Stocks took a major hit, on heavy volume selling early in the week, that foretold more selling to come.

It didn’t come.

Instead, we ripped back higher.

We’re not yet out of the weakness woods, but heavy volume on the move higher into the end of the week is good action to be sure.

I just can’t grasp the heavy selling that only lasts one day.

It’s got to be computer driven action since humans do not react this way.

I know my fragile emotions can’t handle such major weakness that so far seemingly only lasts a day.

It just doesn’t add up.

Anyhow, I’ll dive deeper into the general market and stocks in my blog and Trade Ideas letter for subscribers.

As for the metals, they continue to point to higher prices so let’s take a look.

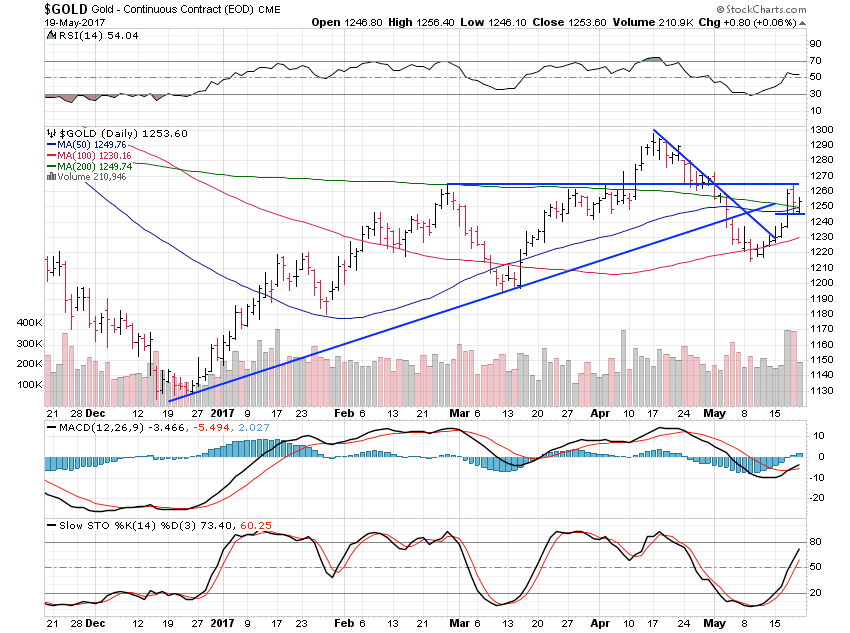

Gold rose 2.11% this past week and looks good for higher still.

Gold moved nicely past the moving average cluster around $1,245 and is holding that level, and building a small bull flag, which points to higher.

As long as we remain above the $1,245 are on a closing basis we’re looking good.

We should see a move up to the $1,300 area before we see any real resistance.

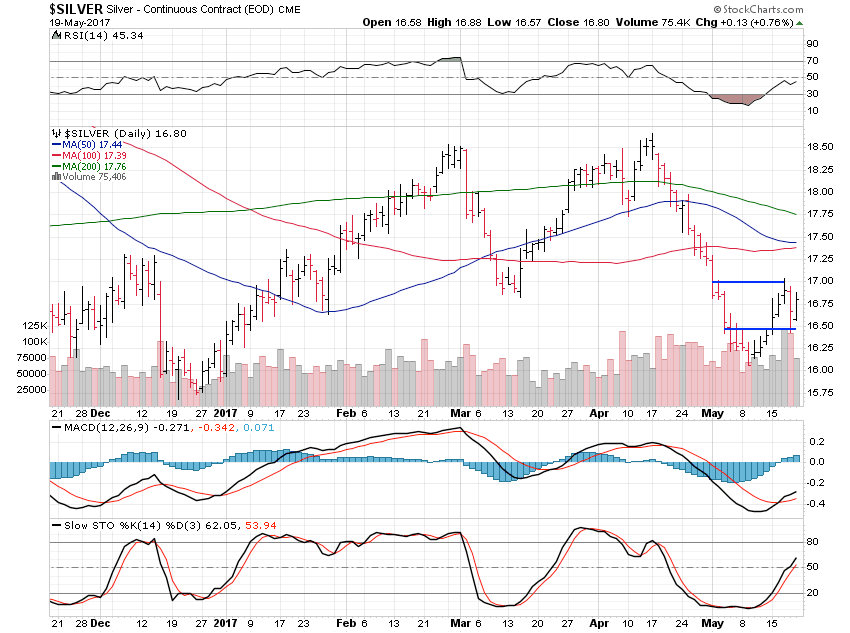

Silver was a bit wild, but ended the week positive, to the tune of 2.40%.

