The P5+1 agreement with Iran on Iran’s nuclear program has generated (sometimes fevered) anticipation of an Iranian oil bonanza at the end of the nuclear agreement rainbow, both in terms of the increase in Iranian crude output and the business opportunities for foreign firms in driving the increase.

The anticipation comes from several sources. Iran’s crude potential is one. According to the U.S. Energy Information Administration (EIA), Iran’s proven crude reserves, 158 billion barrels, are the world’s fourth largest (and among the cheapest to produce at $8-to-$17/barrel, depending on the source,). Iranian public statements expressing determination to increase crude output significantly are another (to 5.7 mmbl/day, according to Mehdi Hosseini, chairman of Iran’s oil contracts restructuring committee). The third is the value of potential contracts for foreign suppliers. Hossein Zamaninia, Iran's deputy oil minister for commerce and international affairs, indicated the government hoped to conclude nearly 50 oil and gas projects worth $185 billion by 2020.

Projected Output and Exports to 2020

Projecting from International Energy Agency (IEA) data, Iran is on track to produce an average ~2.85 mmbl/day of crude in 2015. The IEA puts Iran’s current sustainable capacity at 3.6 mmbl/day (defined as a level achievable in 90 days and sustainable for an extended period). This is roughly comparable to Iranian Oil Minister Bijan Namdar Zanganeh’s assertion Iran could increase output 500,000 barrels per day within a few months after international sanctions on Iran’s economy are lifted and another 500,000 barrels per day in the following months .

The IEA estimates Iran could “push capacity back up to 4 mmbl/d mark towards by the end of the decade” (a level which it says Iran last reached in 2008). For discussion purposes, the table below offers a scenario to arrive at output of 4 mmbl/day by 2020. It also shows projected revenue, assuming constant $55/barrel price, $12.50/barrel production cost, and constant exports at 91,000 barrels per day (Base case); constant $55 price, $12.50/barrel production cost, and increasing exports (Case 1); and $5 annual increase in price, $12.50/barrel production cost, and increasing exports (Case 2).

Sources and Amount of Necessary Foreign Investment

The IEA believes 4 mmbl/day is attainable “with the help of foreign cash and cutting-edge technology.” Saeed Ghavampour, the oil ministry’s general manager of strategic planning, puts the total investment needed in the Iranian energy industry through 2020 at $100 billion to $500 billion through 2020.

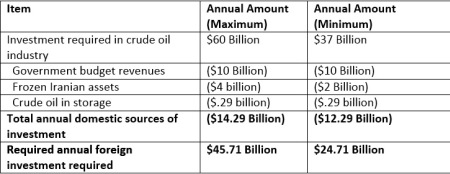

How much foreign investment is necessary to maintain current output and to add the 1.15 mmbl/day incremental capacity necessary to reach 4 mmbl/day? Assuming Zamaninia’s $185 billion is the minimum investment the Iranian oil industry requires over the next five years, and the maximum is $300 billion—half the difference between Ghavampour’s high and low estimate—Iran would need to invest between $35 billion to $60 billion annually.

Iran won’t be able to finance this on its own. It has three “internal” sources of investment—frozen Iranian funds in foreign accounts, government budget resources (oil revenues flow to the Iranian government, a portion of which the government returns to the industry), and oil in storage. (Iranian banks evidently can’t provide meaningful funding). Rough conjectures of the investment Iran could generate from these three sources in current low price environment are as follows:

- Perhaps $2-$4 billion annually through 2020 from frozen Iranian funds in foreign accounts. Some estimates put the total at $100 billion (or $20 billion annually). U.S. Treasury Secretary Lew, in testimony before Congress, put the available funds at $50 billion ($10 billion annually). Since Iran’s oil industry is only one of many claimants on the frozen funds, including the natural gas industry, the Iranian military, Iran’s proxy clients in Lebanon, the Gaza Strip, Syria, Iraq, and Yemen, the commercial aviation industry (replacing the passenger jet fleet), other industries, and the Iranian people, maybe it will receive 20 percent of the frozen funds, or between $2 and $4 billion annually.

- For the sake of argument, $10 billion annually through 2020 from government budget resources, which is very generous given the share of crude export revenues this level of support would consume (see last row of above table), the demands from other Iranian claimants, and Zanganeh’s data (investment fell from an average $20 annually in 2011 and 2012, when the OPEC basket crude averaged $107.46 and $109.45 per barrel respectively, to $6 billion in 2014, when it averaged $96.29, and virtually nothing this year, when it averaged $53.97 through August).

- Perhaps $1-$1.5 billion as a one-time contribution from oil currently in storage. Estimates of this amount vary from less than 10 million barrels to over 30 million barrels. Assuming an OPEC basket price of $54/barrel, production costs of $8-$17/barrel, and 35 million barrels in storage, Iran would net between $1.3 billion (or $260 million annually, if sold in equal tranches over five years) and $1.6 billion (or $320 million annually).

Even doubling the maximum and minimum domestic annual contribution to $28.58 billion or $24.58 billion respectively, Iran would still need substantial foreign investment ($31.42 and $12.42 respectively).

