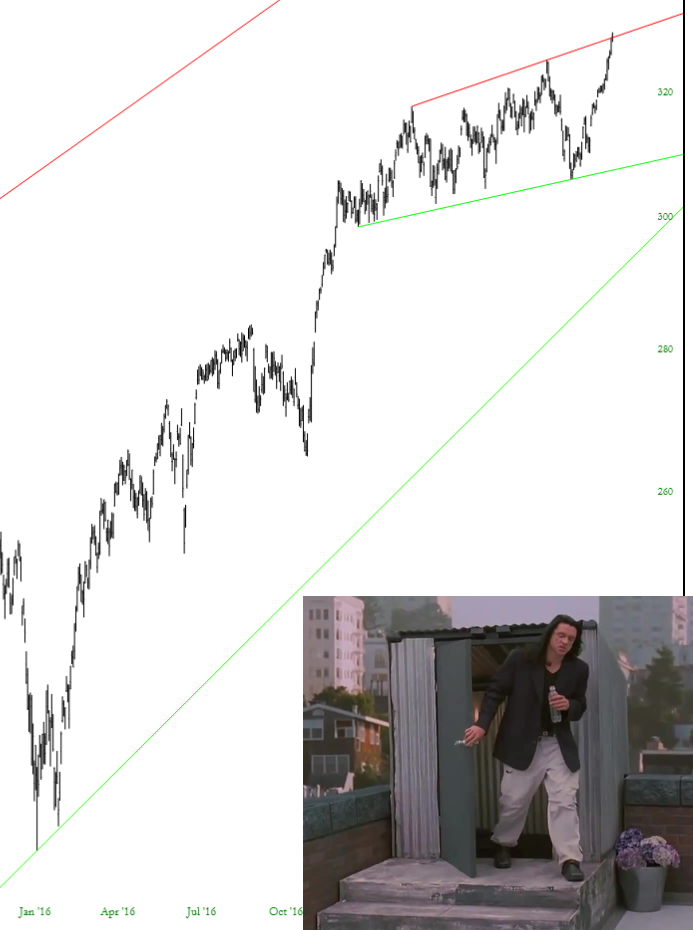

Let’s look at the mid-caps by way MDY. Here’s the short-term view, and as it's plain to see, this bull-run we’ve had lately has been the strongest, steadiest and most annoying of the year. We are rammed up against the Bollinger® band and resistance trendline.

Taking a big step back, we can see we are miles away from major support, but we haven’t had enough weakness to even merit a journey there for years. I think one could at least conclude that we’re awfully lofty now and even if this bull market continues until the year 3298, the next few weeks could at least afford some profit-taking.

The very-big picture shows that we’re at a fairly major decision point. The sheer momentum of the Internet and Housing bubbles can both be scene here, but the present market hasn’t pushed us to the trendline of those extremes. We are actually dead-center between the very long-term trendlines. If we do have the good fortune of moving back to the supporting line of the short-term pattern, the big question will be whether it holds or not. Of course, that seems like science fiction at this point, but if we get there, we can take a hard look at what it would take to create a major support failure.