Last week at the New Orleans 2015 Investment Conference, I saw the most important chart I’ve seen all year.

I’d been invited to the conference to speak to the large audience of resource investors. There was an air of excitement about the place.

And one thing people were especially excited about was gold.

I sat down and talked with CEOs and executives from top junior mining companies. These mining veterans have already gone through the long process of cutting costs. Now, many of them are ramping up production in anticipation of the next big move higher in precious metals.

After all, even if gold prices don’t go higher, the more metal they produce, the more money they make. And thanks to all that cost-cutting, the best miners are turning a profit even at recent low, low prices.

But gold producers are right to believe prices will go higher. And the reason can be seen in the chart I’m about to show you...

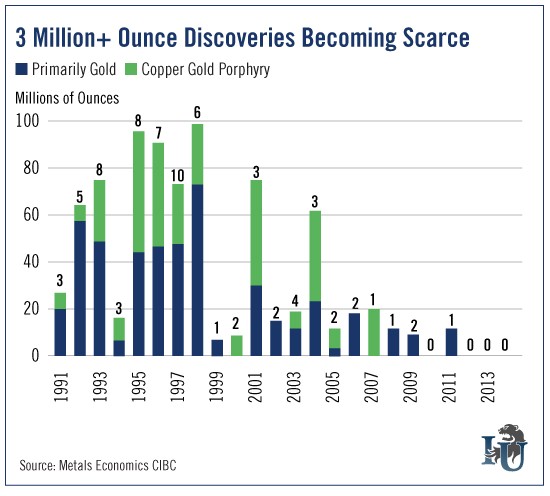

The fact is, big gold discoveries dwindled for years and finally just stopped. And this happened despite millions upon millions of dollars being spent on exploration.

I’m talking discoveries of deposits containing more than 3 million ounces of gold. The last discovery, the Haile Gold Mine in South Carolina, was in 2011. That’s now owned by Oceanagold Corporation (TO:OGC). Haile should go into production next year.

There are a bunch of explorers who think they might be on the trail of the next big gold discovery. I know because I talked to them in New Orleans.

But I can also tell you that, in general, gold explorers are optimists. They have to be or they wouldn’t get out of bed in the morning. It can take 10 years to find a great deposit and another 10 to turn it into a producing mine.

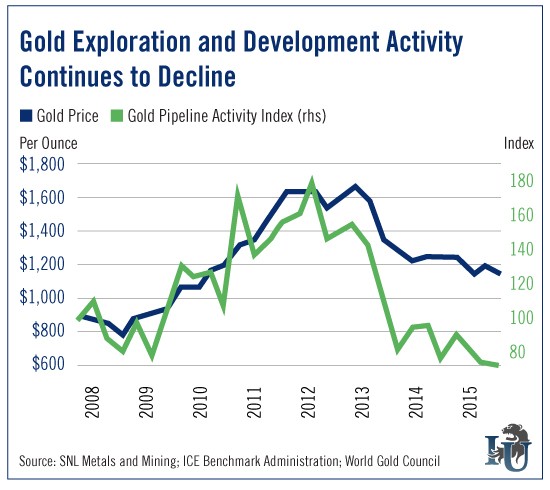

Overall, spending in the gold exploration space is falling hard, as this next chart shows.

This does not indicate a lot of hope for big new discoveries. However, that’s bullish for gold prices.

Meanwhile, according to the World Gold Council, gold demand this year is forecasted to be between 4,200 and 4,300 metric tons. And with the big deposits missing in action, where do you think that gold is going to come from? What do you think will happen to the price of gold?

Well, I talked to some of the companies that will answer those questions. They included...

TriMetals Mining Inc (TO:TMI): This gold explorer works in Nevada, which is a great gold jurisdiction.

Uranium Energy Corp (N:UEC): It’s a uranium producer based in Texas.

Pershing Gold Corp (O:PGLC): This company is developing a gold mine in Nevada that is getting a lot of buzz.

Globex Mining Enterprises Inc. (TO:GMX): This early-stage project generator works on gold, silver, platinum, palladium and more.

GoGold Resources Inc. (TO:GGD): I’ve been following these guys for years. They started with a Mexican silver heap leach project and they keep ramping up and branching out.

Great Panther Silver Limited (TO:GPR): Great Panther CEO Bob Archer has shown he can lead his company through good times and bad. He is cutting costs and ramping up production.

Avino Silver & Gold Mines Ltd. (N:ASM): Not many producers would be able to double their production in a year through grassroots growth, but that’s exactly what Avino has done.

NovaCopper Inc. (TO:NCQ): Its huge copper project in Alaska just got the government go-ahead for a road to link to a major highway.

These are some of the interesting companies I talked to. That doesn’t make them recommendations though, so do your own due diligence before you buy anything.

These are exciting times in the junior mining space. And as that first chart shows, the real excitement for gold may be dead ahead.