Investment Case for Investment in Iranian Oil Industry

Their size, their long life, and their relatively low production cost make Iran’s crude resources attractive.

A number of factors take the gloss off investing in these resources, however. The UN and U.S. economic sanctions on Iran are one (in addition to observing UN sanctions, the U.S. has enacted and observes its own, which are stricter and more extensive). Lifting both the international and U.S. sanctions would require Iran to meet certain milestones and remain in compliance with the terms of the nuclear agreement. At least until U.S. presidential and Congressional elections in November 2016, the U.S. position on both sets of sanctions is subject to change. Domestic political dynamics may cause the U.S. to back away from lifting sanctions, as could Iranian actions, such as aggression, directly or indirectly through proxies, against Israel, Saudi Arabia, and other U.S. allies. Even if UN sanctions are lifted, foreign companies may not want to risk violating U.S. sanctions.

The possibility of direct military conflict between Iran on the one hand and Saudi Arabia and its Gulf Arab allies on the other is another factor. The two sides are already essentially at war indirectly in Yemen, Iraq, Lebanon, and Syria. Moreover, just the threat of direct military conflict or an increase in regional tensions is enough to cause foreigners anxiety.

The deal structure the Iranians will offer foreign companies—Hosseini described it as a “risk service contract”—will increase rather than mitigate risk. Given their lack of capital, the Iranians will be asking foreigners to bear the upfront investment burden in return for payment (cash and/or crude) in the (perhaps distant) future. Foreigners must take into account the possibility that negative changes in the internal and/or external environment will damage the value of their investment.

Foreign investors cannot be confident Iran’s internal political dynamics will be conducive to foreign investment. Not all influential Iranians or Iranian interest groups (for example, the powerful Revolutionary Guards) welcome the nuclear agreement and détente with the United States and Europe. Should the balance of power tip in their favor—or further in their favor—foreign investments could face anything from unpleasant pressure to expropriation.

Moreover, absent a binding agreement within OPEC and between OPEC and Russia on production levels, Saudi and Gulf Arab production policies will threaten the value of foreign investment in the Iranian crude industry. Saudi Arabia’s sustainable capacity is 2.5 mmbl/day more than its average 10.01 mmbl daily output in 1H 2015, while the UAE has announced plans to increase output 600,000 barrels per day in the next few years, and Kuwait by 1.4 mmbl/day by 2020.

Finally, Iran will have to compete with other countries for scarce oil investment funds.

Country and Company Potential

The situations of Individual countries and companies, summarized below, imply limited foreign investment in the Iranian industry in the current environment:

- China. Investing in Iran would reduce dependence on Saudi Arabia and its Gulf Arab allies and increase China’s leverage in negotiations with these countries on price and volumes. However, China already has substantial financial commitments and exposure to Venezuela and its oil industry and to Russia and its energy industry. Its national oil companies, CNOOC Ltd (HK:0883), Petrochina SS (SS:601857), and Sinopec Shanghai Petrochemical Co Ltd (NYSE:SHI) face pressure to cut spending , while Canadian regulators have ordered CNOOC’s Nexen unit to shut down its oil sands pipelines. Any negotiations with Iran are likely to be protracted (using China’s years’ long negotiations with Russia natural gas pricing as a recent example). Also, China cannot risk alienating Saudi Arabia and the Gulf Arab countries on which China will remain highly dependent for crude supplies for the foreseeable future.

- Russia. Russian government finances are stretched, as are the finances of its energy majors, Gazprom (MCX:GAZP), NOVATEK (MCX:NVTK), and Rosneft (MCX:ROSN), from low energy prices, a depreciating ruble, Chinese currency and stock market troubles. In any case, while Russia will finance Iran’s purchase of Russian nuclear power plants, Russia is unlikely to invest substantial amounts in the Iranian oil industry, a major competitor for Asian market share.

- Western countries. If their companies develop proposals to invest in the Iranian energy industry, the UK and France might be willing to approve them, while the U.S. and Canada are not likely to encourage such investment in a direct competitor for market share.

- Western oil majors. Even if their governments are willing to bless projects, Western oil majors—Exxon (NYSE:XOM), Chevron (NYSE:CVX), Shell (NYSE:RDSa), BP (NYSE:BP), Total SA (NYSE:TOT), ENI (NYSE:E)—are unlikely to make major commitments to Iran in the current environment. Exxon and BP are already exposed to substantial political risk with their investments in Iraq and Russia. Shell must fund its $70 billion acquisition of BG Group (LONDON:BG). All are slashing investment budgets. Some, if not all, have committed to maintaining their dividends, and to maintain dividends and fund investment, some may have to borrow. It is likely their banks will be reluctant to lend significant amounts for projects in Iran, given the risks involved and tighter regulatory standards requiring bank reserves to match loan risks.

In Sum

While it is likely Iran will increase crude output once sanctions are lifted, it is possible that Iran will lack the domestic and foreign resources necessary to increase crude output to and over 4 mmbls/day by 2020. Absent a thaw in its relations with Saudi Arabia, the Gulf Arab states, and the West, higher and more stable crude prices, and initial positive experience for foreign companies in negotiating and implementing projects, it is more likely foreign investment will trickle into the Iranian energy industry than gush into it.