The Merchants Trust PLC (LON:MRCH)(MRCH) is managed by Simon Gergel at Allianz Global Investors (AllianzGI). He highlights the trust’s growing income stream, long-term capital growth and above-average dividend yield. The manager notes that in FY19, MRCH’s dividend growth of 4.8% was meaningfully higher than the rate of UK inflation, and a step up in dividend growth following the debt refinancing in January 2018. He explains that revenue growth in FY19 was even stronger, allowing an addition to reserves, which can be used to smooth dividend payments in years when revenue growth is lower. Gergel says that MRCH’s portfolio continues to generate a healthy level of income, with most investee companies increasing their dividends, including Legal & General, St James’s Place and the tobacco companies.

The market opportunity

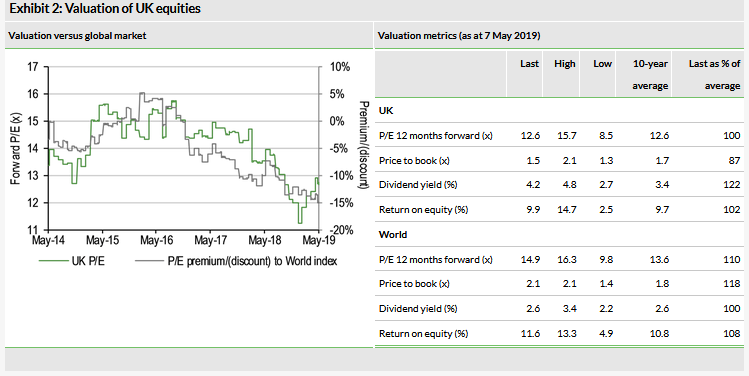

Brexit uncertainty has put pressure on UK equities, and companies with domestic operations have seen particular share price weakness. In aggregate, UK stocks are trading on a forward P/E multiple of 12.6x, a 15.1% discount to world equities, which is considerably wider than the 5.0% average discount over the last five years, perhaps providing an opportunity for investors seeking UK equity exposure.

Why consider investing in The Merchants Trust?

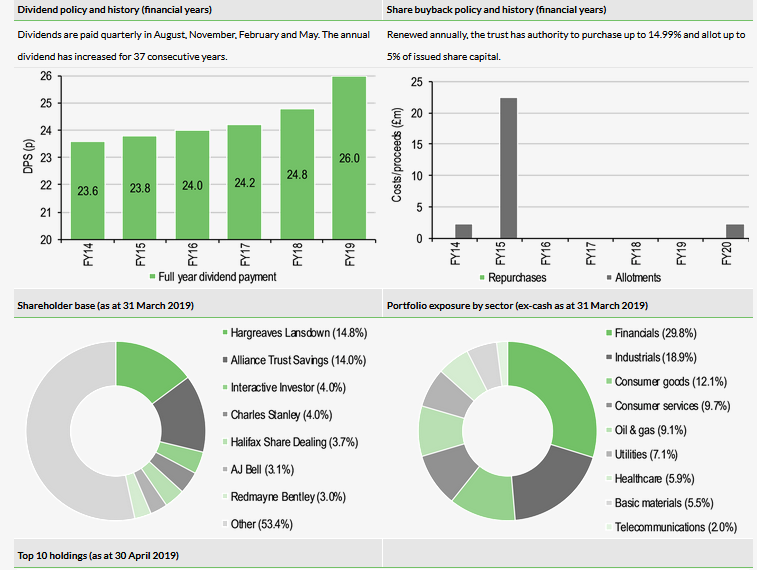

High and growing dividend yield; annual distributions have increased for 37 consecutive years (+4.8% in FY19 and current dividend yield of 5.3%).

Disciplined investment approach to finding undervalued UK equities.

Long-term record of outperformance versus the UK stock market.

Lower interest costs following debt refinancing in early 2018.

Low management fee and experienced independent board.

Discount has narrowed

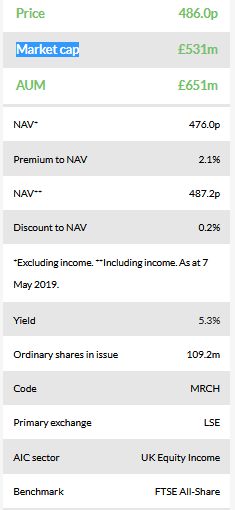

MRCH’s discount has narrowed in recent months, meaning its shares are now trading close to NAV. The current 0.2% discount to cum-income NAV (with debt at market value) compares to the range of a 3.9% premium to a 6.8% discount over the last 12 months. Over the last one, three, five and 10 years, the trust has traded at average discounts in a range of 2.2% to 4.6%.

