For years we’ve heard talk of a coming U.S. Dollar rally which would prove a boon for astute traders. Several years ago I actually had bought into the impending rally myth myself on the grounds that markets are cyclical in nature. I also felt that the U.S. Fed’s QE policies would be followed by other central bankers, and by virtue of the Fed being first the U.S. economy would gain traction and lead the global economy out of the Great Recession, which theoretically would lead to an uptick in U.S. interest rates and a U.S. Dollar rally.

The U.S. economy did manage to hold its own and other central bankers did imitate U.S. economic policies. However, over the last couple of years as we saw the U.S. economy become more dependent on lower interest rates, and a growing government role for a larger percentage of the population, and it also became apparent that a lower U.S. Dollar was playing a significant role in supporting that dynamic.

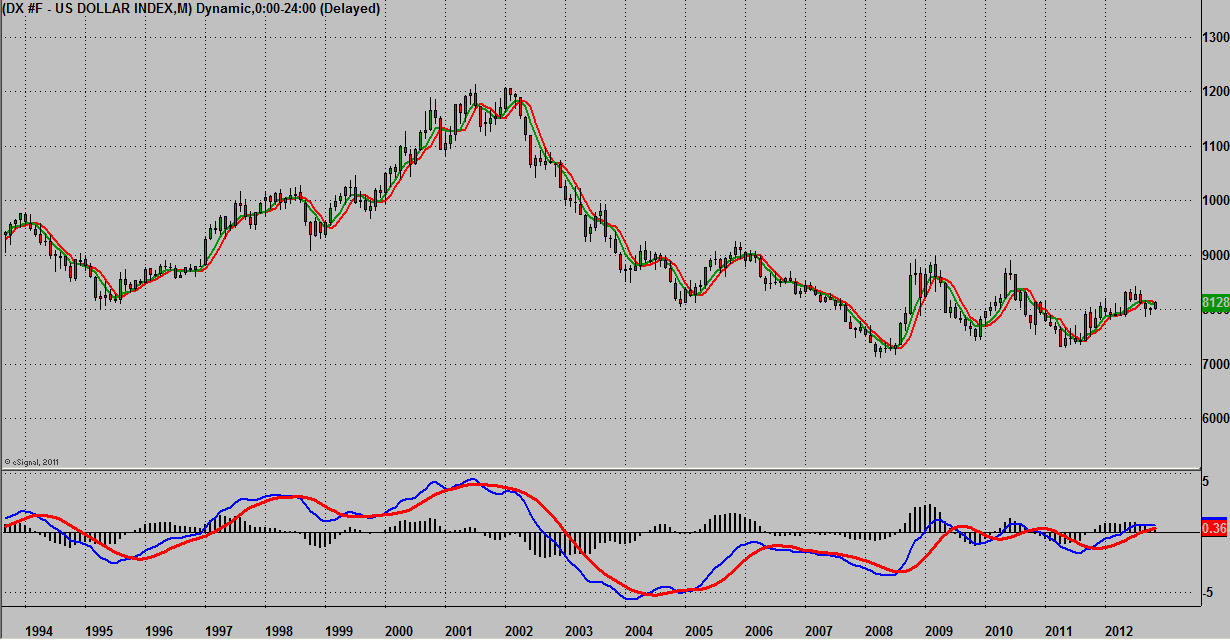

The U.S. economy is currently a tale of two sectors: public and private. While public sector borrowing has increased – which is bearish for the currency — it benefits the private sector – which is bullish for business and equities. This mechanism of public sector support of the private sector is not likely to change over the course of months or even quarters but in years. We take Fed Chairman Bernanke at his word that interest rates will stay where they are thru 2015, and that analysis does not even take into consideration disruptive economic occurrences by individual U.S. states or from natural events. The bottom line is the U.S. government’s role as a back stop is not going to be shrinking any time soon, which supports the current dollar trend in place which is sideways at best intermediate-term- see Figure 1.

For months I’ve been mulling over what the market is showing me as far as Aussie strength versus Euro and Yen weakness against the back-drop of U.S. and global economics, and I just couldn’t fit the Greenback piece into the rest of the puzzle. Then it hit me that while the dollar may not see a rally much beyond the 2009 highs, that this would still be a large directional move.

The design of the currency markets is fascinating because the only instrument as liquid as a currency is another currency. Sell the Euro and your long the U.S. Dollar by default, albeit .58 dollars. Sell the U.S. Dollar Index and your long Euros, Yen, and Pound’s by default. While companies and commodities will always rise and fall, currencies, like temperature bands, stay in relatively reasonable ranges. Even if we were to see the Euro fall 20% it still leaves the Dollar Index right around the 2009 highs. All things being equal that same percentage price move in the Euro and Dollar Index would take USDJPY up a full 16 handles or 1,600 pips. With margin for a standard USDJPY contract a bit over 200 pips you do the math. That would be a tremendous price move, yet it still leaves the Greenback at the top of its current 6-year price range.

