How did the world get this way? I don’t mean the oncoming recession, if that is indeed, as it appears, the economy’s fate. How did the payroll statistics ever attain this kind of deference and even religious zeal?

U.S. manufacturing is shrinking, corporate profits are declining and goods are piling up on warehouse shelves. Those trends have elevated concern that a U.S. recession may loom in the next year or two.

Yet in the one area that matters most, the economy has continued to shine: Hiring.

Those two paragraphs are at extreme odds with each other, so much so that they are mutually exclusive. It cannot be both. Forced to choose, the media and economists pick the latter every time no matter how much of the former forces its way into the analysis (and not voluntarily). It makes no sense for today but perhaps more meaningfully it hasn’t meant anything this whole time. Hiring has supposedly been robust all throughout the past two years and still “manufacturing is shrinking, corporate profits are declining and goods are piling up on warehouse shelves.” There can be but unbreakable ideology to the blindness.

That is visited on the other side of this equation, too. By that I mean the financial and what is ailing the global version of related US malaise. Here, too, convention and orthodoxy prevents full recognition in favor of debt, debt and more debt – the very death trap of monetarism.

Beneath the surface of the global financial system lurks a multitrillion-dollar problem that could sap the strength of large economies for years to come.

The problem is the giant, stagnant pool of loans that companies and people around the world are struggling to pay back. Bad debts have been a drag on economic activity ever since the financial crisis of 2008, but in recent months, the threat posed by an overhang of bad loans appears to be rising. China is the biggest source of worry. Some analysts estimate that China’s troubled credit could exceed $5 trillion, a staggering number that is equivalent to half the size of the country’s annual economic output.

This analysis continues without ever asking how all that happened to begin with; where did all the debt and deference to banking come from and how did it get there? The main economic commentator at the New York Times preaches nothing but credit-based “demand” from every single economic outlet any government or central bank might be able to reach (and a great deal more that he would prefer they just co-opt and direct should any resistance be exercised). Debt is the tool of the statist monetarist, so it is a little late now for someone inside the orthodoxy to suddenly attain conscious awareness.

The idea that you can fix bad debt with more debt is as prevalent as the idea that the US economy can be binge hiring while careening into recession. What’s truly sad is that those two mistakes are really, at root, the same. The road ahead to real recovery and sustainable growth starts with “unlearning” monetarism. It is a huge task.

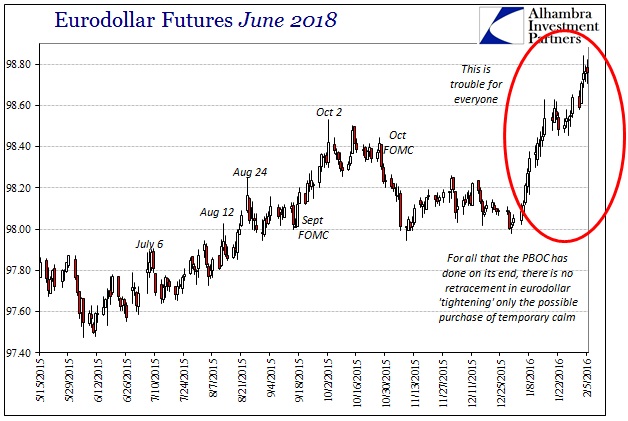

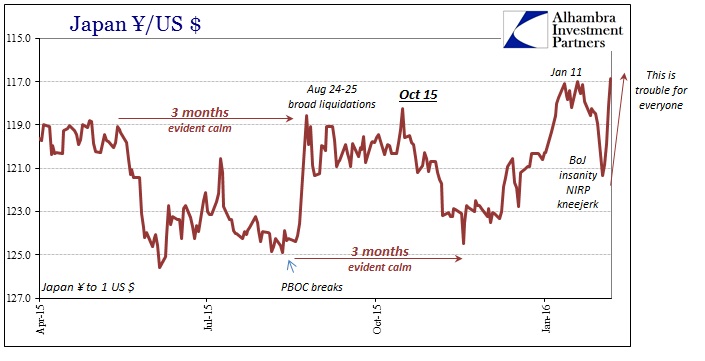

Furthermore, and I write this with increasing frequency, you would think the current problems would be easily and obviously recognizable to any such orthodox persuasion. Collapsing commodities, inability with and even zero “inflation”, only further economic questions and indications of recession; all those add up in traditional format of declining “money supply.” Thus, even if more debt actually were a good idea (and it’s not), there isn’t any way to actually do it. Such enormous piles of bad debt are only serviceable under rapidly expanding money growth; the useless byproducts of QE, or what the Fed calls bank reserves, are nothing of the required monetary component. If money growth is declining then that means all that past debt never created the economy as was intended; without that economy, there will only be less “money.”

For the immediate future, that starts with the curves and RHINO. There is only more trouble lurking there under exactly those terms.