Market outlook: Valuation opportunity

In recent years, UK equities have underperformed the world indices, which have been led by a particularly strong performance from the dominant US stock market. Overseas investors tend to consider the UK market as being dominated by a small number of low-growth companies, which along with Brexit uncertainties has led to significant outflows from UK equities. However, what investors may not appreciate is that around two-thirds of UK-listed companies’ sales and profits are generated overseas, which is a legacy from the country’s history as a trading nation.

Due to UK stocks being particularly out of favour, their valuations are looking relatively attractive. Looking at Datastream indices, the UK is currently trading on a forward P/E multiple of 12.6x, a 15.1% discount to the world index, which is significantly wider than the five-year 5.0% average discount. In addition, more than 30% of FTSE 350 companies offer a dividend yield of 5% or more. For investors willing to take a longer-term view, beyond the uncertainty created by Brexit, current UK equity valuations may provide a compelling opportunity.

Fund profile: Attractively valued UK equities

MRCH is one of the oldest investment trusts listed on the London Stock Exchange, and this year marks its 130th anniversary. Events in the year of the trust’s launch in 1889 include the opening of the Eiffel Tower, the launch of the children’s charity NSPCC and the first publication of the Wall Street Journal. MRCH aims to provide an above-average level of income and income growth, and long-term capital growth from a relatively concentrated portfolio of c 40–60 UK equities. Simon Gergel, chief investment officer for UK equities at AllianzGI, has 31 years of investment experience and has managed the trust since 2006. He works closely with two of AllianzGI’s UK equity specialists, Matthew Tillett (12 years’ experience) and Richard Knight (five years’ experience). The manager employs a contrarian investment approach, seeking undervalued equities, and primarily invests in high-yielding, well-established UK companies that can be held for the long term.

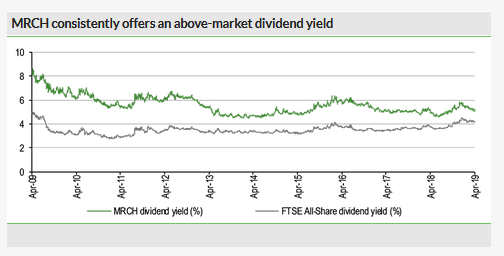

Since end-January 2017, MRCH has been benchmarked against the broader FTSE All-Share Index rather than the large-cap FTSE 100 Index. To mitigate risk, the trust must be invested in at least five of the 10 market sectors (each sector limited to 35%), and a single investment may not exceed 15% of assets. Gearing in a range of 10–25% of NAV, at the time of drawdown, is permitted; at end-March 2019, net gearing was 19.1%. MRCH offers an above-market dividend yield of 5.3% and its annual distribution has increased for the last 37 financial years, with reserves being used to supplement income when required.

The fund manager: Simon Gergel

The manager’s view: Polarisation providing opportunities

Commenting on the macro backdrop in the UK, Gergel says it is still dominated by Brexit uncertainty, although he believes the chance of a ‘no-deal’ exit is looking more remote. The manager suggests that the lower expectation of a worst-case scenario means investors are more optimistic about the outlook for the UK stock market, albeit that concerns remain at both the corporate and consumer level. Companies are reluctant to make investment decisions, and Gergel says ‘life is still getting a bit tougher’ for industrial companies, although the UK economy has experienced a boost from inventory stocking. The manager is confident that when there is more clarity regarding Brexit, pent-up demand should be an important driver for the UK economy.

Looking at global growth, Gergel believes that the trade relationship between the US and China is looking more positive. Both parties would benefit from a resolution to the recent dispute, and China is also stimulating its economy, although the outlook for European growth remains muted. Overall, he says that the world economy is slowing, but the environment is ‘not terrible’, and has been helped by the US Federal Reserve adopting a more dovish stance by putting interest hikes on hold. The manager is keen to emphasise that the majority of profits generated by UK companies come from overseas, so he is not overly concerned that the UK economy is ‘muddling along’, helped by low levels of unemployment. Gergel suggests that since the global financial crisis, there has not been too much to worry about in the global macro environment, as any moderations in economic growth have so far not been significant, nor have they been sustained.

In terms of the structure of the UK stock market, the manager notes wide valuation dispersions within, not just between, different sectors. He argues that this environment is providing interesting investment opportunities for value investors who have a long-term view. Gergel notes the underperformance of smaller-cap equities; as asset managers have experienced outflows, this has put pressure on the share prices of widely owned smaller companies, which he says ‘has created some real bargains’. (As an example, he has added to MRCH’s holding in specialist geotechnical contractor Keller following share price weakness.)

