Key Points:

- The pair is at a crucial point of inflection.

- Technical bias is intimating that support should hold firm.

- FFR hike could provide the spark to kick start the reversal.

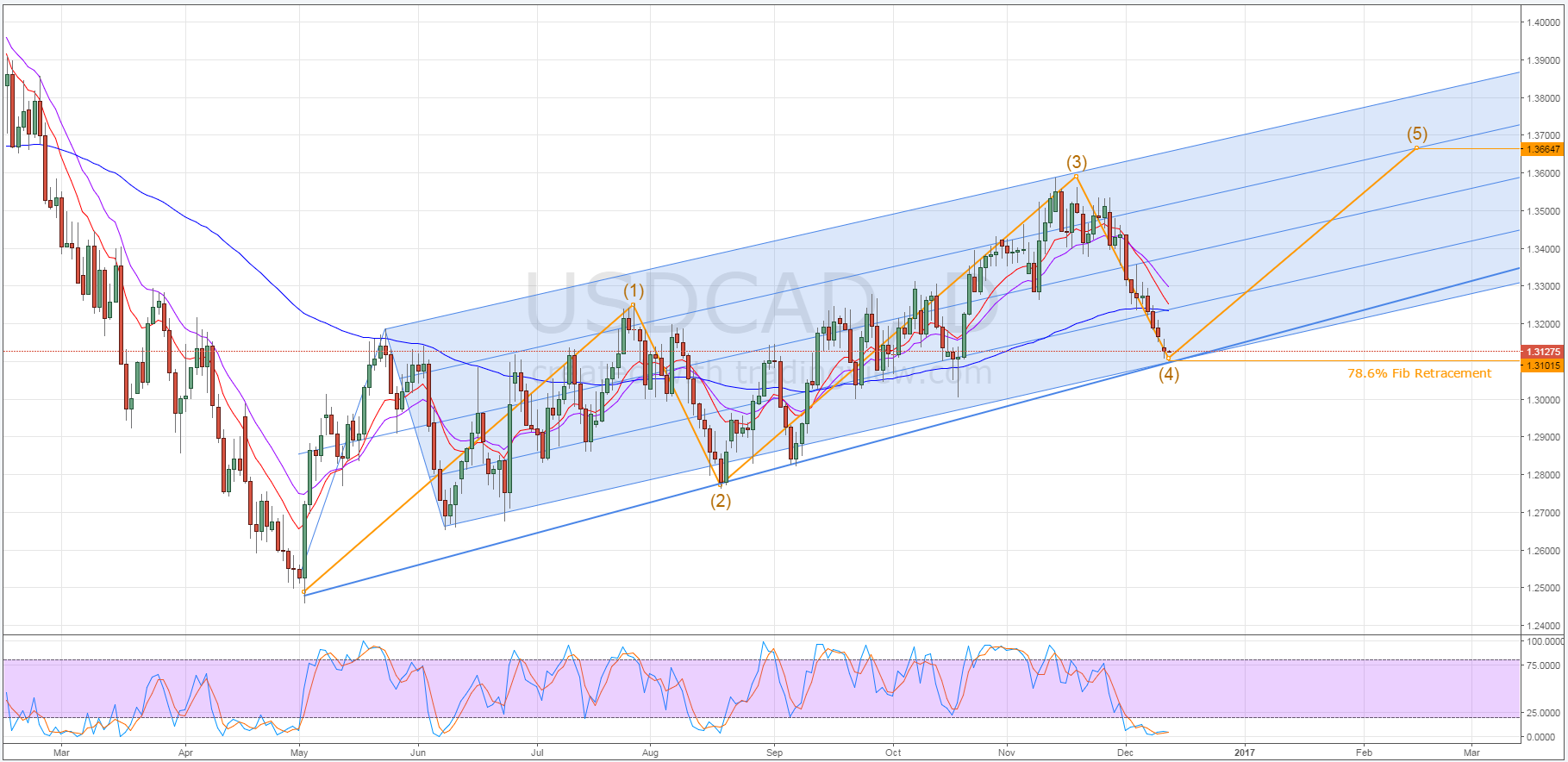

It’s make or break time for the long-term pattern developing for the Loonie and, if the pair fails to reverse, we could have some serious downsides on our hands. Fortunately, the FFR decision couldn’t come at a better time to help maintain the integrity of the Elliot wave that has been shaping up over the past number of months. Specifically, the almost certain rate hike should give the pair the fuel needed to reignite buying pressure and, therefore, see the final leg of the pattern crystallise.

Demonstrated below, the loonie has been forming a rather patent Elliot wave over the past few months and it has repeatedly lived up to expectations, following the forecasted movements almost surgically. Moreover, the pair has now converged on a likely point of inflection that could mark the start of another protracted rally for the USD/CAD. Indeed, the shift in technical bias is already becoming apparent and this will not be going unnoticed by traders.

Firstly, from a technical perspective, support should be highly resistant to any attempts to breakout for a number of reasons. As mentioned, the completion of the fourth leg of the wave pattern is the primary force providing robust support at this level. However, the intersection of the lower boundary of a pitchfork structure and the long-term ascending trend line should also provide some stiff opposition to any attempts by the bears to extend the recent tranche of losses.

Zooming into the four-hour timeframe, there are a number of other signals indicating that the pair will be hard pressed to extend on its tumble. Firstly, the pair is presently hovering just above the 78.6% Fibonacci retracement which will be reinforcing support generated by the aforementioned wave, pitchfork, and trend line. Furthermore, stochastics on not only the four-hourly chart but also the daily chart are squarely in oversold territory. Finally, the MACD oscillator is on the cusp of experiencing a bullish crossover which should occur within the next day or so.

Whilst on its own this slew of technical data supports the argument that the Loonie should be loath to sink lower, it doesn’t necessarily indicate that the rather sharp correction forecasted above is ready to take place. Conveniently, the FFR decision is poised to generate the spark needed to ignite such a surge in buying pressure, at least in the near-term.

While, yes, the US rate hike has been largely priced in across the market, there is still likely to be some buoyancy generated which could see the bulls seize on the resultant momentum and push the pair higher.

Ultimately, the risk of the Fed reneging on its effective promise to raise rates this time around remains the highest risk factor for the Loonie. If rates are held steady, the subsequent slide could be severe and it would largely invalidate the Elliot wave. As a result, keeping an eye on the announcement of the FFR will be the highest priority for anyone watching this or any other USD pair.