The market digests its recent highs amidst a rush of politically charged news as more riots and a second impeachment dominate headlines.

We believe the market is more focused on the economic plans of the incoming administration and not as much on the politics at hand.

The marijuana industry can attest to that with its recent strong performance.

Furthermore, the Chamber of Commerce reported that the tariffs on China have negatively impacted U.S. manufacturing and agriculture. Whether Biden reworks the China tariffs or not remains to be seen.

Both the ETFs that represent China (FXI) and the pot sector (MJ) closed up yesterday, with MJ breaking multi-month highs, and FXI looking to test a resistance level at 48.71.

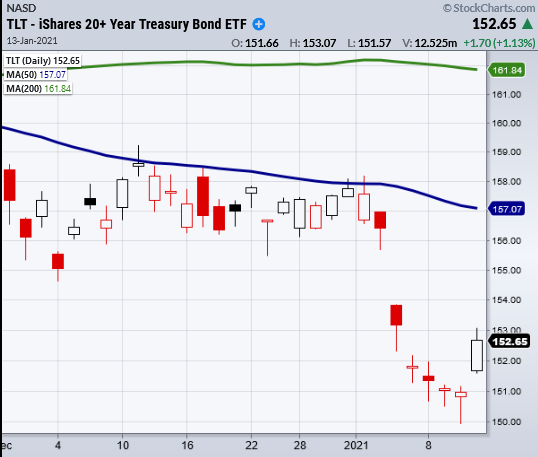

With that said, money has also moved into the safety of U.S government bonds (TLT) creating a bottoming reversal chart pattern.

Today’s gap up in TLTs was followed by a large range day with the next important level to clear at 153.85 or the high of 1/6.

If the TLTs can hold over the 152 and begin to build a base around the 154 area, then look for a potential fill of the gap back to 155.66.

On the risk on front, junk bonds show no signs of abating their recent run at this point. JNK is close to a breakout over 109, with 107.60 the key support to hold.

All in all, apart from the upcoming inauguration creating an out-of-control situation that ultimately disrupts business and the economy, we see more signs of further gains once the dust settles.

Whenever you’re ready, here are 3 ways I can help you reach your trading goals…

- Stay one step ahead of the market with my daily market analysis, Mish’s Daily.

- Get the foundational building blocks of my trading strategies from my book, Plant Your Money Tree: A Guide to Building Your Wealth, and accompanying bonus training.

- Trade with me and take your trading the next level by following my real-time trading ideas as a member of my premium services.

S&P 500 (SPY) 375 support. 380.62 Resistance.

Russell 2000 (IWM) New highs but closed down. 200 support.

Dow (DIA) Support 306.66. Resistance 312.03 high of monthly Bollinger band.

NASDAQ (QQQ) 310 support. Resistance 319.39

KRE (Regional Banks) 55.41 support the 10-DMA

SMH (Semiconductors) 221.79 support.

IYT (Transportation) Like to see this hold 228 area.

IBB (Biotechnology) Small range days with 155.70 support.

XRT (Retail) Doji day or tight range day