The $1 range this past week is pretty wide but should soon lead to a nice move higher back to $18.25, then $18.50.

$17 is the breakout area and should be bested in the coming week, or chances of failure increase exponentially.

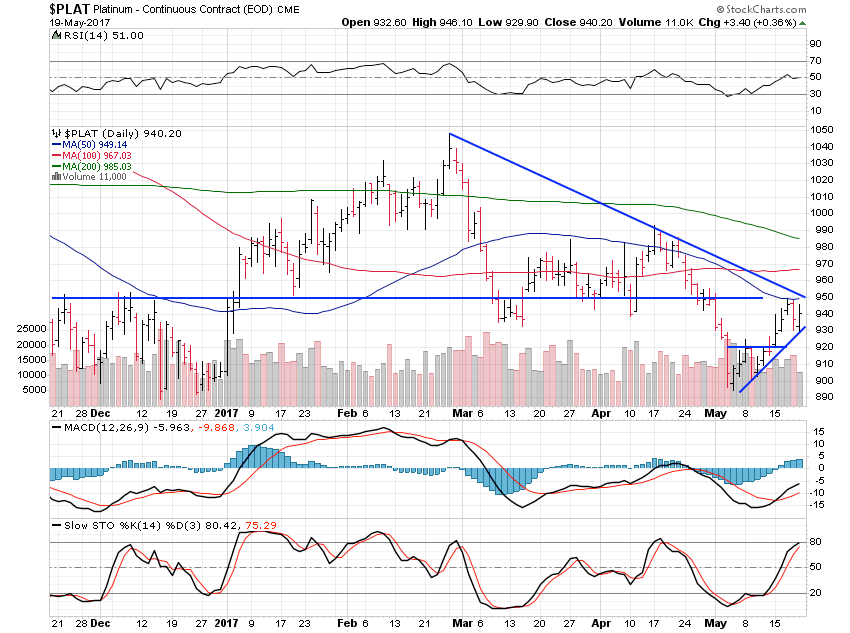

Platinum gained a respectable 2.47% and looks set for a nice move higher.

This little rest area under $950 looks great.

If we can best the large downtrend line, which now coincides with horizontal resistance at $950, we should be on the way to $990 in short order.

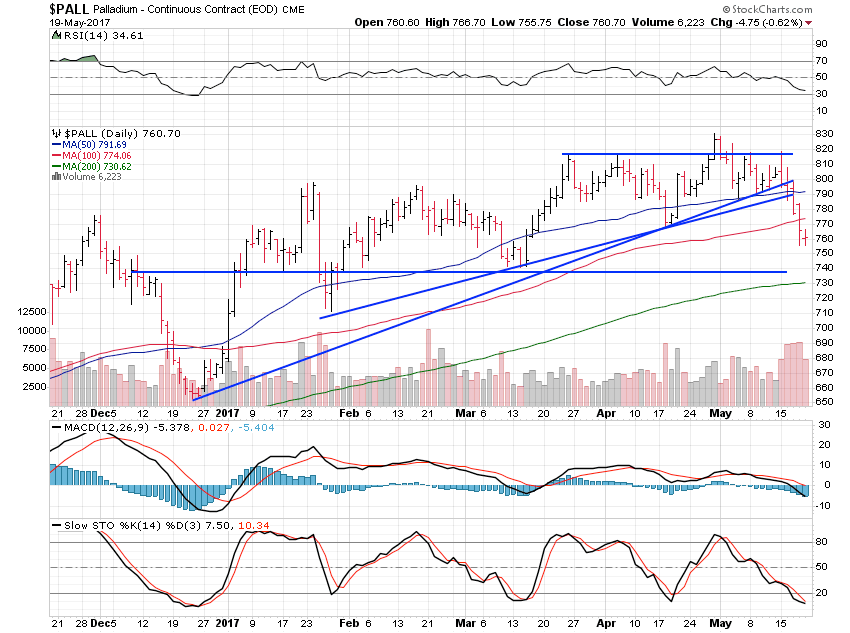

Palladium fell a hefty 5.33% and looks to have a little more downside in its near future.

I’m a bit surprised to see palladium fail after looking fine.

The failed breakout in early May was the tell, as it often is.

Failed breakouts often lead to weakness, but not always, and I did think palladium would be fine in a rising gold environment.

I was wrong.

Looks like we will test the $740 support area near the 200 day moving average where we should be looking for a turn in the chart.