I have written extensively on my blog about the relationship between the returns of assets and their volatility. It is a point of interest. Commentators on financial television frequently discuss the performance of the VIX and compare it to the performance of the market. This common usage leads us to believe that the VIX is a factor we should pay a lot of attention to.

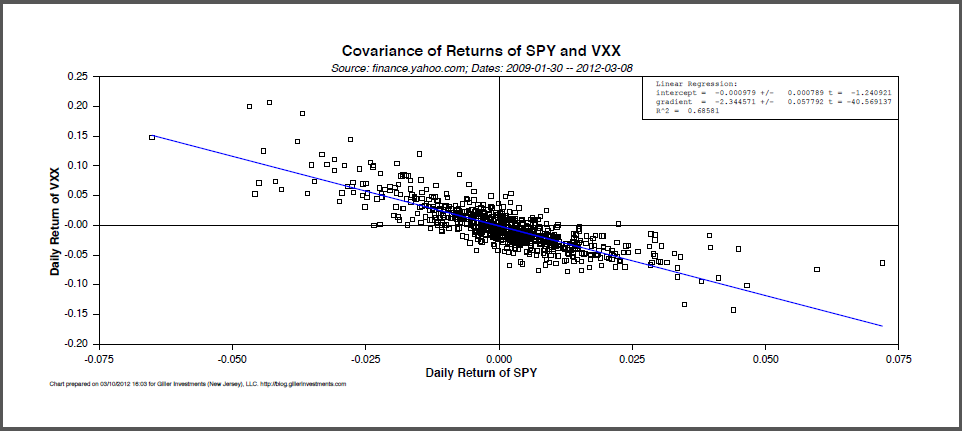

But empirically we do not see this. What we see is that the daily returns of the market, for which I'll take the returns of the SPY ETF, and the returns of the VIX, for which I'll take the returns of the VXX ETF are stabily and extremely negatively correlated. The chart below illustrates a linear regression of the returns of VXX onto the returns of SPY for several recent years of daily data. This negative relationship is extremely clear and strong (the R2 is some 69%, which is a big value for the returns of different assets in finance — it's equivalent to a correlation of −83%).

From a statistical point of view: when the market goes up the VIX goes down and when the market goes down the VIX goes up. Now these assets are not identical and their long-term trends do differ, hopefully the market ultimately drifts upwards whereas the VIX mean-reverts about a “typical” value, but on a daily basis they really disagree completely on direction in a very predictable manner.

In finance we are interested in assets that diversify our portfolio. This means that when add an asset to our portfolio the consequence ought to be that the net variance of the whole portfolio decreases. In their book on active portfolio management, Grinold & Kahn give the following formula for the risk of a portfolio of N assets all of which have a common pairwise correlation coefficient

This is actually one of my favourite sections in the whole book. It's simple, and brings home the rule that what we want to invest in are uncorrelated assets. The VIX is negatively correlated, but from a risk management point of view the sign of the correlation coefficient is less interesting than its closeness to zero. After all the sign just tells you to short the asset rather than go long it.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Market is Up and the VIX is Down – How Much Extra Investing Info Do We Have?

Published 03/11/2012, 04:13 AM

Updated 07/09/2023, 06:31 AM

The Market is Up and the VIX is Down – How Much Extra Investing Info Do We Have?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.