Or: Gold Miners’ Doom Is Streaming Companies’ Boom.

The gold (NYSE:RING) and silver (NYSE:SLVP) miners are in crisis, as metal prices hover around break-even for many and capital dries up for most. Dozens of companies are one or two quarters away from running out of cash and closing down, and their executives are ready to deal.

This is, in short, the part of the cycle when the smart money sets itself up to make a fortune in the next bull market. Chief among this bunch are the streaming companies that finance developing mines in return for a share of future production.

In good times they do all right but find it hard to cut deals on favorable terms because the miners have access to cheap capital from less discerning banks and equity investors. But at the bottom of bear markets — like now — the streaming companies find themselves virtually alone in the industry in having both cash and an interest in putting it to work. Miners who need financing to survive now have nowhere else to turn, and the streaming companies are feasting. Here’s a recent Bloomberg profile of the biggest of them:

Franco-Nevada Mulls Credit as `Hokey’ Streaming Goes Mainstream

For Franco-Nevada Corporation (NYSE:FNV)., the best time to take on debt is at the bottom of a market. The day may be approaching for the Canadian royalty and streaming company as the commodity rout boosts demand for alternative funding.

“There are so many opportunities out there, we might have to dip into our credit lines,” Chief Executive Officer David Harquail said in an interview last week from his Toronto offices. “The ideal is you lever yourself up at the very bottom of the bear market and hopefully, if you’ve called it right, then you really benefit as the market turns around.”

Streaming companies like Franco-Nevada, Silver Wheaton Corp (NYSE:SLW). and Royal Gold Inc (NASDAQ:RGLD). give miners upfront payments in exchange for the right to buy metals at a discount in the future. Franco-Nevada also does royalty agreements, tying portions of production to land titles.

Plunging metal prices, with copper down 24 percent and gold 11 percent in the past year, combined with surging credit costs and volatile stock markets, have made streaming attractive even for majors such as Barrick Gold Corporation (NYSE:ABX). and Freeport-McMoran Copper & Gold Inc (NYSE:FCX)., giving the business more credibility.

“It’s something that’s gone from being seen as kind of hokey, to where now every major company and their CFO has to consider it among their financing options,” Harquail said.

Unused Credit

With no debt, about $610 million in cash, plus $110 million in marketable equities and an unused line of credit worth about $1 billion, the company has plenty of scope for more deals. “Without going back to the equity markets, right now, we’ve got one and a half billion to play with,” Harquail said.Two types of deals have become more common in recent years, Harquail said. Medium-sized producers are turning to royalty and streaming companies for help buying assets from larger miners. Lundin Mining Corporation (TO:LUN) purchase of Freeport’s Candelaria copper mine, which Franco-Nevada helped finance in exchange for a gold and silver stream, is a case in point, he said.

Also, the largest producers are now willing to sell streams on their most prized assets, Harquail said. “We’re getting the opportunity to bid on some of the best mines in the world.”

For an idea of how much things have changed in mining, consider Glencore (LONDON:GLEN). With a 2011 market cap of $100 billion, it could have swallowed all the streaming companies without getting indigestion. Then commodities tanked and Glencore’s stock crashed — and now it’s scrounging for the funds to keep its mines afloat:

Glencore in talks on streaming deals on Chile, Peru mines

(Reuters) – Glencore is in talks with Franco-Nevada Corp, Silver Wheaton Corp, Royal Gold, and Osisko Gold Ro (TO:OR) to sell portions of the future production of three South American copper mines. One source said on Wednesday the talks could expand to include other Glencore mines.

The longer the gold/silver bear market grinds on, the more desperate the miners become and the better deals the streaming companies receive. And when prices rebound — as they will (since if they don’t the mining industry will collapse and supplies will dry up) the streaming companies will generate massive cash flow.

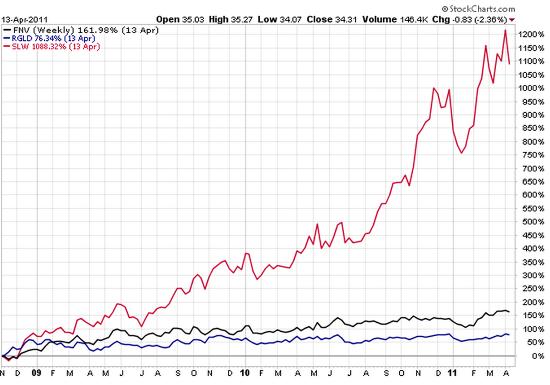

Here’s what this meant for the market values of the biggest streaming companies following the 2008 precious metals bear market:

Will they do this again? No. They should do a lot better because the 2008 precious metals bear market lasted less than a year, which was too little time for the proper amount of panic to take hold. This bear market has been grinding on for three years, and now the miners are out of cash and desperate, which should allow far more ounces to be bought at bargain basement prices — and far more cash to be generated on those ounces when prices start rising.