Some myths just won’t die!

A year ago, I warned about a massive lie being perpetrated against the investing public. Specifically, that higher GDP growth translates into higher stock market returns. And, conversely, that lower GDP growth translates into lower stock market returns.

Try as I did to debunk those beliefs for good, they’re rearing their ugly heads again -- albeit in a slightly different manner. Nevertheless, they’re still false.

It’s time to usher in new (graphic) evidence to prove that this is the most dangerous assumption an investor can make about stocks and GDP growth rates.

Divorced: U.S. Stocks And The Economy

With a rash of U.S. economic reports – like The Institute for Supply Management (ISM) services and manufacturing indices – coming in stronger than expected, investors have been treating it as a signal to jump into stocks. Forget that they’re four years late to the profit party.

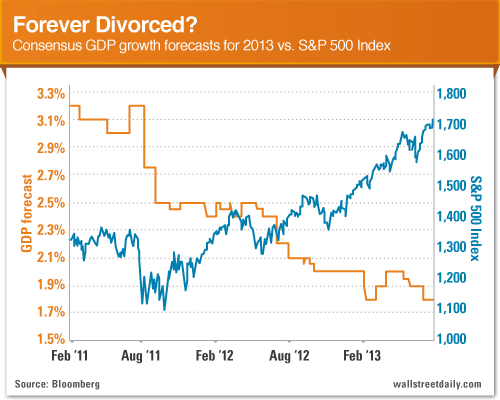

What troubles me most is the faulty logic behind their actions. Namely, that since the U.S. economy is strengthening, then it automatically means stocks are going to do better. Please, people, stop thinking that! The U.S. stock market is not the same thing as the U.S. economy. And this chart, recently tweeted by Bloomberg Chief Economist, Michael McDonough, proves it.

It shows the consensus forecast for U.S. GDP growth versus the performance of the S&P 500 Index.

Unless you’re blind, you can see that practically the entire time GDP forecasts for 2013 have been falling – from 3.2% in 2011 to 1.8% currently – stocks have been rising. Put another way, as economists told us the economy was getting worse, stocks did better. Still think stocks and GDP growth rates are inextricably linked? I didn’t think so. What’s important now is that you understand why…

It’s A Global World After All

Although the U.S. economy represents the biggest source of business for the companies in the S&P 500, it’s not the only source. Roughly 40% of profits at S&P 500 companies come from overseas – about 17% from Europe, 15% from emerging markets and 8% from other developed markets. So at best, we’re talking about a 60% overlap between the U.S. economy and U.S. stock market.

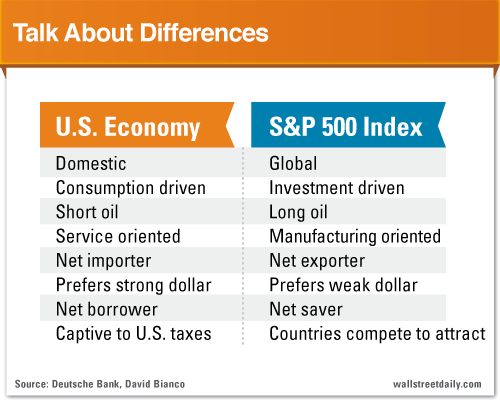

But even that’s stretching it because the economy and the stock market aren’t the same thing. As Deutsche Bank’s (DB) Chief U.S. Equity Strategist, David Bianco, likes to regularly point out, there are eight major differences between U.S. GDP and the S&P 500.

Another major difference is that GDP growth rates are historical measurements, whereas the stock market is forward-looking by design.

Bottom Line

Economic growth rates are terrible proxies for predicting stock market returns. So if you’re interested in consistently making money, stop using them as a basis for your investment decisions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Most Dangerous Assumption About Stocks And GDP

Published 08/12/2013, 03:13 PM

Updated 05/14/2017, 06:45 AM

The Most Dangerous Assumption About Stocks And GDP

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.