One big reason today why some pundits and analysts are calling for a U.S. Dollar rally is because of the possibility of U.S. energy independence. No doubt this is a bullish development for America.

But there is a cost, which the drought over the last two years has highlighted. For every barrel of oil retrieved from the great Bakken formation in Montana and North Dakota it will take 4 barrels of water to get the job done. It is currently estimated that the oil and gas industry in the Bakken region will require as much as 5.5 billion gallons of water per year for the next 20-years.

While American farmers and ranchers may side with conservatives on many social issues, they will likely side with environmentalists if the trend of scolding summers with no precipitation continue. To make just 4 pounds of choice cut steak takes enough water to fill an Olympic sized swimming pool, and no one knows the importance of preserving ground and well water like farmers in the American West.

If the oil and gas industry and the farmers and ranchers are going to co-exist, America better hope for a reversal of the current precipitation trends in place. There certainly is plenty of oil in the Bakken formation though, which extends into Saskatchewan, Canada. And Canada still has plenty of water to drill it out.

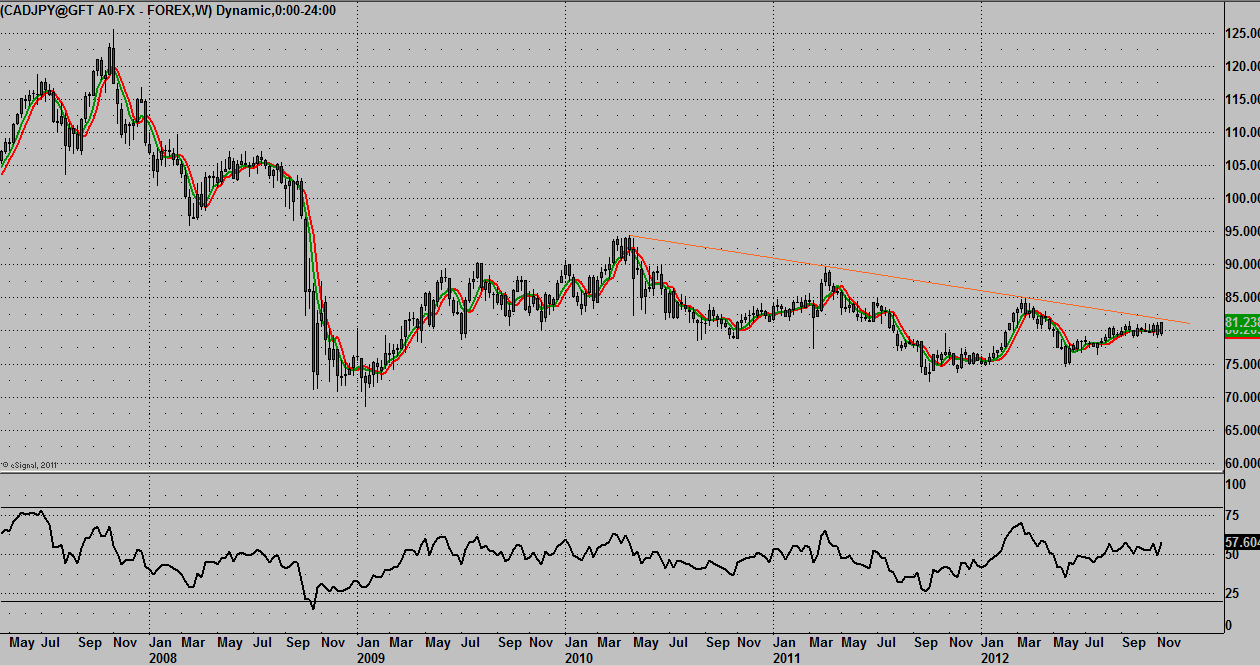

Our guess is oil independence for North America is more bullish for the Loonie than the Greenback. From our perspective the CAD/JPY Forex pair in Figure 2 looks to be worth monitoring. CAD/JPY Chart" title="Figure 2. Weekly CAD/JPY Chart" width="1260" height="666">

CAD/JPY Chart" title="Figure 2. Weekly CAD/JPY Chart" width="1260" height="666">

The cause, or determinants, of price movement always make for interesting conversation for many of us, particularly during off market hours. But it is the effect and execution of trading and investing strategies that we need to focus on come Monday’s opening bell. The CAD/JPY Forex pair is a market that we see as having potential for advancement, and being worth focusing on from both a trading and investment standpoint.

Disclosure: Trading is a risky endeavor and not suitable for all investors!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Myth Of A Big Dollar Rally And Little CAD/JPY

Published 11/18/2012, 02:07 AM

Updated 07/09/2023, 06:31 AM

The Myth Of A Big Dollar Rally And Little CAD/JPY

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.