The metals continue to show some mixed strength, and weakness, but the week ahead should tell us if a low is in fact in, or if more basing is needed.

Gold gained 2.73% as we moved through the first week of Chinese New Year.

Not bad action at all but gold still can’t get, and stay, above $1,220.

A move above said level would be positive but I see the more likely scenario to play out being a chop between $1,160 and $1,220 until May or so.

Time will tell.

Silver continues to try to lead gold higher and gained 2% this past week.

Seeing silver hold above $17.25 is positive but I need to see gold above it’s $17.25 level of $1,220 for me to vocalize the start of a new up-trending metals market.

Let’s see if gold can get in gear in the week to come or if silver fails this attempt to trend.

Platinum rose 2.38% last week but still cannot move above the resistance of $1,015 where the 200 day moving average coincidentally sits.

Funny how select moving averages are such magnets, or is it!

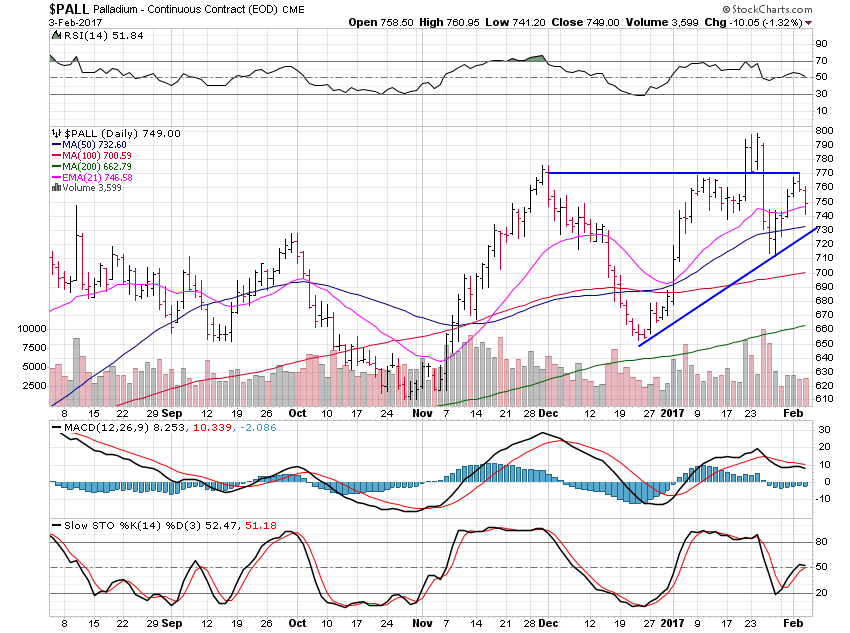

Palladium gained 1.41% this past week but is struggling to move above its personal level of defiance, $770.

Palladium isn’t anything special here and will follow the pace set by gold and silver if they can ever decide which way they will travel.