The manager points out that value stocks have underperformed growth names over the last 10 years, as the low level of interest rates as a result of quantitative easing has supported ‘bond proxies’. He believes that over time, as interest rates normalise, value stocks should perform relatively better. During recent years, when the US was raising interest rates, Gergel notes that value stocks did not outperform; however, over the long term, they have generated higher total returns than growth stocks.

Asset allocation

Investment process: Seeking undervalued UK equities

Gergel believes that stock markets are inefficient, and that thorough fundamental research can uncover mispriced securities. He has a bias towards higher-yielding stocks, as evidence shows that on average companies paying high dividend yields have delivered above-average total returns, not just higher income streams. The manager always considers the total return potential of each position in the portfolio; a high dividend yield in itself is an insufficient basis for investment, while a holding is not automatically sold if a company’s dividend yield falls below that of the market. Gergel is able to draw on the large resources of AllianzGI, which include a global team of equity and credit analysts; an environmental, social and governance (ESG) team; and the proprietary Grassroots market research platform.

The buy discipline has three pillars, seeking to answer three questions about a company – how good is its business (fundamentals), are its shares undervalued (valuation) and how supportive is the environment (themes)?

Fundamentals – focusing on industry dynamics, a company’s competitive position, its financials (including growth rates, cash flow and balance sheet strength) and its ESG track record.

Valuation – in absolute and relative terms (versus history, the sector and the market) along with dividend yield.

Themes – analysis of the macroeconomic outlook, the business cycle and industry/secular themes. The manager aims to avoid value traps (stocks that look cheap, but are structurally challenged).

MRCH’s resulting portfolio typically contains 40–60 positions. Holdings may be sold if the target price is met, there is a change in the investment case, or a superior investment opportunity has been identified. Gergel highlights that each of the holdings can be categorised in one of four ways:

High yield (35.0% of the portfolio at end-FY19) – undervalued companies with a high dividend yield. Expected return is from dividends and revaluation.

Cyclical growth (35.6%) – companies that can grow over a cycle, but may have economic or market sensitivity. Expected return is from revaluation, compounding growth and dividends.

Defensive growth (20.9%) – firms that can grow over time with limited economic sensitivity. Expected return is from dividends, compounding growth and potentially revaluation.

Special situations (8.5%) – companies undergoing a turnaround or restructuring. Expected return is primarily via capital appreciation as their shares are revalued.

ESG is an increasingly important element of the research process; in FY19, Gergel and his team engaged 44 times with 24 different companies (around half of the portfolio), covering a variety of topics including environmental issues, remuneration, board structure, corporate strategy, and mergers and acquisitions.

Current portfolio positioning

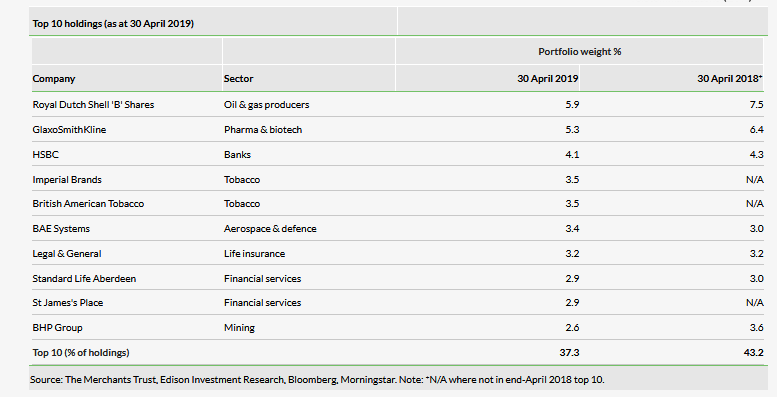

Gergel has continued to reduce MRCH’s concentration in the top 10 holdings, which made up 37.3% of the portfolio at end-April 2019 compared with 43.2% a year earlier (seven names were common to both periods – Exhibit 1). Over time, exposure to the top three holdings, Royal Dutch Shell (LON:RDSa), GlaxoSmithKline and HSBC, has come down. While they are high-yielding stocks, and have generally performed well, there has been a lack of dividend growth; sale proceeds have been reinvested into companies with more attractive dividend growth prospects.

