Intel (O:INTC) is one of the stalwarts of the technology space. A general during the tech boom of the 90s and a core part of the computing world now. And today, the stock looks ready to make a major move higher.

I follow a mosaic approach when looking at stock charts of price action. When there are multiple forms of technical analysis that all point in the same direction, it re-enforces the view. And in Intel, the mosaic is strong.

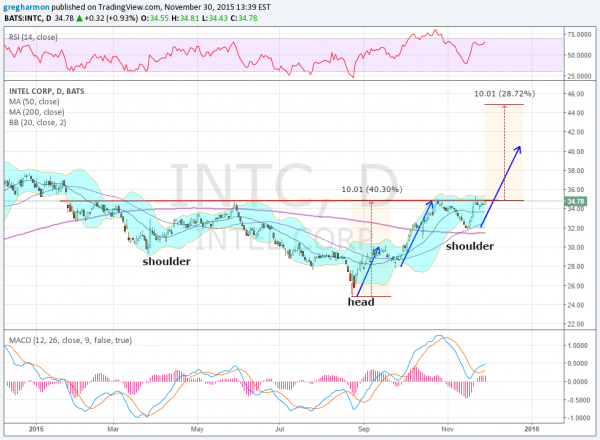

First there is the most famous of technical patterns, a Head and Shoulders. This is actually an inverse Head and Shoulders, and the price is right at the neckline. A break above that neckline would give a price objective of at least 44.85. The second is a 3 Drives pattern. This is a series of 3 moves higher with partial retracement. In the chart above, this one is building with a 127% extension the second thrust, so targeting 40.50 for the final 3rd thrust.

If that is not enough, the momentum indicators also support a move higher. The RSI is in the bullish range and holding. The unbounded MACD has crossed up and is rising. Finally, there was a Golden Cross that printed in mid November as the 50 day SMA crossed up through the 200 day SMA.

All of these reads point to more upside in Intel. So what are you waiting for?

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.