Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The Canadian dollar (loonie) is on a roll thanks to another stellar jobs report from Canada. Most of the country has been locked in a brutal cold spell but Friday’s employment data was red hot for the second straight month. Recall that the Canadian dollar was the top-performing currency in the G10 in 2016 (not the USD) and among the top-4 performers in 2017. Will 2018 prove another winner for the loonie?

Not only did Friday’s December employment report produce a monstrous net 79K, obliterating expectations of a 2K reading following a similarly spectacular November 79.5K reading, but the unemployment rate plummeted to 5.7% from 5.9%, its lowest in over 40 years. The participation rate edged up to 65.8 from 65.7.

Monetary Policy Normalization

Canada’s impressive jobs figures, coupled with Crude oil's rise to a 3-year high of $62 (breaching the 200-day moving average for the first time since summer 2014) should considerably bolster expectations of a rate hike from the Bank of Canada on January 17. The odds of a hike have jumped to 82.5% from 45% before Friday’s data, and the market now sees a better than 60% chance of three or more hikes this year.

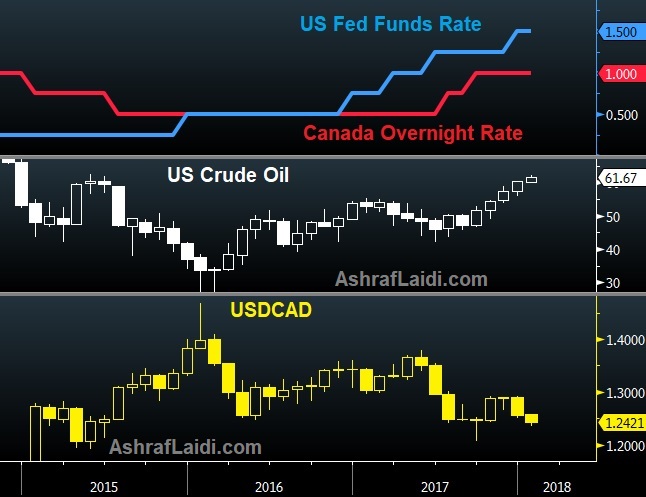

The BoC has already raised rates three times since Summer 2015 when it began normalizing monetary policy following the oil-related economic slowdown of 2014-2015. Although the BoC’s benchmark overnight rate of 1.0% target is 50 bps below the Federal Reserve’s Fed Funds rate, Canada’s growing growth and inflation dynamics have dragged the USA-Canada 10-year yield spread to a 3-month low.

The odds of a March rate hike from the Fed remain near 80% despite a lackluster US jobs report, but any further Fed tightening is likely to be accompanied by similar steps from the BoC.

Fiscal Superiority

And it’s not all about jobs. Canada’s structural strength has also helped the currency stand out from the rest of the pack. A budget deficit of less than 1% of GDP compares with 3.7%, 2.4% for the US and UK respectively. This has enabled Ottawa to deliver tax cuts back in 2015 without any acrobats from their own Congress, something that no major G5 nation could contemplate due to their deteriorating fiscal balances.

The charts above highlights how CAD began responding to rising oil prices following the BoC’s continued monetary tightening. Rather than requiring further gains in oil for prolonged CAD strength, the status quo in energy prices and Toronto’s fiscal stance will likely be sufficient in driving USD/CAD to 1.20.