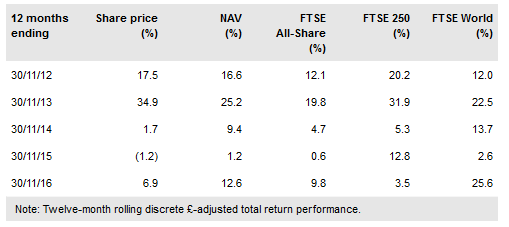

The Law Debenture Corporation (LON:LWDB) is one of the longest established investment trusts, with a 40-year record of raising or maintaining its dividend. The trust holds a diversified global portfolio, primarily invested in UK equities, and is differentiated by its independent fiduciary services (IFS) business, which provides a regular income stream. This underpins the steadily rising dividends and allows the manager flexibility to pursue high return but low yield investments. The discount has widened since the move to reporting NAV including the IFS business at fair value, even with LWDB’s fair value NAV total return outperforming its FTSE All-Share index benchmark over one, three, five and 10 years. The trust has a competitive 0.45% ongoing charge and its 3.0% yield is one of the highest in the sector.

Investment strategy: Broadly unconstrained

LWDB maintains a portfolio of c 130 holdings, diversified by sector and geography, with the strong income contribution from the IFS business allowing investment in a wider range of opportunities than an income-focused fund would usually consider. The manager adopts a bottom-up stock selection approach, focusing on companies with growing businesses, trading at valuations that do not reflect their long-term prospects. Investments are made across the market cap spectrum without bias to value or growth, with the aim that the portfolio has genuine diversity of underlying activities. Overseas stock selection is driven by gaining exposure to more attractive investment opportunities than can be found in the UK. 10-15% of the portfolio is held in open- and closed-ended funds to add specialist regional or sector exposure.

To read the entire report Please click on the pdf File Below