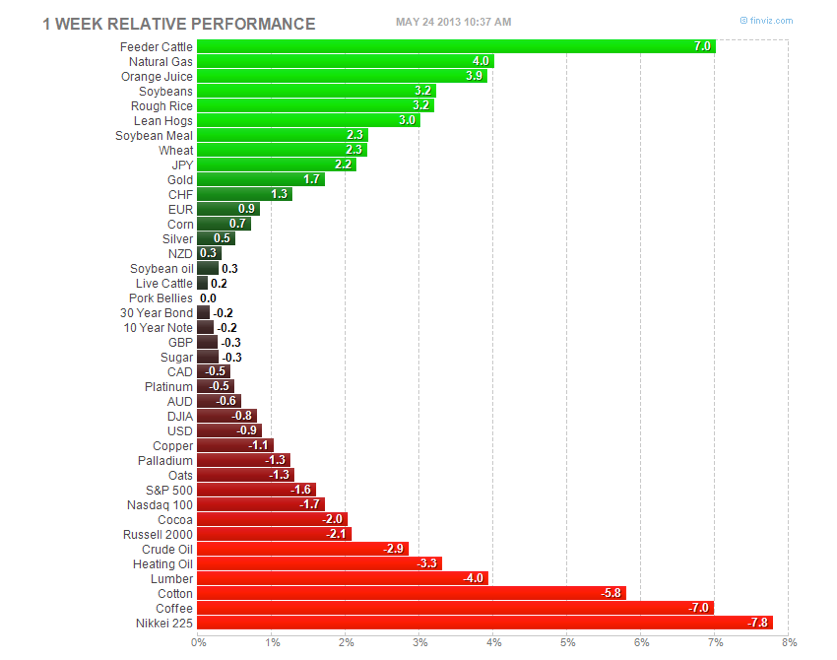

At 10 am Chicago time, here's what the week looks like in Commodity Land:

Unless we get some serious buy-the-dippers coming into the market, this looks like the first down week for equities since the Boston Marathon/Tax Day beat down where commodities led the market lower. Time will tell, but the Nikkei and Nasdaq made multi-year highs and the S&Ps and RUT made all-time highs just after the Bernanke testimony was released on Wednesday and then we reversed.

Markets are grappling with Inflationary monetary policy combine with a deflationary economic reality. I believe this tug of war will continue for a long time with little change in global monetary policy (The Race to Debase will continue).

2+2=5?

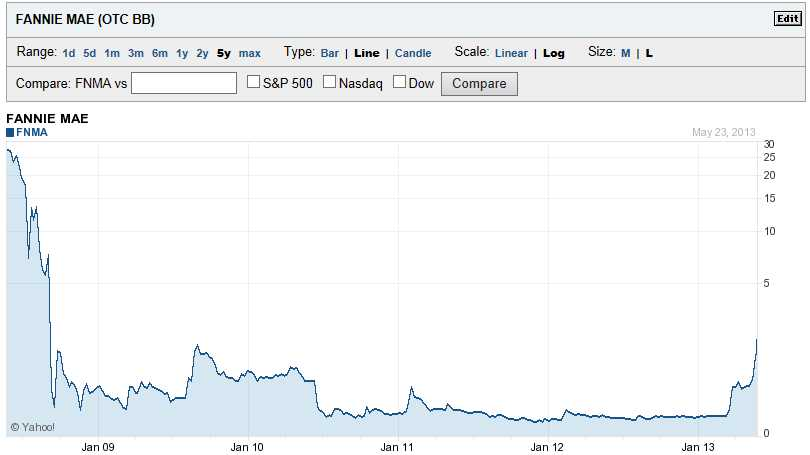

In another 2007-esque move you have Fannie Mae ripping higher and Lumber prices tanking. Something doesn't add up, but I know for sure that there are bidding wars for cookie cutter condos in Chicago again. Real Estate brokers must love Quantitative Easing. FNMA (massive government program backstopping Housing) is trading where it was the last time there was a scramble into housing when they instituted an $8000 tax credit for first time home buyers.

The Nikkei tried to rally again last night, trading up 2% in early trade and then dropped a smooth 1,000 points (while the Yen rallied). Being short gamma in the Nikkei/Yen/S&Ps/and Soybeans this week would be a good way to join next week's Jobless Claims numbers.

Futures will open on Sunday and trade an abbreviated session on Monday.

Tuesday is options expiration for June gold, silver, copper, gasoline, heating oil and natural gas.

This week may have been a pivotal one. Time will, of course tell. In my estimation you may have put in trading tops in the equities and the U.S. dollar. Some currency crosses may also have peaked. Soybeans appear to have top ticked yesterday as well and the July vs. Nov spread could unwind. I believe that the precious metals may catch a bid again before long. Watching the 1350 level in gold and 22 level in silver closely. I'm sure I'm not the only one. Also, I believe the soft markets -- coffee, sugar and -- to a lesser degree -- lumber, have tremendous potential after their two-to-three-year bear markets.

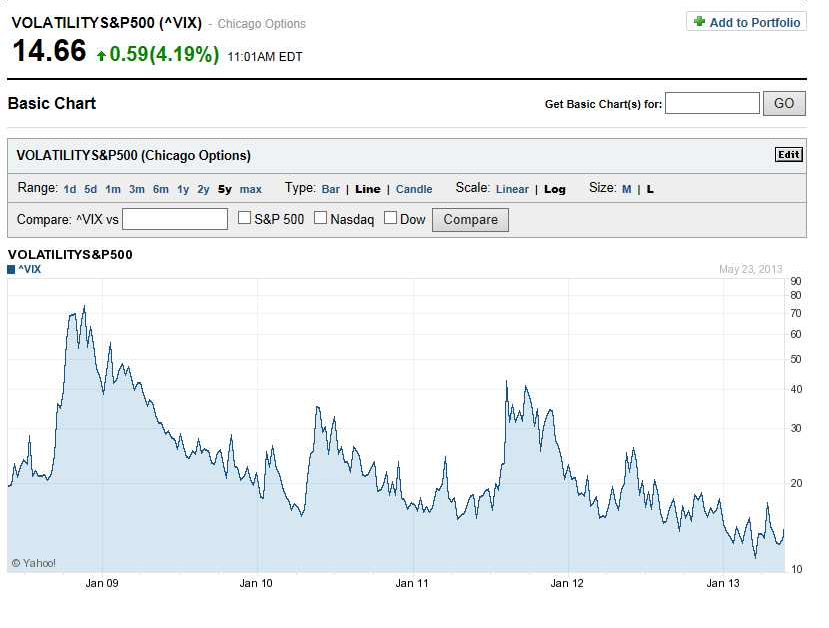

A Look At Volatility

Finally, I find it interesting/telling that even on all-time highs this week, the VIX was well off lows.

If the Bernanke testimony was just a trail balloon...it wasn't well received.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Long, Strange Week That Was

Published 05/24/2013, 01:52 PM

Updated 07/09/2023, 06:31 AM

The Long, Strange Week That Was

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.