The Sahm Rule recession indicator has been triggered. The yield curve (2-years and 10-years) has finally un-inverted, which, if it steepens aggressively, is a sure-fire recession signal.

Out come the tweets and subscriber emails about buying gold stocks after the downturn.

After all, the precious metals sector has performed poorly during the last three bear markets in stocks.

However, investors, speculators, and even gold bugs are falling victim to recency bias. This cognitive bias favors recent events over historical ones and gives greater importance to the most recent events.

The current context for precious metals is completely different than it was heading into the last three bear markets for stocks.

In fact, the current context is most similar to the two points in history when precious metals diverged from stock market bears.

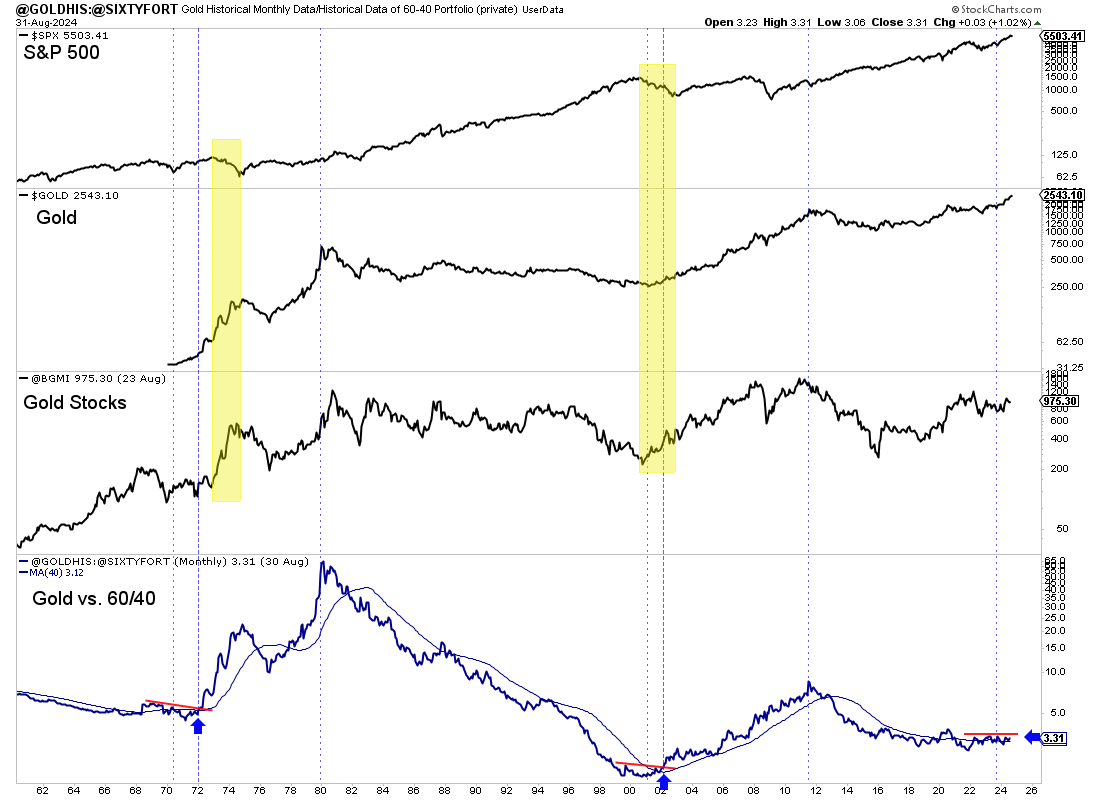

As the chart below shows, Gold and gold stocks trended higher during the bear markets of 1972-1973 and 2000-2002.

That negative correlation transpired as Gold broke out against and outperformed the 60/40 portfolio, which confirmed a new secular bull market. This is the major development we have been anticipating.

It is all connected.

Gold will have no acceleration phase until it breaks out against the 60/40 portfolio. That requires a bear market in the stock market.

Precious Metals will diverge as capital flows out of conventional stocks and into precious metals, which are massively under-owned relative to conventional stocks.

The divergence or non-correlation transpires only around the beginning of a secular bull market because precious metals are so under-owned and there are so few sellers.

In early 2008, all Gold ETFs amounted to 4% of all ETF assets. Several months ago, that figure was barely more than 1%.

Sure, there would be some selling and corrections along the way. There were multiple 20% declines in gold stocks during 1972-1973 and 2001-2002.

Rather than panic selling out of positions, one should take advantage of market-induced weakness. Tweak your portfolio and focus on the high-quality juniors that have the most value and upside potential.