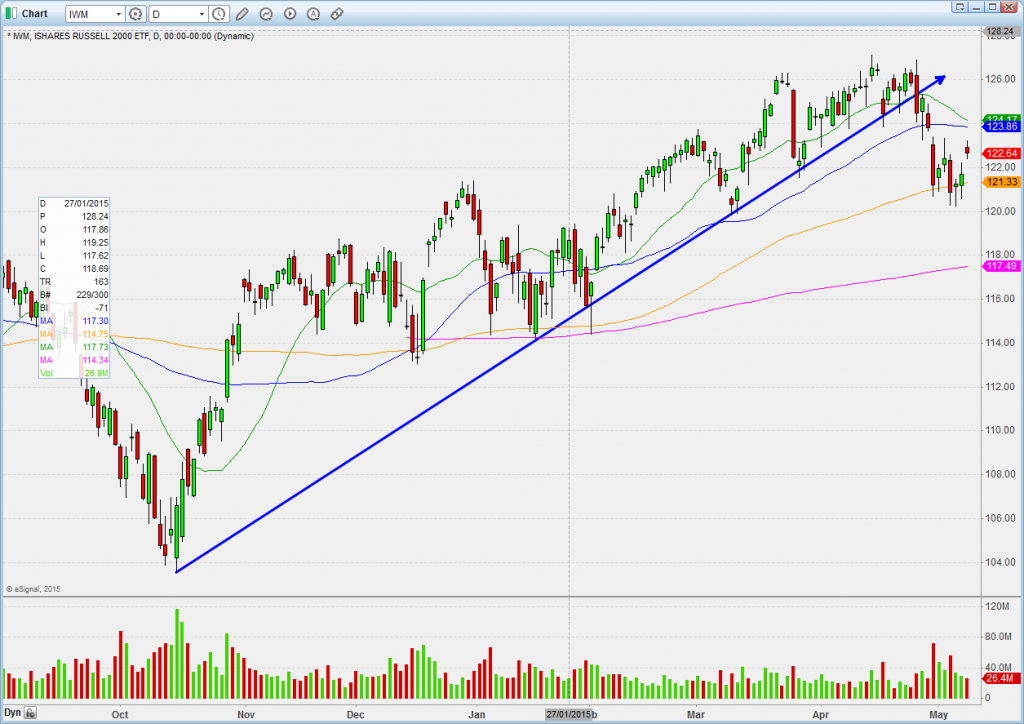

As our readers and newsletter followers know, we have been using the IWM trend-line as THE tell for months. The Russell 2000 NR has been the leader now and one step ahead of its brethren this year -- once it broke we became more defensive:

We bought support on the 100-sma (posted real time on our StockTwits account) on the first test and we dipped long again this week when we saw (ARCA:IWM) outperform the other indices. We bought (NYSE:MA) and (NASDAQ:SPLK) on Thursday for a swing and were lucky enough to enjoy the solid breakouts on Friday (took some off but still long).

Nice trend-line break SPLK — want more on this post 70

Solid breakout on MA

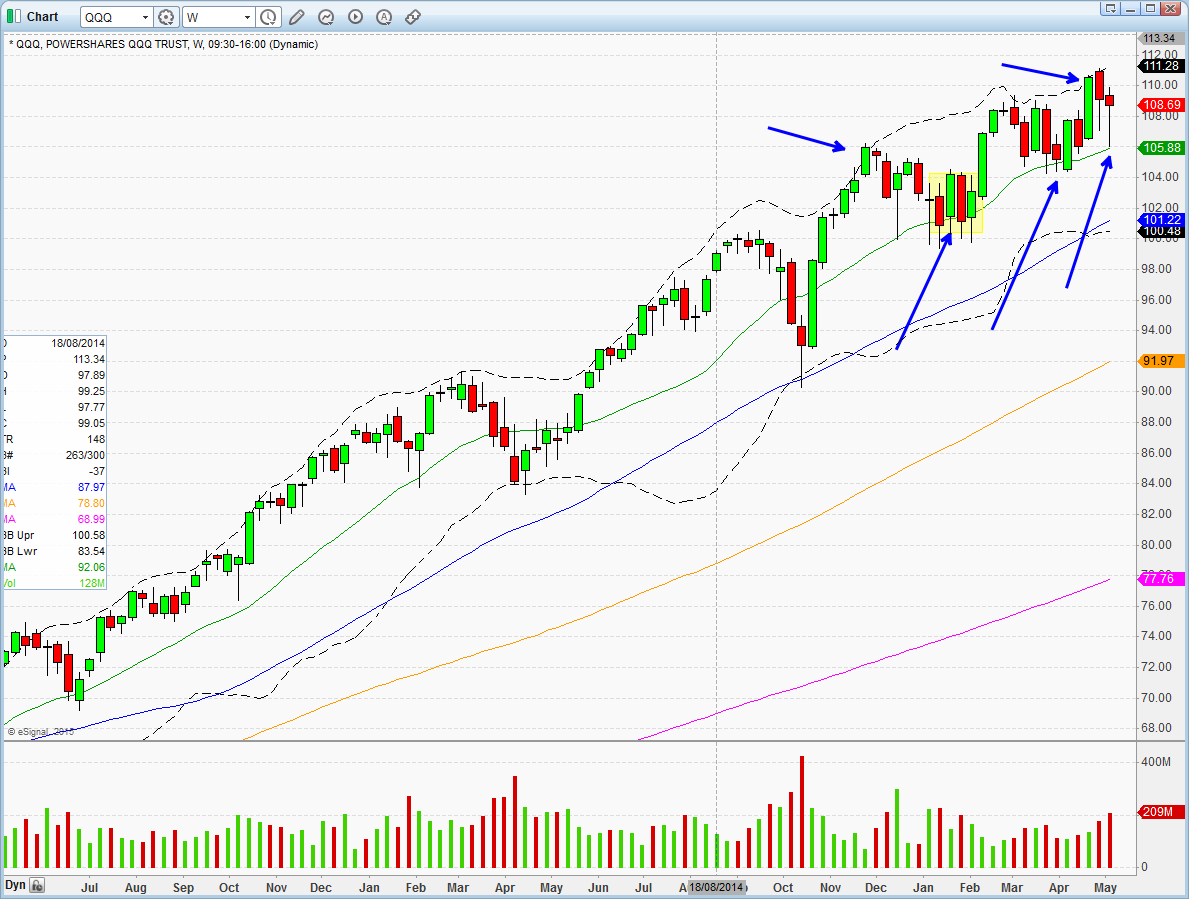

Once the IWM trend-line broke we lost our “tell” -- we couldn’t buy against it anymore. But now there’s a new tell that has cropped up on our screens and the one we are using to gauge sentiment in this crazy bull market. The weekly 20sma on the (NASDAQ:QQQ).

When the QQQ went over weekly BB it caused a short-term top and then bounced on the weekly 20-sma (short-term bottom). That’s our map now going forward.

It gives us a mental edge when we have a clear tell in the market -- a map that helps clear psychological noise. If you swing trade like us then do yourself a favor and keep this weekly chart of the QQQ on your radar.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.