Why use lots of words when pictures will do?

That’s my thinking every Friday when I select a handful of graphics to put important economic and investing news into perspective for you.

This week, I’m dishing on bull markets, excess cash, why the world’s most precious metal is getting less precious, and – last, but not least – the most outrageous economic stimulus plan ever conceived.

So, pop in that dusty ‘N Sync compact disc and say “Bye, Bye, Bye” to the long-winded commentary – and “Hey, Hey, Hey” to some pretty pictures and quick-hit observations.

Death Cross? Say it isn’t So!

Fibonacci retracement. McClellan oscillator. Parabolic Stop and Reversal.

I shudder at the thought of putting much stock, if any, in such technical indicators.

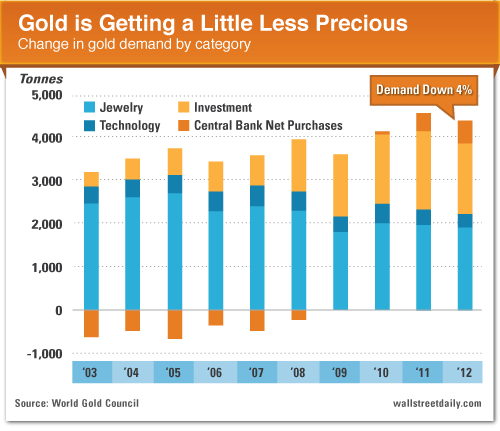

Lately, though, traders can’t stop fearing the increasing likelihood of a “death cross” taking shape in gold prices.

They’re convinced it’s a clear sign that prices could be headed much lower.

But is there a more fundamental reason why the precious metal is dropping in price, down about 8% year-to-date?

A drop in demand, perhaps?

According to a new report from the World Gold Council, global gold demand fell 4% in 2012.

So is the recent price drop all about the fundamentals, or is it technical? I vote for the former. But feel free to debate that amongst yourselves.

It’s Déjà Vu All Over Again, Yogi Berra!

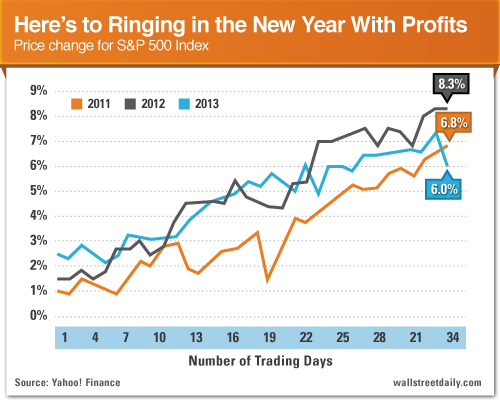

Last week, I proved that stocks had not run too far, too fast in 2013. I’ve done some more number crunching since, and it turns out that stocks are off to their slowest start in the last three years.

Of course, stocks are rallying for the third consecutive year. So I’m not about to bemoan the repeat, repeat performance.

Forget the Mattresses, Stuff it in the Bank!

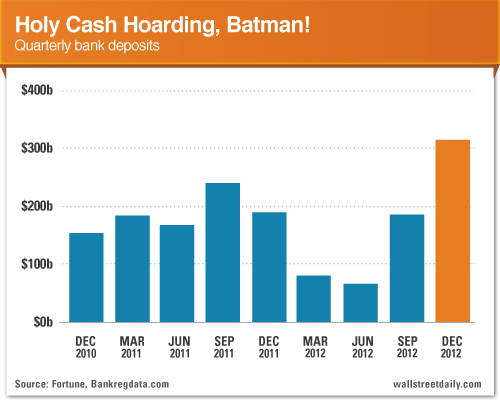

While we’re talking about bull markets, don’t dare to think that there’s nothing left to drive prices even higher.

Why not?

Because investors and corporations have been hoarding cash. In the fourth quarter, “Deposits went nuts,” according to Bill Moreland of bank research firm, Bankregdata.com.

He’s not exaggerating, either. A record $312 billion poured into bank accounts.

I’m sorry. But capital ultimately flows to where it’s treated best.

With the average money market fund yielding a measly 0.7%, compared to a 2.1% yield for the average stock in the S&P 500 Index – with soaring prices, to boot – it’s only a matter of time before that cash gets reallocated.

Giddy up, bull market! Giddy up!

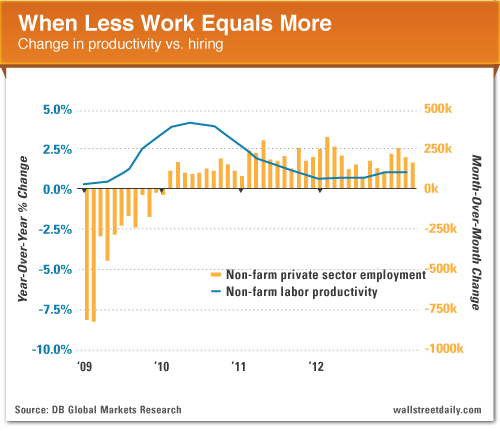

Be Lazy, Help the Economy

Consider this the most alternative economic stimulus plan out there: Americans with jobs should stop working so hard, so Americans without jobs can finally get one.

Why? Because new research out of Deutsche Bank demonstrates that declines in productivity do, indeed, lead to hiring booms.

So go ahead and take an extra-long lunch break today in the name of economic stimulus!

I’m totally kidding, of course.

My hope is that such an asinine suggestion might actually inspire politicians to resolve the budget impasse. That way, corporations can stop worrying about policy in Washington and get back to hiring. Now that’s a novel idea, isn’t it?

That’s it for this week. Before you go, though, let us know what you think of this weekly column – or any of our recent work at Wall Street Daily – by sending an email to feedback@wallstreetdaily.com or leaving a comment on our website.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Most Outrageous Economic Stimulus Plan Ever

Published 02/23/2013, 06:50 AM

Updated 05/14/2017, 06:45 AM

The Most Outrageous Economic Stimulus Plan Ever

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.