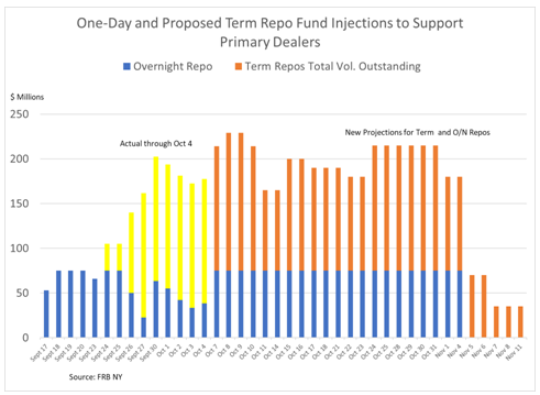

The Federal Reserve Bank of New York announced on Friday, Oct. 4 that it would continue to offer a maximum of $75 billion in overnight repurchase agreements and at the same time offer a series of term repos through at least November 4 according to the following schedule:

This extension seems to be an attempt to use the market to determine exactly how much excess collateral is in the financial system that needs to be financed. The term repos are a way of sterilizing a large portion of the excess supply of securities and then the overnight repos provide some indication of how much funding may or may not be available on the margin. The following chart provides some clues as to the maximum amount of financing that the Fed may be willing to provide and represents an experiment to let the market determine, given the lack of bank financing that is apparently quite scarce for this market, how big a facility might be necessary to support the primary dealers.

The proposed extension shows the Fed could provide up to $225 billion in total financing, which is a little more than the maximum amount provided on September 30. Clearly, the demand for overnight financing has slacked off, probably in part because of the availability of significant term financing. This may mean that the upper limit of $75 billion in overnight financing may be larger than needed. At the same time, while the facility is billed as temporary, some have speculated that this is a precursor to establishing a permanent repo facility.

The one caution is that such a facility is really a backdoor to creating a discount window for primary dealers and indirectly for money market funds and GSEs. Moreover, the volume of securities on the balance sheet of the primary dealers that may need to be financed on a short duration basis, creates a potential problem of financial instability for two reasons. The extreme short-term nature of the funding means that any hint of a problem could put the primary dealers at risk, necessitating rescue by the Fed. Then there is also the interconnectedness among the market participants that could transmit financial difficulties in a large and important portion of the market. Maybe it is time to re-evaluate the usefulness of the primary dealer system relative to the risks and benefits.