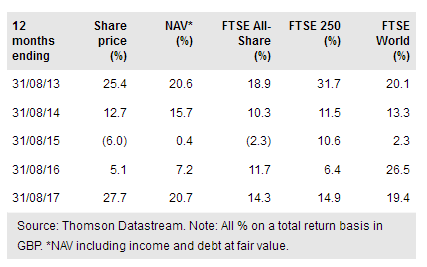

Law Debenture Corp (LON:LWDB) is differentiated by being both an investment trust with a diversified portfolio of global equities and a leading provider of independent professional services through its IPS subsidiaries. The bottom-up managed portfolio is globally diversified with a strong bias towards UK equities. IPS is highly profitable, regularly providing revenue earnings well ahead of its share of NAV, supporting a strong track record of dividend growth and allowing greater flexibility within the portfolio to pursue high-return but lower yield investments. LWDB is benchmarked against the FTSE All-Share index, which it has outperformed over one, three, five and 10 years. Ongoing charges are competitive and the 2.8% yield is one of the highest in the sector.

Investment strategy: Flexible with income support

LWDB maintains a diversified, bottom-up managed portfolio of c 130 holdings, typically 70-75% drawn from the UK. The managers seek out growing businesses, trading at valuations that do not reflect their long-term prospects, investing across the market cap spectrum without bias to value or growth. The strong income contribution from the IPS businesses allows investment in a wider range of opportunities than a typical income-focused fund may normally consider. Overseas stock selection (typically 25-30%) is driven by gaining exposure to more attractive investment opportunities than can be found in the UK and 10-15% of the portfolio is held in open- and closed-ended funds to add specialist regional or sector exposure.

To read the entire report Please click on the pdf File Below: