Investing.com’s stocks of the week

There is an allure to stock picking that many investors find irresistible. They want to believe that uncovering the next Apple (NASDAQ:AAPL), Facebook (NASDAQ:FB), or Amazon (NASDAQ:AMZN) is just a click away. That they will have the fortitude to hold through the desperate times, in order to reap the rewards of exponentially increasing their wealth.

Individual stocks also carry unique and personable stories that make them easier to latch onto. Products that consumers love. Executives with a firm grasp on their business model. Fundamentals that belie the true value of the company’s hidden potential. Some, or all, of these factors add to the attractiveness of publicly-traded stocks as they align with your philosophical beliefs about the markets and economy.

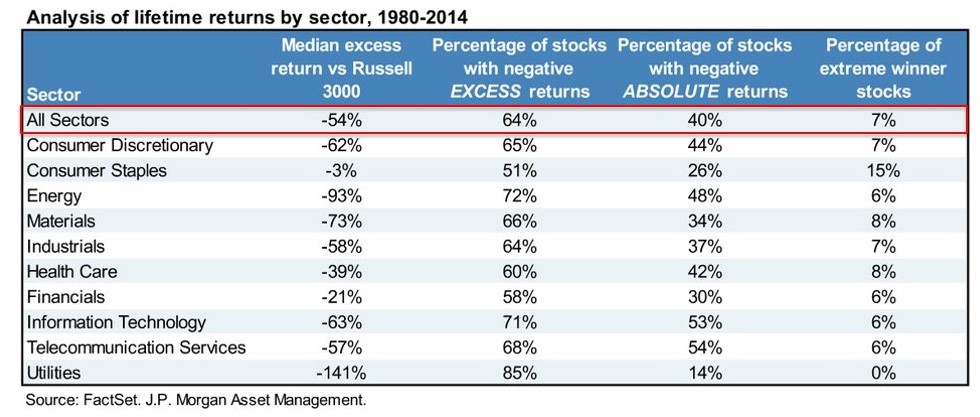

Nevertheless, the reality of buying and holding successful companies over long stretches of time may be far different than most investors imagine. The table below illustrates a study completed by J.P. Morgan Asset Management and FactSet regarding the excess returns of individual stocks versus the Russell 3000 Index over a 34-year time frame.

For the sake of this study, the Russell 3000 is considered a “total market” benchmark that is inclusive of large, mid, and small-cap companies. The iShares Russell 3000 ETF (NYSE:IWV) is the exchange-traded fund that tracks this broad range of domestic stocks.

The results found that between 1980 and 2014, 64% of stocks had negative relative returns versus the benchmark. Furthermore, nearly 40% of stocks had negative absolute returns. This means that four out of ten stocks lost money over that 34-year period.

Those statistics are clearly a nod towards the diversification and risk mitigation that indexing provides. However, the truly interesting component was that only 7% of stocks were identified as extreme winners. Those odds don’t instill a great deal of confidence in the stock picking game.

What isn’t illustrated in this table is that many of the excess winners went through tremendous periods of volatility during the 1987 crash, the 2000-20002 tech bubble, and the 2008 financial crisis. Those were difficult periods to hold on to public companies that may have been temporarily performing worse than the market, even for true believers.

These statistics underscore the advantages of passively managed ETFs that provide low-cost exposure to a wide subset of stocks. Instead of having to worry about beating the benchmark, you can simply own the benchmark for a very minimal fee. The transparency of ETFs ensure that you know exactly what you own and why you own it.

Furthermore, the reconstitution and rebalancing of the index is automatically completed by the fund sponsor on a regular basis. This allows a continual flow of new companies to be admitted or those who have gone bankrupt or consolidated to be absorbed with little fanfare.

Another often overlooked advantage of ETFs is their faceless ownership structure. There is no charismatic CEO to fall in love with. There are no quarterly earnings reports or scandals to worry about. It’s simply a vehicle that allows investors to carry exposure to a subset of the stock market without the noise associated with each individual business model.

The Bottom Line

Over extremely long-term cycles, the advantages of owning index-based ETFs clearly outweigh the unknowns of individual stock picking. Investors who are planning for their future many years in advance should consider these tools as an essential part of their wealth building strategy.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.