Gold stocks are entering a sweet spot.

In recent months, we have written about how gold stocks outperform gold after breakouts in the gold price. This has transpired since March.

However, in the past two weeks, the miners began to lead gold, although gold had yet to break out of its consolidation.

The sweet spot occurs after the first move in gold and into the second move. In other words, gold led the move from $2100 to $2400; now, miners can lead the move from $2400 to $3000.

Here is the evidence:

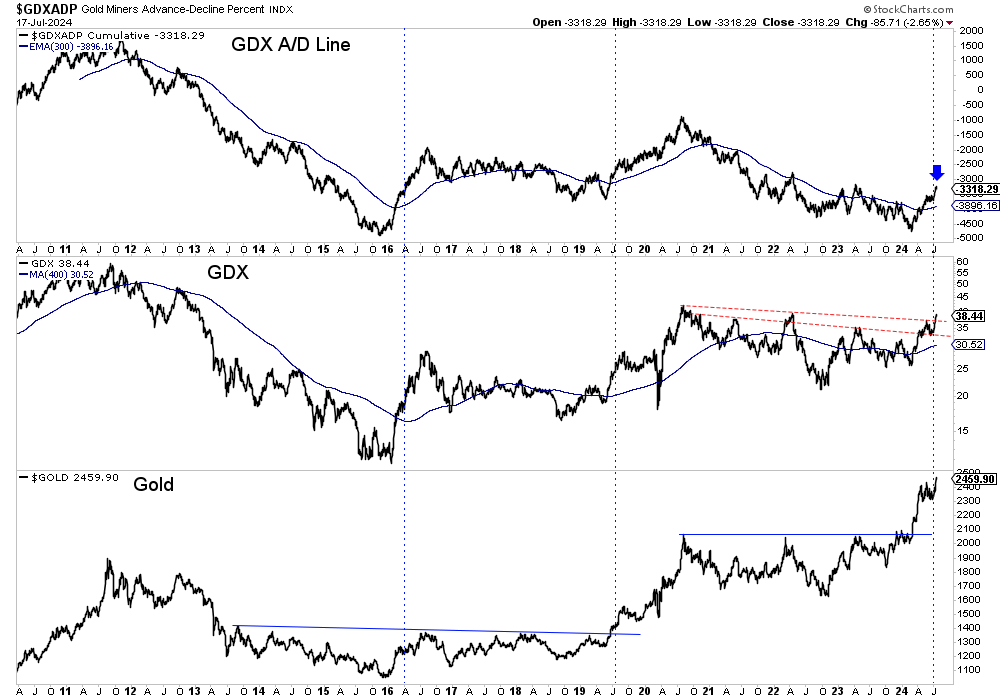

The GDX advance-decline line, a breadth indicator and often a leading indicator, made a new 52-week high two weeks ago. That was before GDX and gold made new highs.

It was the first time the GDX advance decline made a new 52-week high in four years and only the third time in a similar context in the last 13 years.

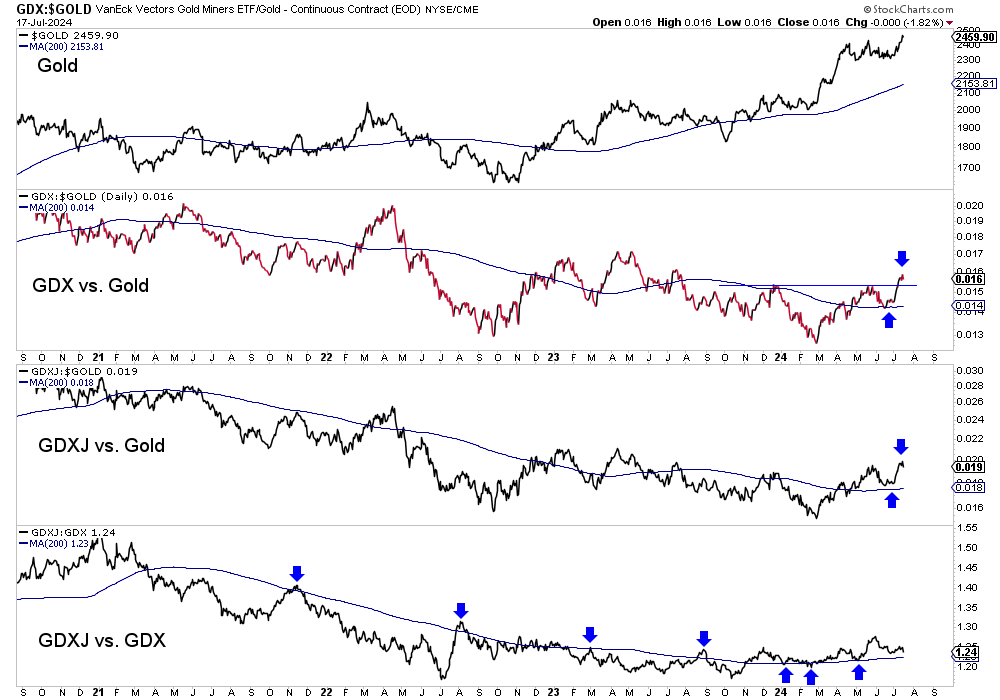

In recent days, both GDX and GDXJ to Gold broke to new highs and made higher highs before gold!

The GDXJ to Gold ratio closed Tuesday at a 14-month high, and the GDX to Gold ratio closed Tuesday at an 11-month high.

Furthermore, the GDXJ to GDX ratio has transitioned from a bearish trend to a bullish trend.

These indicators signal that the miners are leading gold and that the larger juniors (GDXJ) are outperforming the seniors (GDX).

How well did the gold stocks perform during similar breakouts in the gold price?

Following the 2005 breakout, GDXJ gained another 195% over the next two years and two months. Following the 1972 breakout, Barron’s Gold Mining Index surged 320% over the next two years and three months.

The epic breakout of the gold stocks in late 1964 (a proxy for gold at the time) carried another 290% over the next three years and eight months.

If we have a recession, then it’s probable we'll get similar gains over the next few years.