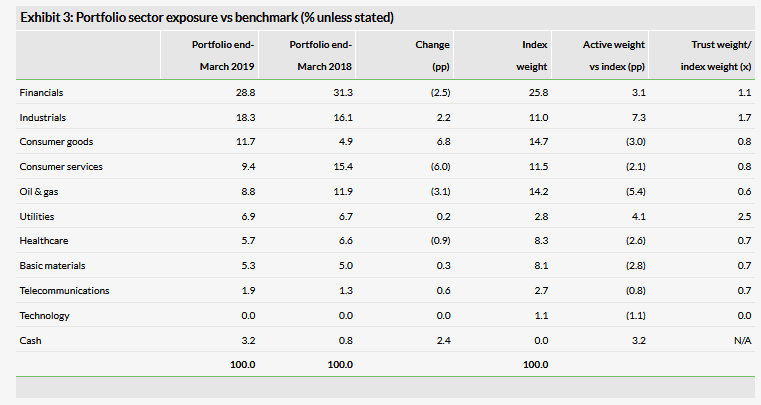

In terms of sector exposure (Exhibit 3), at 31 March 2019, compared with 12 months earlier, MRCH has higher exposure to consumer goods (+6.8pp) and a lower consumer services weighting

(-6.0pp). The two largest active weights are industrials (+7.3pp) and oil & gas (-5.4pp).

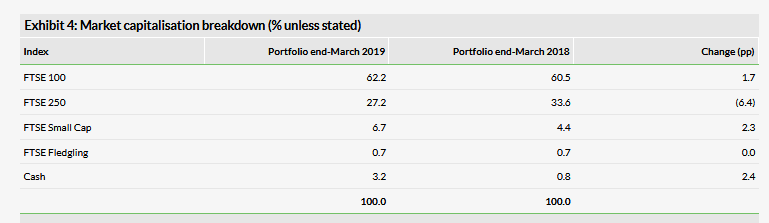

Over the last year, the fund’s mid-cap exposure has fallen, while the weightings in the largest UK companies, small caps and cash have increased (Exhibit 4).

Gergel highlights two of MRCH’s most recent new holdings, British American Tobacco (LON:BATS) (BAT) and PZ Cussons. The manager re-entered the tobacco space in Q218 with the purchase of Imperial Brands (LON:IMB), following significant share price weakness. He has since increased sector exposure with the January 2019 purchase of BAT, which he believes has slightly better emerging market exposure than Imperial. There has been a big change in investor sentiment towards the tobacco industry. Two years ago, there was optimism about the companies’ cash flow generation and dividend growth. This was followed by concerns about lower volumes, the impact of new disruptive products and ESG issues. Gergel believes that given the sell-off in the group has been so severe (for example, BAT’s dividend yield rose from 3.5% to 7.0%), the industry risks are priced in. The manager is optimistic that there is potential for the tobacco companies to grow their profits due to higher pricing, new smoke-free product introductions (both BAT and Imperial are very active in this regard) and ‘premiumisation’ in emerging markets, as consumers trade up to higher-margin products.

PZ Cussons has a portfolio of strong consumer brands (including Carex, Imperial Leather, Sanctuary Spa and St. Tropez), with operations in Africa, Asia and Europe, which also exports into the US. The company has a significant presence in Nigeria, representing around a third of its total sales; however, operations in this country are currently not profitable (historically around a third of income). The Nigerian economy is under significant pressure following oil price weakness and a government austerity programme, but Gergel notes the country’s very large and growing population, offering growth potential over the longer term. He says that PZ Cussons’s shares are pricing in no economic recovery in Nigeria, and following a multi-year hiatus in wage growth, if minimum wages were to rise, it should have a meaningful positive effect on disposable incomes and hence on the company’s operations in the country.

Recent complete disposals from MRCH’s portfolio include: Diageo (LON:DGE) and Equiniti following re-ratings; Lloyds Banking Group (LON:LLOY) due to concerns about the slowing UK economy; and Marks and Spencer (LON:MKS) (M&S), which announced its intention to focus more heavily on its food offering, including a joint venture with Ocado (LON:OCDO) that will require a £600m rights issue and a 40% cut in M&S’s dividend.

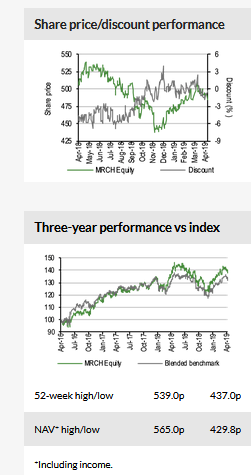

In FY19 (ended 31 January 2019), MRCH saw NAV and share price total returns of -5.2% and +1.7%, respectively, compared with the benchmark’s -3.8% total return. The largest contributor to performance (+1.8pp) over the period was not owning British American Tobacco (BAT), which performed poorly, although the shares have recovered well (+ c 15% year-to-date) since Gergel bought a position in BAT in January 2019. Another strong contributor was GlaxoSmithKline (adding 0.8pp), which saw positive developments in each of its three divisions, (pharmaceuticals, consumer health and vaccines); while Standard Life (LON:SLA) Aberdeen was the greatest detractor (-1.2pp), having experienced poor investment performance and client outflows.

