Unconstrained bond funds are a relatively new category of the exchange-traded fund universe. The basic concept is to create an actively managed ETF with no barriers to sector exposure, position size, interest rate correlation, duration, or credit quality. Put simply – the gloves are off. The fund manager has discretion to go wherever they feel offers the most value to generate income, manage risk, and achieve capital appreciation.

Many investors think that ALL active funds are allowed this type of leeway. However, even well-known examples such as the PIMCO Total Return Active Exchange-Traded (NYSE:BOND) or SPDR DoubleLine Total Return Tactical (NYSE:TOTL) have prospectus limits for many characteristics. For instance, they may be able to choose between 0-15% emerging market exposure, but they can’t necessarily short a Treasury bond or suddenly go all in on bank loans and convertibles. There are guidelines that allow them some freedom within tolerable limits.

The benefit of this more traditional method is that the portfolio experiences less turnover and is more dependable for the fund investors. Even though a year later they might shift 25% of the underlying positions, it’s not going to look wildly different from today’s exposure. This is also how they generate alpha or manage risk in comparison to a benchmark such as the iShares Core US Aggregate Bond (NYSE:AGG).

By contrast, an unconstrained manager has the flexibility to do whatever they want. This allows them to seek unconventional returns versus traditional passive and even actively managed funds. That type of autonomy can be liberating for the manager and offer value to the investor. But it also comes with its own unique risks as well.

Reviewing The Playing Field

Of the 56 actively managed ETFs currently offered in the U.S. market, there are three with unconstrained mandates. These include:

WisdomTree Western Asset Unconstrained Bond (NASDAQ:UBND)

RiverFront Dynamic Unconstrained Income ETF (RFUN)

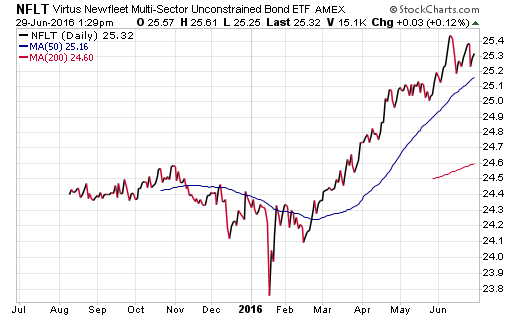

Virtus Newfleet Multi-Sector Unconstrained Bond (NYSE:NFLT)

Each variant is managed by a team of strategists that invest the portfolio according to their unique views on the interest rate and credit markets. The outlook of the manager and construction of the portfolio are two key characteristics that must be thoroughly researched when evaluating these funds.

Fortunately, the portfolio holdings for each ETF are required to be posted to the fund providers website on a daily basis for complete transparency. Furthermore, the managers often compile monthly or quarterly commentary as to why their portfolio is constructed and what challenges or opportunities they see on the horizon.

NFLT is the largest of this group with $173 million in total assets. They also charge the highest net expense ratio at 0.80%. While this may seem on the high side for a fixed-income ETF, it is reasonable to assume that more complex or unique strategies will charge a concomitant larger fee.

At the moment, this ETF is highly diversified with nearly 400 individual fixed-income securities. Their approach is to actively rotate between various sectors of the bond market (including international) according to their fundamental research. They are also focused on managing risk without the constraints of following a relative benchmark.

Unconstrained bond funds can also get into esoteric markets as well. For instance, UBND currently owns both long and short currency holdings in its portfolio as well as short positions in U.S. Treasury futures contracts. Being able to keep all those varying hedges in place can become expensive and difficult to track over long periods of time unless the manager is on the right side of the market.

Two other funds that deserve an honorable mention in this discussion are the Newfleet Multi-Sector Income (NYSE:MINC) and ALPS RiverFront Strategic Income (NYSE:RIGS). Both use a multi-sector approach with broad leeway in their portfolio exposure. However, strategic income and multi-sector income funds usually have some guidelines that must be adhered to.

The Bottom Line

The obvious benefit to investors in these strategies is they get unconventional exposure to corners of the bond market that may not be emphasized in a passive index. However, they are also susceptible to the fund manager selecting overly risky or fundamentally flawed trends that fail to develop as expected. Furthermore, the higher fees are another risk that must be weighed versus the minuscule expense of a conventional index fund.

Investors must also be cautious about how these funds are marketed. The fund companies do an excellent job spelling out the typical disclaimers, but often times these are overlooked for flashy buzzwords like “non-correlated”, “alternative”, or “low risk”.

For those who believe in the active management story, these funds can potentially work to supplement core bond exposure as a tactical holding. It’s also worth keeping an eye on the manager and strategy regularly to ensure the fund is meeting your expectations as it changes over time.

Disclosure: FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.