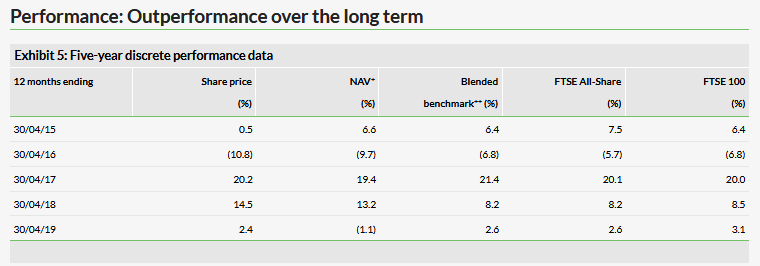

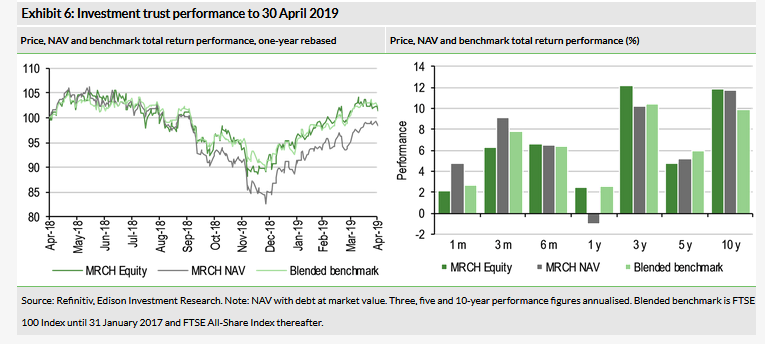

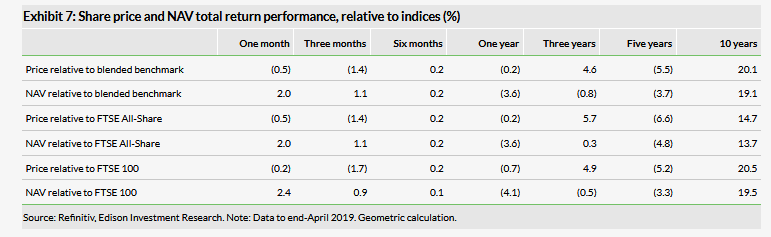

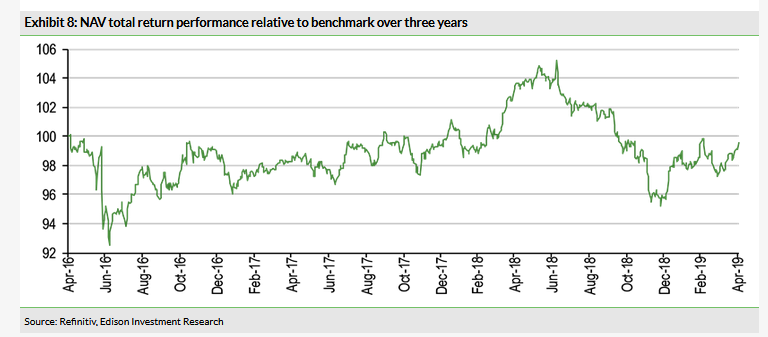

MRCH’s relative performance is shown in Exhibit 7. Its NAV and share price total returns are above those of the benchmark over 10 years. The trust’s share price has also outperformed over three years, over which period MRCH’s discount has narrowed; its shares now regularly trade close to NAV. The trust suffered a meaningful period of underperformance immediately following the UK’s European referendum, which has negatively affected MRCH’s three-year numbers (Exhibit 8); the effects of gearing in a falling market in Q418 have also been detrimental.

Discount: Trust has been revalued

MRCH’s valuation is shown in Exhibits 9 and 10. Over the last three years its discount has narrowed; the trust’s shares currently trade at a 0.2% discount to cum-income NAV (with debt at market value), and Gergel suggests this illustrates that the key features of the trust, such as its generous dividend yield, are resonating with private investors. The current valuation compares to the range of a 3.9% premium to a 6.8% discount over the last 12 months, and average discounts in a range of 2.2% to 4.6% over the last one, three, five and 10 years.

As shown in Exhibit 1, following MRCH’s move to trading at a premium, there has been selective share issuance. The board’s policy is to issue shares when they are trading at a premium to cum-income NAV (with debt at market value), to meet natural demand in the market and to ensure that existing shareholders are not diluted.